Answered step by step

Verified Expert Solution

Question

1 Approved Answer

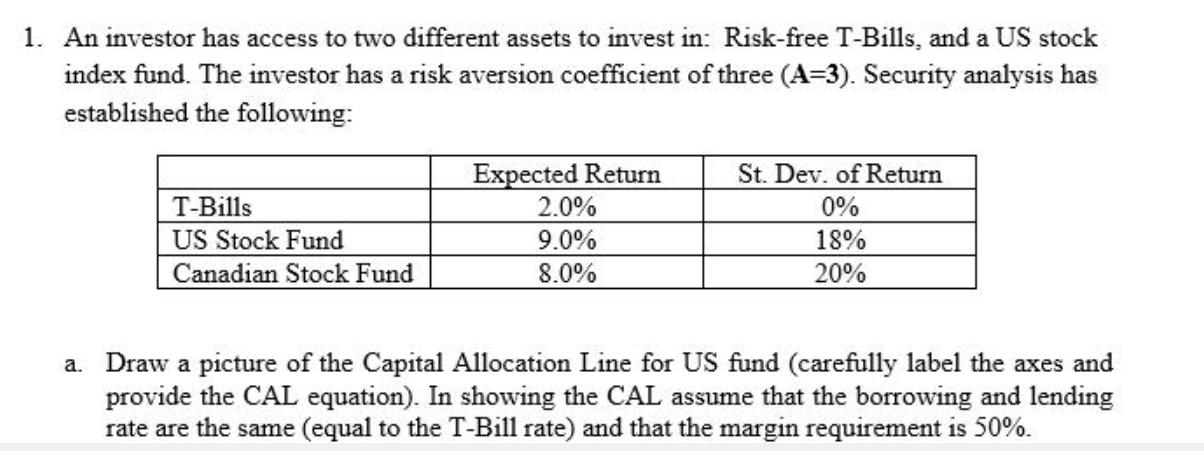

1. An investor has access to two different assets to invest in: Risk-free T-Bills, and a US stock index fund. The investor has a

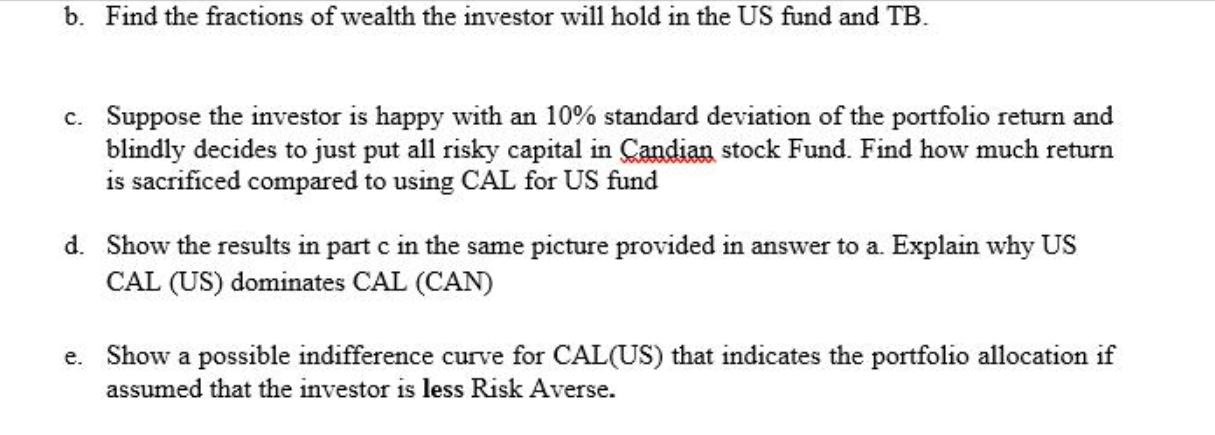

1. An investor has access to two different assets to invest in: Risk-free T-Bills, and a US stock index fund. The investor has a risk aversion coefficient of three (A-3). Security analysis has established the following: Expected Return St. Dev. of Return T-Bills 2.0% 0% US Stock Fund 9.0% 18% Canadian Stock Fund 8.0% 20% a. Draw a picture of the Capital Allocation Line for US fund (carefully label the axes and provide the CAL equation). In showing the CAL assume that the borrowing and lending rate are the same (equal to the T-Bill rate) and that the margin requirement is 50%. b. Find the fractions of wealth the investor will hold in the US fund and TB. c. Suppose the investor is happy with an 10% standard deviation of the portfolio return and blindly decides to just put all risky capital in Candian stock Fund. Find how much return is sacrificed compared to using CAL for US fund d. Show the results in part c in the same picture provided in answer to a. Explain why US CAL (US) dominates CAL (CAN) e. Show a possible indifference curve for CAL(US) that indicates the portfolio allocation if assumed that the investor is less Risk Averse.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started