Answered step by step

Verified Expert Solution

Question

1 Approved Answer

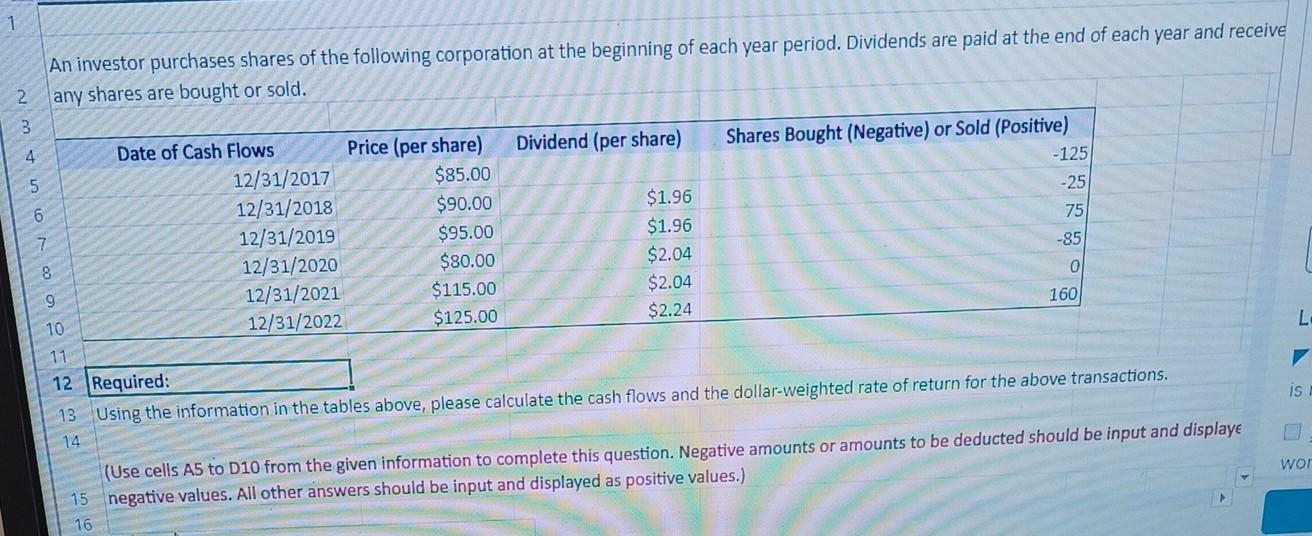

1 An investor purchases shares of the following corporation at the beginning of each year period. Dividends are paid at the end of each

1 An investor purchases shares of the following corporation at the beginning of each year period. Dividends are paid at the end of each year and receive 2 any shares are bought or sold. IN NEDAWN 10 11 Date of Cash Flows 14 12/31/2017 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 Price (per share) $85.00 $90.00 $95.00 $80.00 $115.00 $125.00 Dividend (per share) $1.96 $1.96 $2.04 $2.04 $2.24 Shares Bought (Negative) or Sold (Positive) -125 -25 75 -85 0 160 12 Required: 13 Using the information in the tables above, please calculate the cash flows and the dollar-weighted rate of return for the above transactions. (Use cells A5 to D10 from the given information to complete this question. Negative amounts or amounts to be deducted should be input and displaye 15 negative values. All other answers should be input and displayed as positive values.) 16 L is wor Date of Cash Flows 12/31/2017 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 4 Dollar-Weighted Rate of Return Cash Flows

Step by Step Solution

★★★★★

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of the cash flows for each year 12312017 Shares bought 125 Cash flow Shares bought Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started