Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. An OTC forward contract is: a. a forward contract b. a customised agreement that is not traded on an exchange c. a standardised agreement

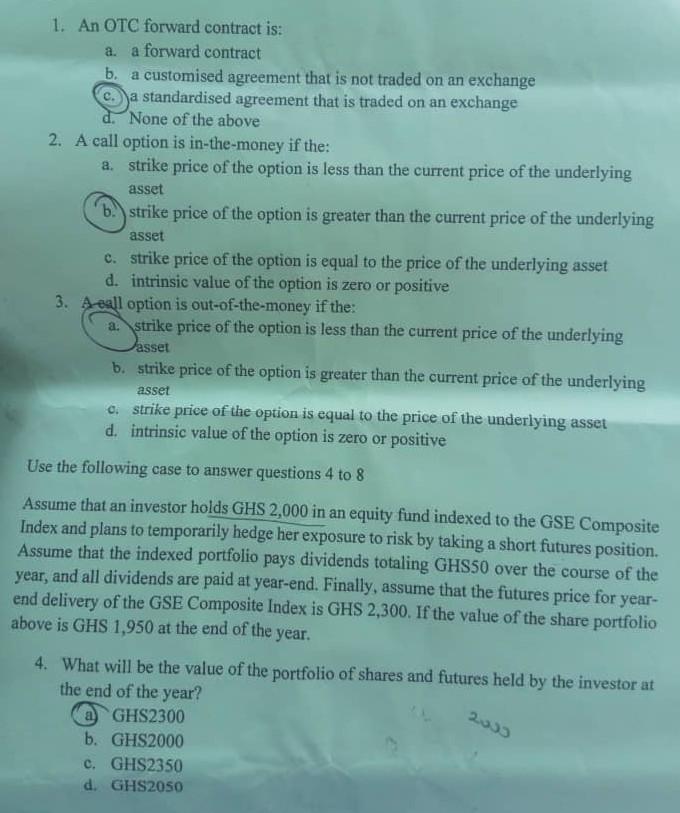

1. An OTC forward contract is: a. a forward contract b. a customised agreement that is not traded on an exchange c. a standardised agreement that is traded on an exchange d. None of the above 2. A call option is in-the-money if the: a. strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset intrinsic value of the option is zero or positive d. 3. A call option is out-of-the-money if the: a. strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset d. intrinsic value of the option is zero or positive Use the following case to answer questions 4 to 8 Assume that an investor holds GHS 2,000 in an equity fund indexed to the GSE Composite Index and plans to temporarily hedge her exposure to risk by taking a short futures position. Assume that the indexed portfolio pays dividends totaling GHS50 over the course of the year, and all dividends are paid at year-end. Finally, assume that the futures price for year- end delivery of the GSE Composite Index is GHS 2,300. If the value of the share portfolio above is GHS 1,950 at the end of the year. 4. What will be the value of the portfolio of shares and futures held by the investor at the end of the year? 2033 GHS2300 b. GHS2000 c. GHS2350 d. GHS2050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started