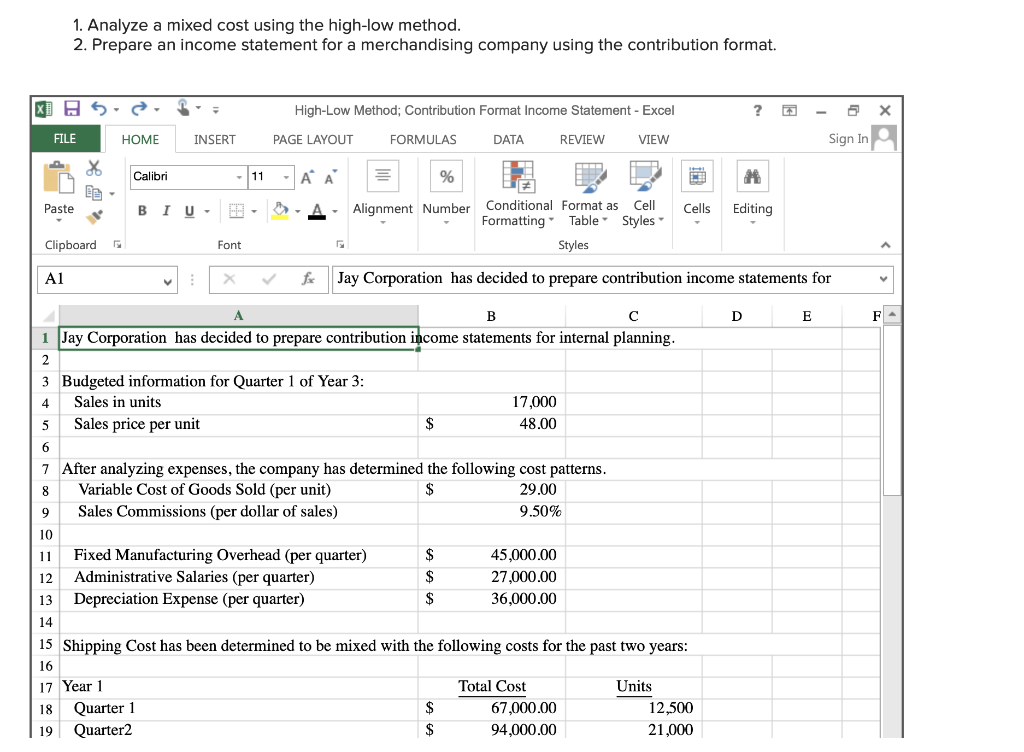

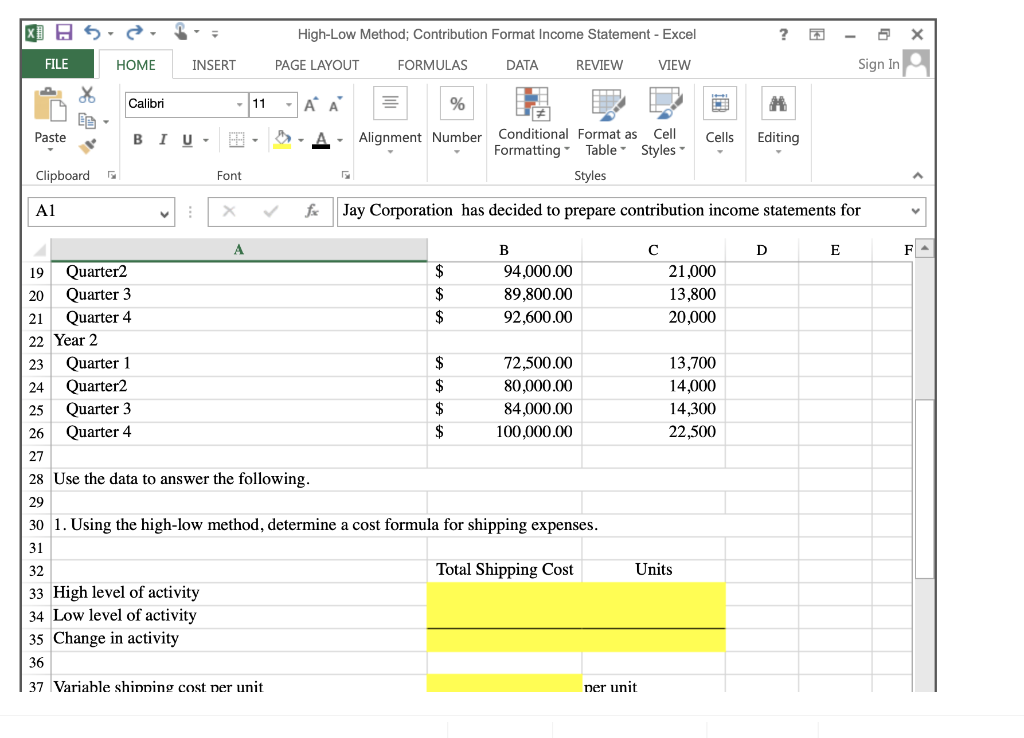

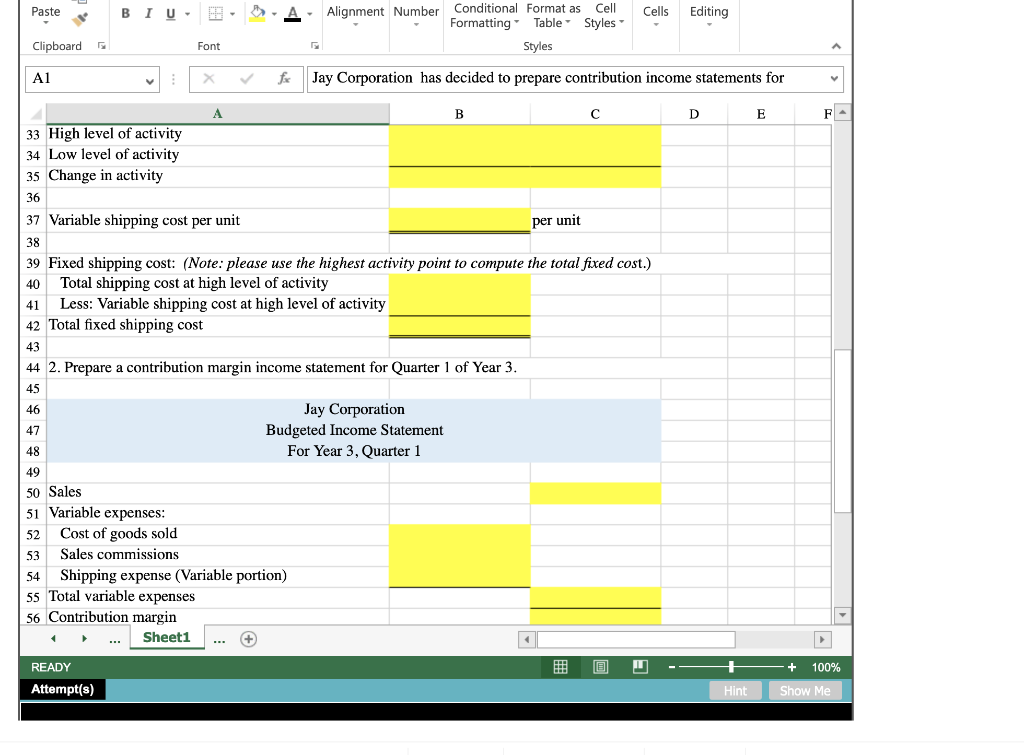

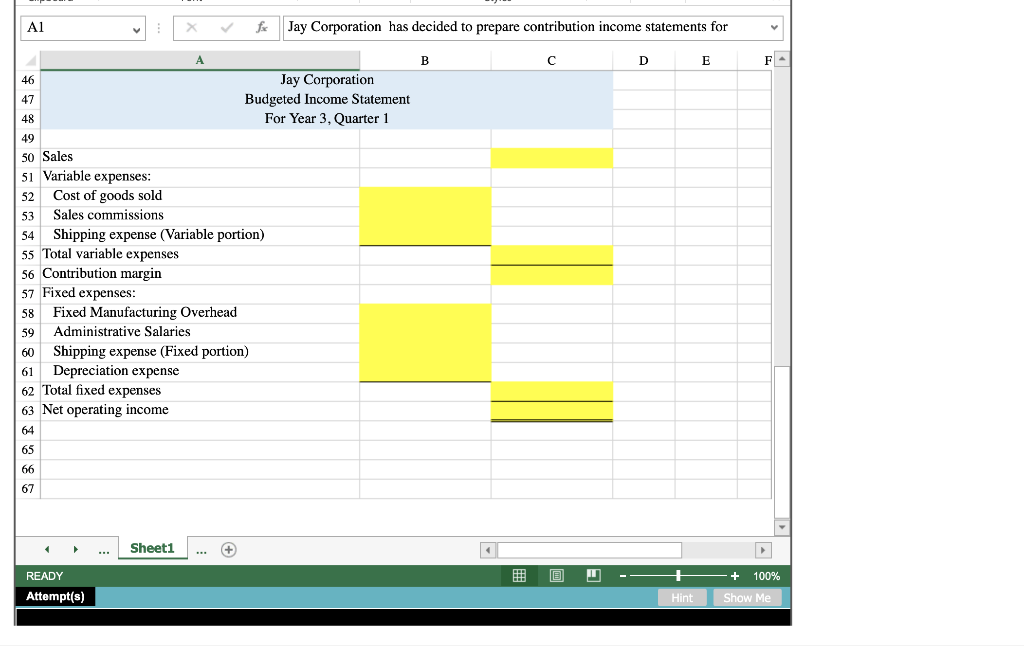

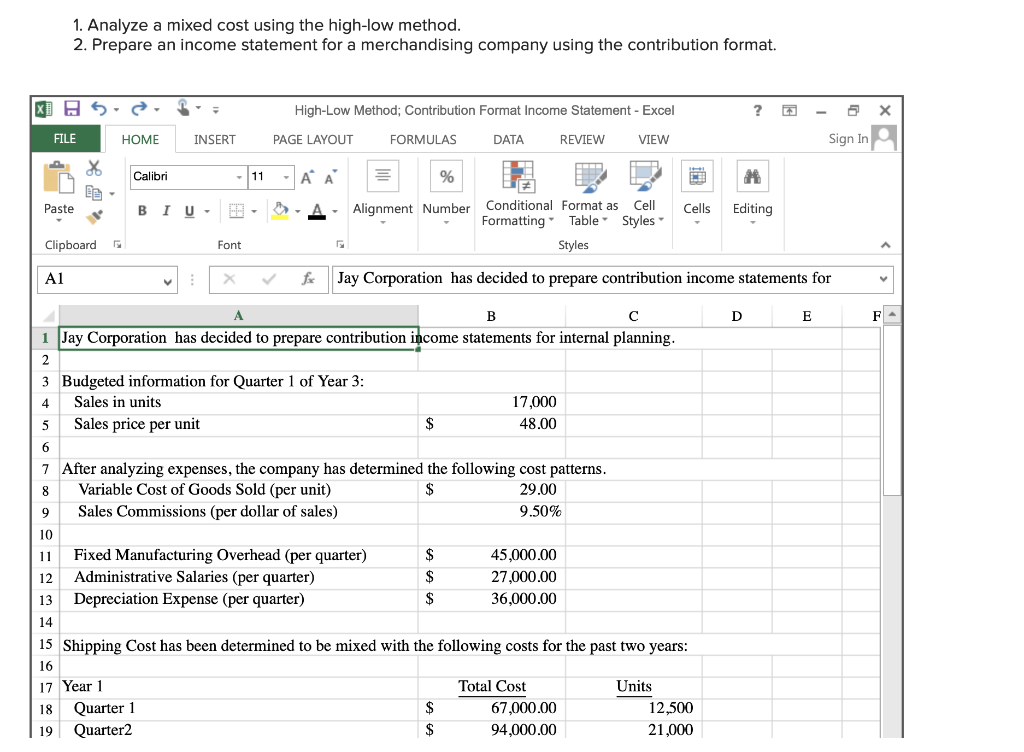

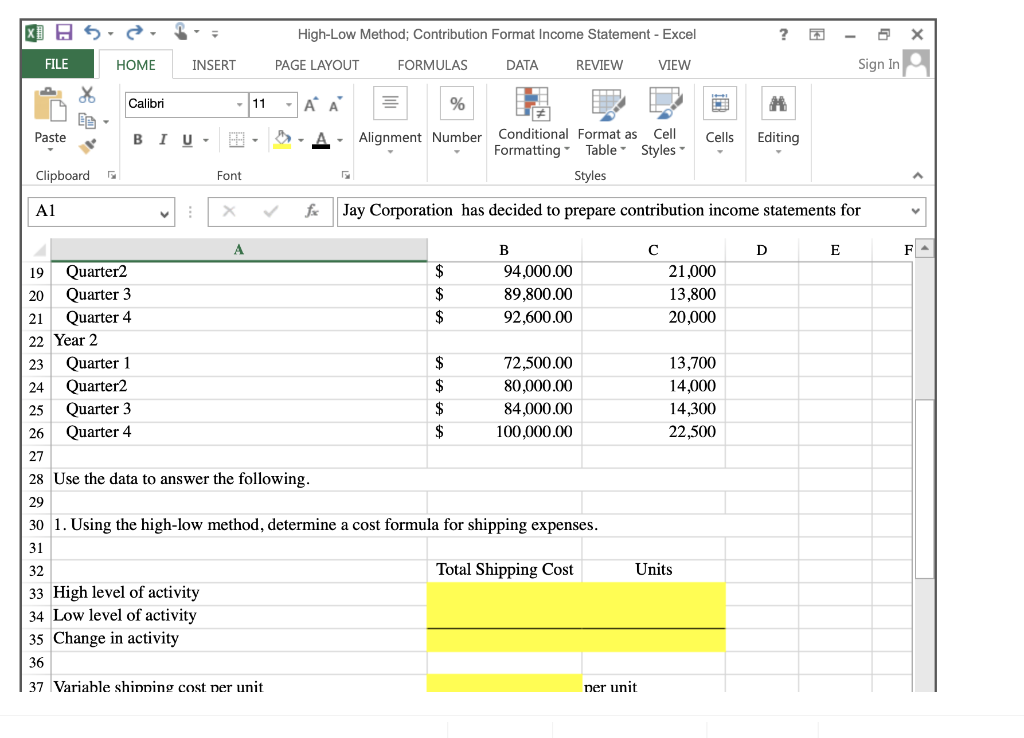

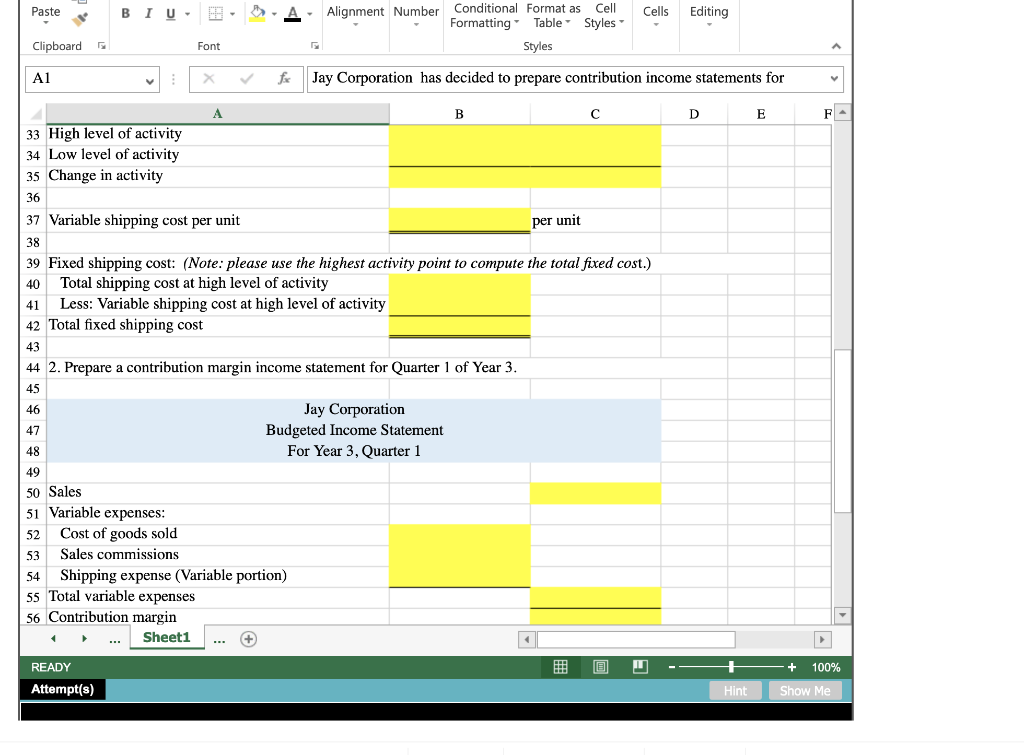

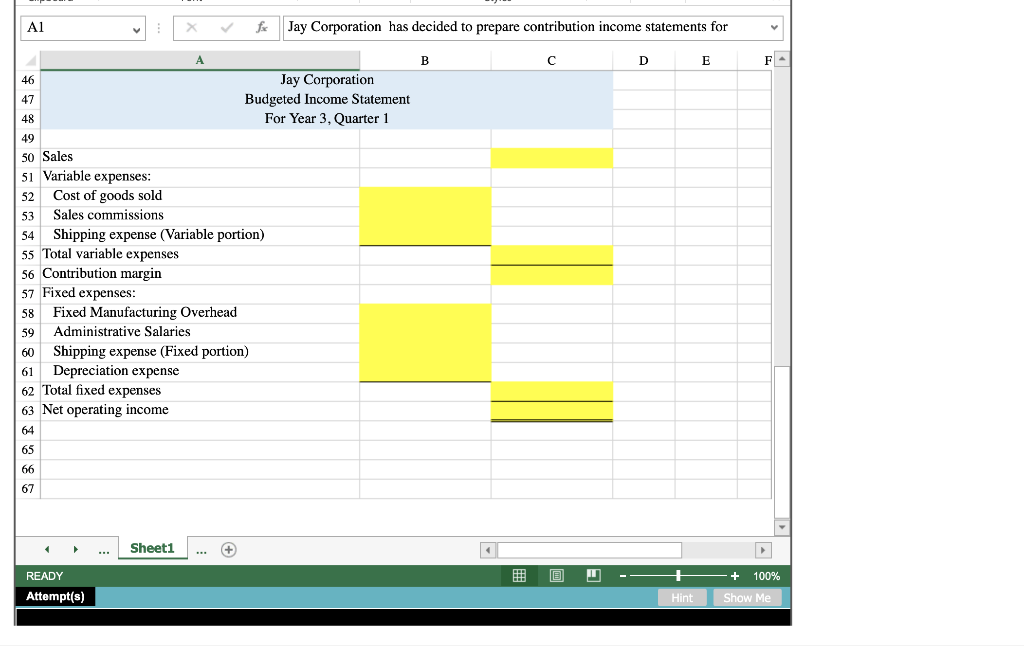

1. Analyze a mixed cost using the high-low method. 2. Prepare an income statement for a merchandising company using the contribution format. X 5 High-Low Method; Contribution Format Income Statement - Excel ? FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 A Paste B I U - % Alignment Number Conditional Format as Cell Formatting Table Styles Styles Cells Editing Clipboard Font A A1 Jay Corporation has decided to prepare contribution income statements for D E F - 4 8 9 A B 1 Jay Corporation has decided to prepare contribution income statements for internal planning. 2 3 Budgeted information for Quarter 1 of Year 3: Sales in units 17,000 5 Sales price per unit $ 48.00 6 7 After analyzing expenses, the company has determined the following cost patterns. Variable Cost of Goods Sold (per unit) $ 29.00 Sales Commissions (per dollar of sales) 9.50% 10 11 Fixed Manufacturing Overhead (per quarter) $ 45,000.00 Administrative Salaries (per quarter) $ 27,000.00 13 Depreciation Expense (per quarter) $ 36,000.00 14 15 Shipping Cost has been determined to be mixed with the following costs for the past two years: 16 17 Year 1 Total Cost Units 18 Quarter 1 $ 67,000.00 12,500 19 Quarter2 $ 94,000.00 21,000 12 High-Low Method; Contribution Format Income Statement - Excel ? FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In X Calibri - 11 I % Paste B IU- Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 Jay Corporation has decided to prepare contribution income statements for D E A B 19 Quarter2 $ 94,000.00 21,000 20 Quarter 3 $ 89,800.00 13,800 21 Quarter 4 $ 92,600.00 20,000 22 Year 2 23 Quarter 1 $ 72,500.00 13,700 24 Quarter2 $ 80,000.00 14,000 25 Quarter 3 84,000.00 14,300 26 Quarter 4 $ 100,000.00 22,500 27 28 Use the data to answer the following. 29 30 1. Using the high-low method, determine a cost formula for shipping expenses. 31 32 Total Shipping Cost Units 33 High level of activity 34 Low level of activity 35 Change in activity 36 37 Variable shipping cost per unit per unit Paste Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 Jay Corporation has decided to prepare contribution income statements for A D E per unit 40 B 33 High level of activity 34 Low level of activity 35 Change in activity 36 37 Variable shipping cost per unit 38 39 Fixed shipping cost: (Note: please use the highest activity point to compute the total fixed cost.) Total shipping cost at high level of activity 41 Less: Variable shipping cost at high level of activity 42 Total fixed shipping cost 43 44 2. Prepare a contribution margin income statement for Quarter 1 of Year 3. 45 46 Jay Corporation 47 Budgeted Income Statement 48 For Year 3, Quarter 1 49 50 Sales 51 Variable expenses: 52 Cost of goods sold 53 Sales commissions 54 Shipping expense (Variable portion) 55 Total variable expenses 56 Contribution margin Sheet1 READY 100% Attempt(s) Hint Show Me Al Jay Corporation has decided to prepare contribution income statements for B D E F A 46 Jay Corporation 47 Budgeted Income Statement 48 For Year 3, Quarter 1 49 50 Sales 51 Variable expenses: 52 Cost of goods sold 53 Sales commissions 54 Shipping expense (Variable portion) 55 Total variable expenses 56 Contribution margin 57 Fixed expenses: 58 Fixed Manufacturing Overhead 59 Administrative Salaries 60 Shipping expense (Fixed portion) 61 Depreciation expense 62 Total fixed expenses 63 Net operating income 64 65 66 67 Sheet1 B - + 100% READY Attempt(s) Hint Show Me