Question

1. Analyze a residential property using the following information: Purchase price: $150,000 Real estate loan o 85% loan to value o 30 year amortization o

1. Analyze a residential property using the following information:

Purchase price: $150,000

Real estate loan

o 85% loan to value

o 30 year amortization

o Interest rate 4%

o 3 points at closing

o Monthly interest payments

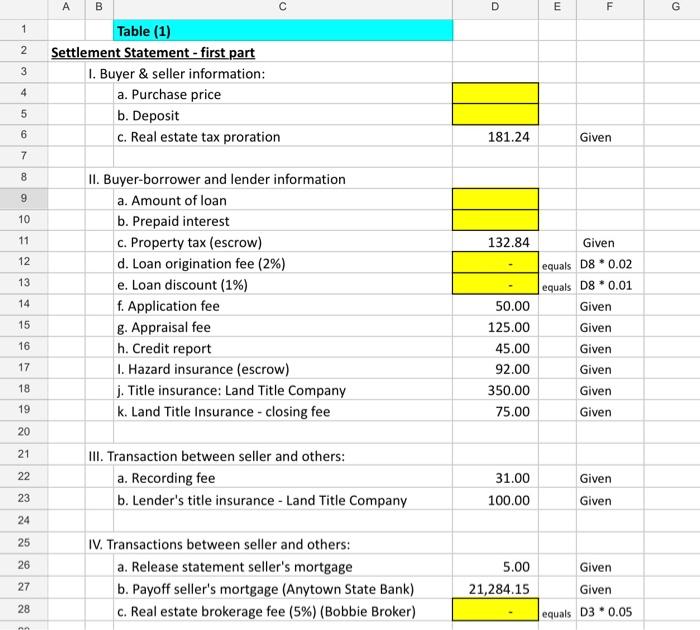

Settlement cost use table (1)

o Adjustments to table (1)

Purchase price

Deposit $5,000

Amount of loan

Prepaid interest: 10 days

Loan origination: 2% (same as points)

Loan discount: 1% (same as points)

Real estate brokerage fee: 5%

Redo table (1) using the latest information above

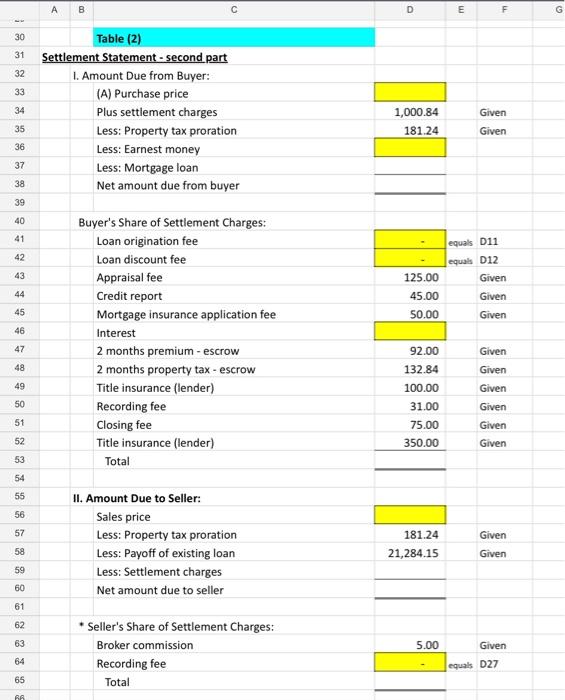

Redo table (2)

o Amount due from buyer

o Amount due to seller

o Assume information:

Payoff existing loan to be the same

2. As residential home loan agent,

Discuss how the closing statement works?

Who completes the closing statements?

How does the bank get involved in the closing process?

What are the examples of problems when completing the closing statements?

Where is the closing using located?

Make an example of a closing statement used by banks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started