Answered step by step

Verified Expert Solution

Question

1 Approved Answer

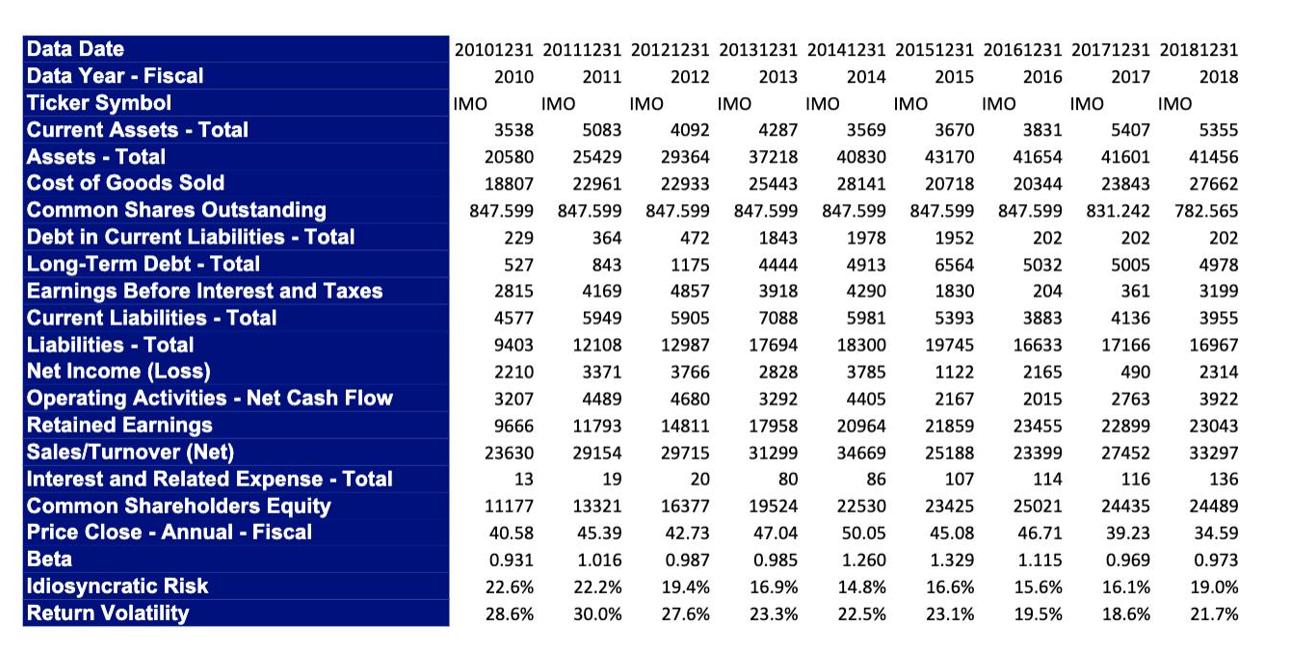

1. Analyze the performance of the firm over time. Your analysis should include ROE, ROA, COGS/Sales, Current ratio, D/E and Interest Coverage. Analyze means, trends

1. Analyze the performance of the firm over time. Your analysis should include ROE, ROA, COGS/Sales, Current ratio, D/E and Interest Coverage. Analyze means, trends and variance

2. Calculate estimates of bankruptcy risk over time using Altman’s Z-Score.

3. Using the Modified Kaplan-Urwitz model, calculate the estimated credit ratings of the firms over time

4. Provide appropriate interpretations of the ratio analysis and draw linkages between the ratio analysis and the bankruptcy/credit rating analyses.

Data Date Data Year - Fiscal Ticker Symbol Current Assets - Total Assets Total Cost of Goods Sold Common Shares Outstanding Debt in Current Liabilities - Total Long-Term Debt - Total Earnings Before Interest and Taxes Current Liabilities - Total Liabilities - Total Net Income (Loss) Operating Activities - Net Cash Flow Retained Earnings Sales/Turnover (Net) Interest and Related Expense - Total Common Shareholders Equity Price Close - Annual - Fiscal Beta Idiosyncratic Risk Return Volatility 20101231 20111231 20121231 20131231 20141231 20151231 20161231 20171231 20181231 2010 2011 2012 2013 2014 2015 2016 2017 2018 IMO 3538 20580 18807 847.599 IMO 11177 40.58 0.931 22.6% 28.6% IMO 5083 25429 22961 847.599 847.599 11793 29154 19 13321 45.39 1.016 22.2% 30.0% IMO 4092 4287 29364 37218 22933 25443 IMO 5407 5355 41456 3831 41654 41601 20344 23843 27662 847.599 847.599 831.242 782.565 847.599 847.599 1843 229 364 472 1978 1952 202 202 527 843 1175 4444 4913 6564 5032 5005 2815 4169 4857 3918 4290 1830 204 361 4577 5949 5905 7088 5981 5393 3883 4136 9403 12108 12987 17694 18300 19745 16633 17166 2210 3371 3766 2828 3785 1122 2165 490 3207 4489 4405 2167 2015 2763 4680 3292 14811 17958 20964 9666 21859 23455 22899 23630 25188 27452 29715 20 31299 34669 80 86 19524 22530 23399 114 13 107 116 16377 23425 25021 24435 42.73 47.04 50.05 45.08 46.71 39.23 0.987 0.985 1.260 1.329 1.115 0.969 19.4% 16.9% 14.8% 16.6% 15.6% 16.1% 27.6% 23.3% 22.5% 23.1% 19.5% 18.6% IMO IMO 3569 3670 40830 43170 28141 20718 IMO IMO 202 4978 3199 3955 16967 2314 3922 23043 33297 136 24489 34.59 0.973 19.0% 21.7%

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started