Answered step by step

Verified Expert Solution

Question

1 Approved Answer

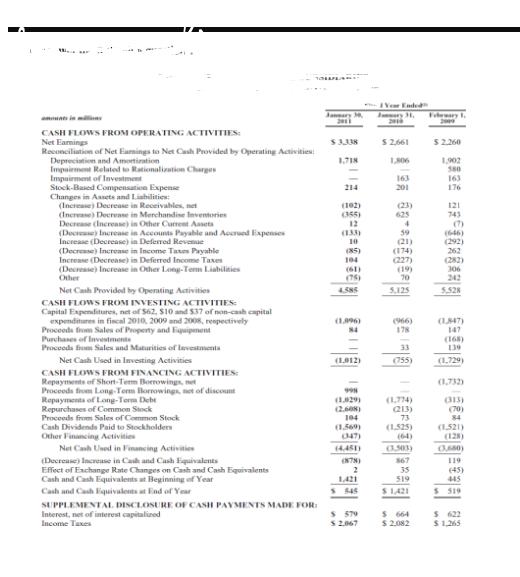

Year Ended CASH FLOWS FROM OPERATING ACTIVITIES: Net Earnings Reconciliation of Net Earnings to Net Cash Provided by Operating Activities Depreciation and Amortization Impairment

Year Ended CASH FLOWS FROM OPERATING ACTIVITIES: Net Earnings Reconciliation of Net Earnings to Net Cash Provided by Operating Activities Depreciation and Amortization Impairment Related to Rationalization Charges Impairment of Investment Stock-Based Compensation Expense Changes in Assets and Liabilities: (Increase) Decrease in Receivables, net (Increase) Decrease in Merchandise Inventories Decrease (Increase) in Other Current Assets (Decrease) Increase in Accounts Payable and Accrued Expenses Increase (Decrease) in Deferred Revenue (Decrease) Increase in Income Taxes Payable Increase (Decrease) in Deferred Income Taxes (Decresse) Increase in Other Long-Term Liabilities Other Net Cash Provided by Operating Activities CASH FLOWS FROM INVESTING ACTIVITIES: Capital Expenditures, net of $62, $10 and $37 of non-cash capital expenditures in fiscal 2010, 2009 and 2008, respectively (1.096) Proceeds from Sales of Property and Equipment Purchases of Investments Proceeds from Sales and Maturities of levestments Net Cash Used in Investing Activities CASH FLOWS FROM FINANCING ACTIVITIES: Repayments of Short-Term Borrowings, net Proceeds from Long-Term Borrowings, not of discount Repayments of Long-Term Debt (1.029) Repurchases of Common Stock Proceeds from Sales of Common Stock (2.608) 104 Cash Dividends Paid to Stockholders Other Financing Activities Net Cash Used in Financing Activities (Decrease) Increase in Cash and Cash Equivalents Effect of Exchange Rate Changes on Cash and Cash Equivalents (1,569) (347) (4,451) (878) 2 Cash and Cash Equivalents at Beginning of Year 1,421 Cash and Cash Equivalents at End of Year 5 545 SUPPLEMENTAL DISCLOSURE OF CASH PAYMENTS MADE FOR: Interest, net of interest capitalized $579 Income Taxes $2.067 $3,338 $2,661 $2.260 1,718 1,806 1,902 214 (102) (355) 12 (133) 10 (85) 104 (61) (75) 4.585 | @ } 580 163 176 121 743 (7) (646) (292) 262 (282) 306 242 5.528 (147) 147 (168) 139 (1.729) (1,732) (213) (313) (70) 84 (1.525) (64) (1521) (128) (3,503) (3,680) 119 (45) 445 $519 $622 $1,265 1. Why are depreciation expense, impairments and stock-based compensation added back to the net income in operating activities? 2. What was the amount of cash net income for the period ended on January 30, 2011? 3. What was the amount of non-cash net income for the period ended on January 30, 2011? 4. Did Home Depot have net cash inflow or outflow from operating activities for the period ended on January 30, 2011? Amount of net cash inflow or outflow? 5. Did Home Depot have net cash inflow or outflow from investing activities for the period ended on January 30, 2011? Amount of net cash inflow or outflow? 6. Did Home Depot have net cash inflow or outflow from financing activities for the period ended on January 30, 2011? Amount of net cash inflow or outflow? 7. Did Home Depot have total net cash inflow or outflow for the period ended on January 30, 2011? Amount of net cash inflow or outflow? 8. What was the amount of cash Home Depot spent on acquiring PP&E for the period ended on January 30, 2011? 9. What was the amount of cash Home Depot received from selling PP&E for the period ended on January 30, 2011? 10. What was the amount of cash Home Depot spent on purchasing investments for the period ended on January 30, 2011? 11. What was the amount of cash Home Depot received from selling investments for the period ended on January 30, 2011? 12. What was the amount of cash Home Depot spent on paying back short-tem debt for the period ended on January 30, 2011? 13. What was the amount of cash Home Depot received from issuing long-term debt for the period ended on January 30, 2011? 14. What was the amount of cash Home Depot spent on paying back long-tem debt for the period ended on January 30, 2011? 15. What was the amount of cash Home Depot paid to repurchase common shares for the period ended on January 30, 2011? 16. What was the amount of cash Home Depot received from issuing common shares for the period ended on January 30, 2011? 17. What was the amount of cash Home Depot spent on dividend payout for the period ended on January 30, 2011? 18. What was amount of cash Home Depot had on its balance sheet as of January, 31, 2010? 2. Compute and Interpret Liquidity, Solvency and Coverage Ratios (LO3) Balance sheets and income statements for Lockheed Martin Corporation follow. Refer to these financial statements to answer the requirements. Consolidated Statements of Earnings Year Ended December 31 (in millions) 2012 2011 2010 Net sales Products.. Services $37,817 9,365 $36,925 9,574 $36,380 9,291 Total net sales. 47,182 46,499 45,671 Cost of sales Products.. (33,495) (32,968) (32,539) Services (8,383) (8,514) (8,382) Severance and other charges.. (48) (136) (220) Other unallocated costs.. (1,060) (1,137) (686) Total cost of sales. (42,986) (42,755) (41,827) Gross profit.. Other income, net. 4,196 238 3,744 276 3,844 261 Operating profit 4,434 4,020 4,105 Interest expense.. (383) (354) (345) Other non-operating income (expense), net.. 21 (35) 18 Earnings from continuing operations before income taxes 4,072 3,631 3,778 Income tax expense... Net earnings from continuing operations... Net (loss) earnings from discontinued operations. Net earnings.. (1,327) (964) (1,164) 2,745 2,667 2,614 (12) 264 $ 2,745 $ 2,655 $2,878 Consolidated Balance Sheets 2012 2011 December 31 (in millions, except par value) Assets Current assets Cash and cash equivalents. Receivables, net. Inventories, net. Deferred income taxes Other current assets. Total current assets. Property, plant, and equipment, net. Goodwill Deferred income taxes. Other noncurrent assets. Total assets. Liabilities and stockholders' equity Current liabilities Accounts payable.. Customer advances and amounts in excess of costs incurred Salaries, benefits, and payroll taxes. Current portion of long-term debt Other current liabilities Total current liabilities Long-term debt, net. Accrued pension liabilities Other postretirement benefit liabilities Other noncurrent liabilities.. $ 1,898 $ 3,582 6,563 6,064 2,937 2,481 1,269 1,339 1,188 628 13,855 14,094 4,675 4,611 10,370 10,148 4,809 4,388 4,948 4,667 $38,657 $37,908 $ 2,038 $ 2,269 6,503 6,399 1,649 1,664 150 1,815 1,798 12,155 12,130 6,158 6,460 15,278 13,502 1,220 1,274 3,807 3,541 38,618 36,907 Total liabilities.. Stockholders' equity Common stock, $1 par value per share. 321 321 Additional paid-in capital Retained earnings.. 13,211 11,937 Accumulated other comprehensive loss (13,493) (11,257) Total stockholders' equity.... 39 1,001 Total liabilities and stockholders' equity. $38,657 $37,908 Required a. Compute Lockheed Martin's current ratio and quick ratio for 2012 and 2011. b. Compute total liabilities-to-equity ratios and total C. Compute times interest earned ratio for 2012 and 2011. d. debt-to-equity ratios for 2012 and 2011. Summarize your findings in a conclusion about the company's credit risk. Do you have any con- cerns about the company's ability to meet its debt obligations?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Detailed Explanation Part 1 Answer 1 Depreciation expense impairments and stockbased compensation are added back to net income in operating activities because they represent noncash expenses or adjust...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started