Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Apply 3 lot-sizing rules (FOQ, POQ and L4L) to the data given in the problem. 1. Estimate the holding cost 2. Estimate the

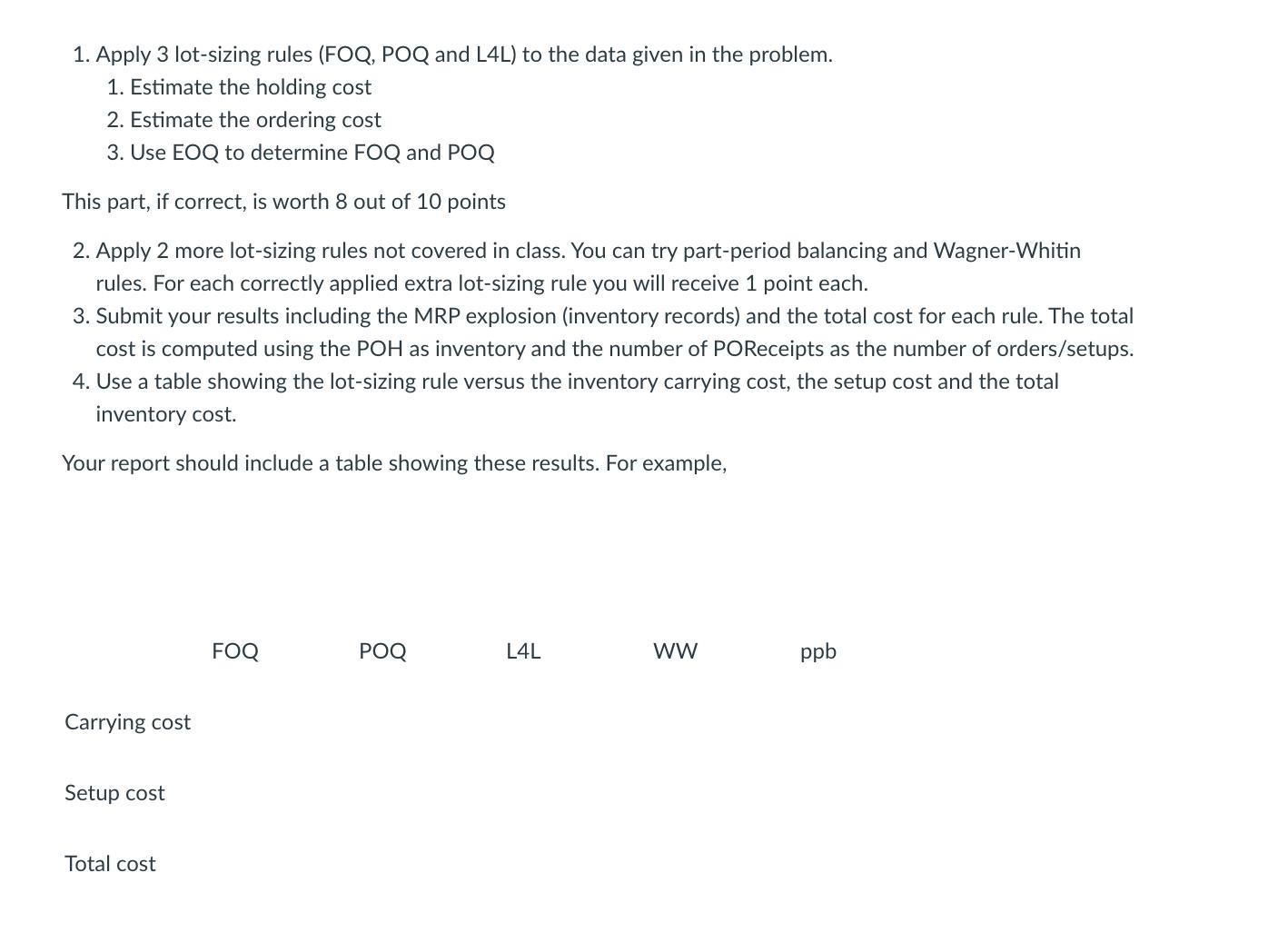

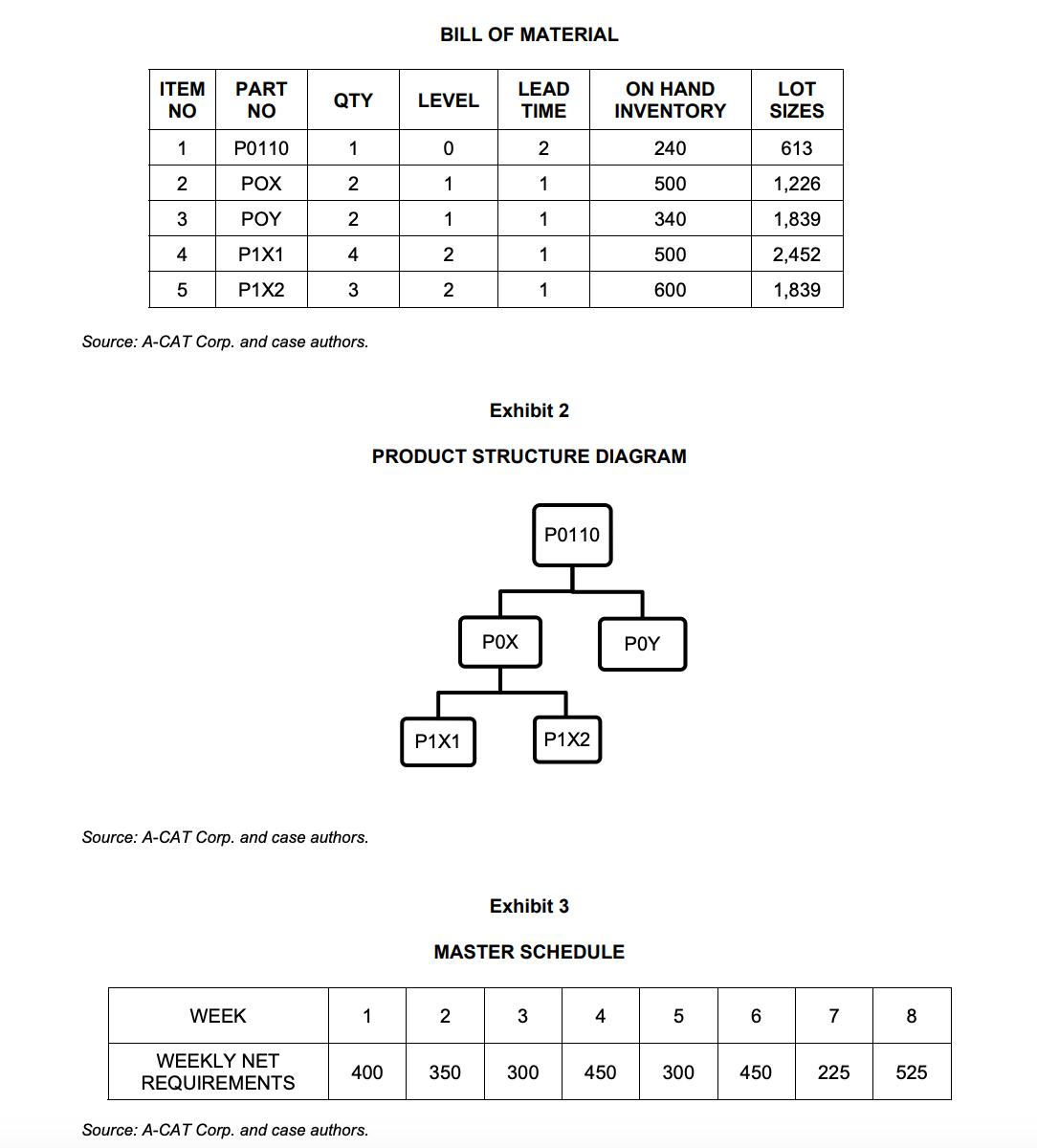

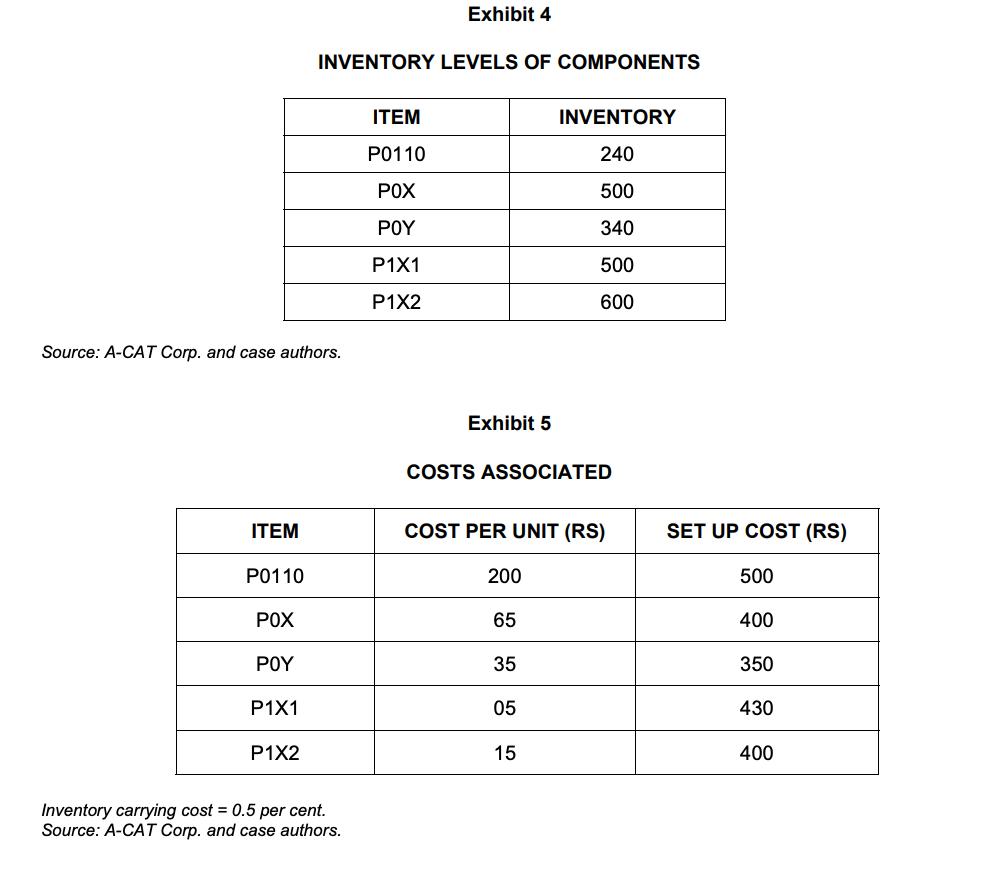

1. Apply 3 lot-sizing rules (FOQ, POQ and L4L) to the data given in the problem. 1. Estimate the holding cost 2. Estimate the ordering cost 3. Use EOQ to determine FOQ and POQ This part, if correct, is worth 8 out of 10 points 2. Apply 2 more lot-sizing rules not covered in class. You can try part-period balancing and Wagner-Whitin rules. For each correctly applied extra lot-sizing rule you will receive 1 point each. 3. Submit your results including the MRP explosion (inventory records) and the total cost for each rule. The total cost is computed using the POH as inventory and the number of POReceipts as the number of orders/setups. 4. Use a table showing the lot-sizing rule versus the inventory carrying cost, the setup cost and the total inventory cost. Your report should include a table showing these results. For example, Carrying cost Setup cost Total cost FOQ POQ L4L ww ppb ITEM NO 1 2 3 4 5 PART NO P0110 POX P1X1 P1X2 QTY Source: A-CAT Corp. and case authors. WEEK 1 2 2 4 3 Source: A-CAT Corp. and case authors. WEEKLY NET REQUIREMENTS 1 400 Source: A-CAT Corp. and case authors. BILL OF MATERIAL LEVEL 0 1 1 2 2 P1X1 LEAD TIME 2 1 1 1 PRODUCT STRUCTURE DIAGRAM 2 350 Exhibit 2 1 POX 3 P0110 Exhibit 3 MASTER SCHEDULE P1X2 300 ON HAND INVENTORY 240 500 340 500 600 4 450 300 6 LOT SIZES 450 613 1,226 1,839 2,452 1,839 7 225 8 525 Source: A-CAT Corp. and case authors. ITEM P0110 POX P1X1 P1X2 INVENTORY LEVELS OF COMPONENTS Inventory carrying cost = 0.5 per cent. Source: A-CAT Corp. and case authors. Exhibit 4 ITEM P0110 POX P1X1 P1X2 Exhibit 5 COSTS ASSOCIATED COST PER UNIT (RS) 200 INVENTORY 240 500 340 500 600 65 35 05 15 SET UP COST (RS) 500 400 350 430 400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started