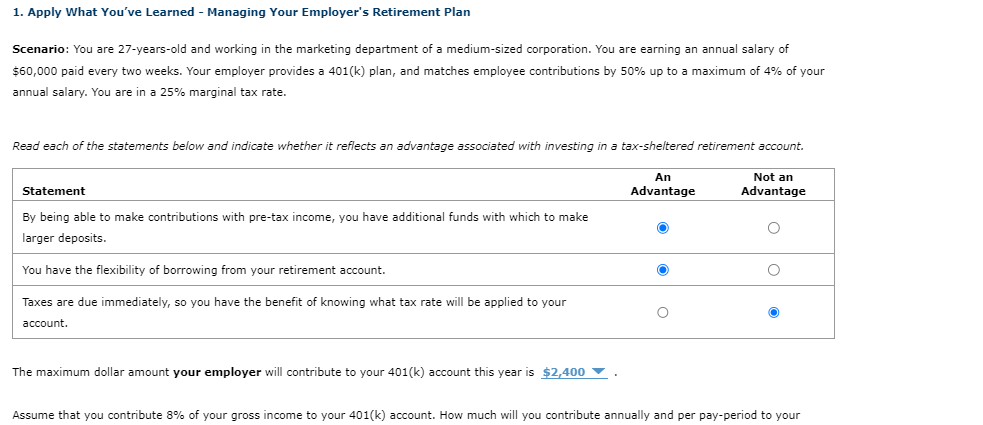

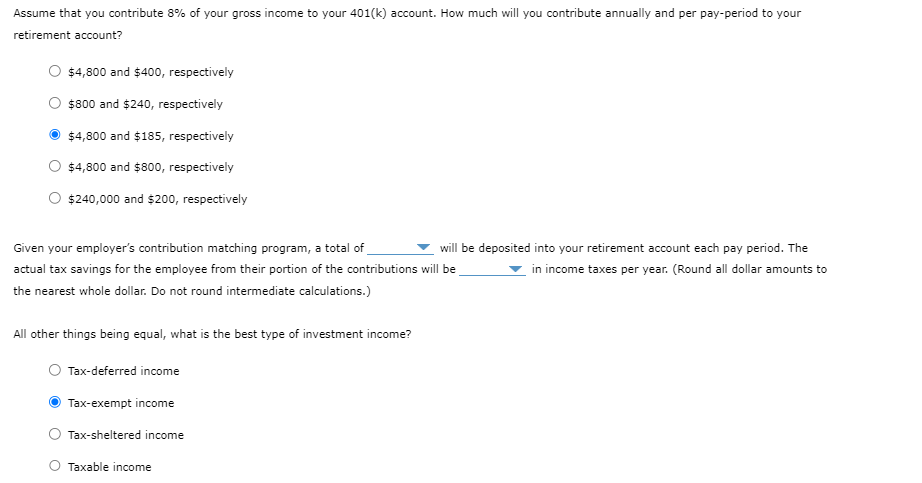

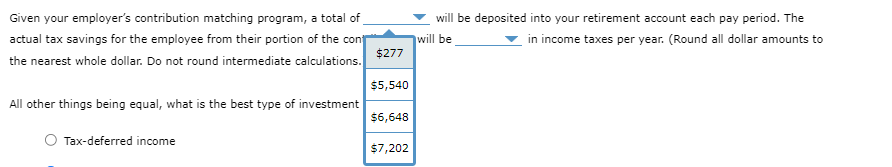

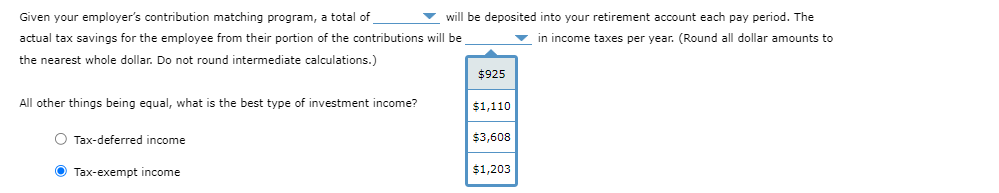

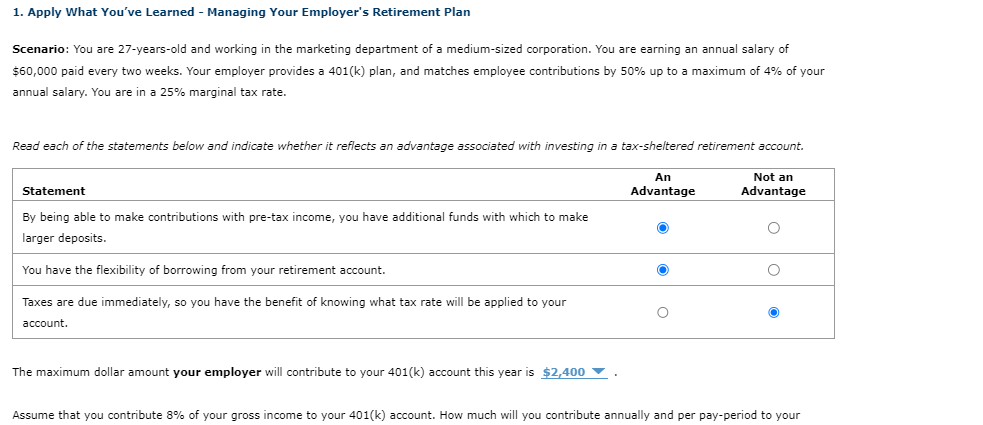

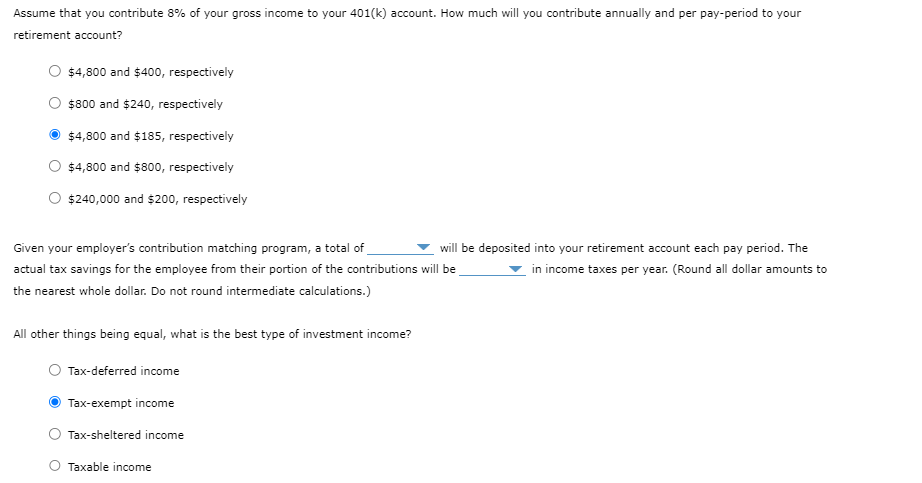

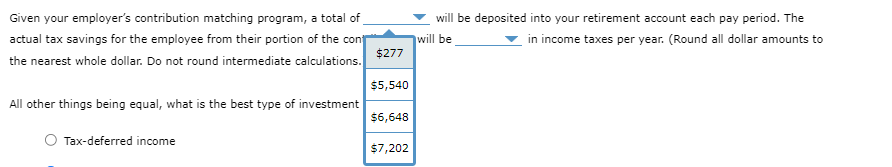

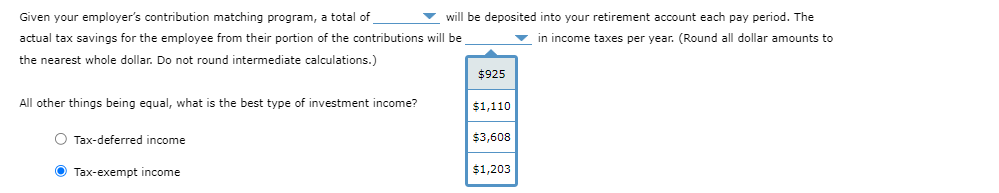

1. Apply What You've Learned - Managing Your Employer's Retirement Plan Scenario: You are 27-years-old and working in the marketing department of a medium-sized corporation. You are earning an annual salary of $60,000 paid every two weeks. Your employer provides a 401(k ) plan, and matches employee contributions by 50% up to a maximum of 4% your annual salary. You are in a 25% marginal tax rate. Read each of the statements below and indicate whether it reflects an advantage associated with investing in a tax-sheltered retirement account. The maximum dollar amount your employer will contribute to your 401(k) account this year is Assume that you contribute 8% of your gross income to your 401(k) account. How much will you contribute annually and per pay-period to your Assume that you contribute 8% of your gross income to your 401(k) account. How much will you contribute annually and per pay-period to your retirement account? $4,800 and $400, respectively $800 and $240, respectively $4,800 and $185, respectively $4,800 and $800, respectively $240,000 and $200, respectively Given your employer's contribution matching program, a total of will be deposited into your retirement account each pay period. The actual tax savings for the employee from their portion of the contributions will be in income taxes per year. (Round all dollar amounts to the nearest whole dollar. Do not round intermediate calculations.) All other things being equal, what is the best type of investment income? Tax-deferred income Tax-exempt income Tax-sheltered income Taxable income Given your employer's contribution matching program, a total of will be deposited into your retirement account each pay period. The actual tax savings for the employee from their portion of the cont will be in income taxes per year. (Round all dollar amounts to the nearest whole dollar. Do not round intermediate calculations. All other things being equal, what is the best type of investment Tax-deferred income $7,202 Given your employer's contribution matching program, a total of will be deposited into your retirement account each pay period. The actual tax savings for the employee from their portion of the contributions will be in income taxes per year. (Round all dollar amounts to the nearest whole dollar. Do not round intermediate calculations.) All other things being equal, what is the best type of investment income? Tax-deferred income Tax-exempt income \begin{tabular}{|l|} \hline$925 \\ $1,110 \\ $3,608 \\ \hline$1,203 \\ \hline \end{tabular}