Answered step by step

Verified Expert Solution

Question

1 Approved Answer

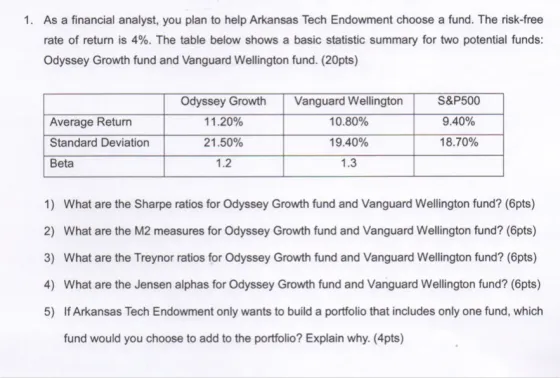

1. As a financial analyst, you plan to help Arkansas Tech Endowment choose a fund. The risk-free rate of return is 4%. The table

1. As a financial analyst, you plan to help Arkansas Tech Endowment choose a fund. The risk-free rate of return is 4%. The table below shows a basic statistic summary for two potential funds: Odyssey Growth fund and Vanguard Wellington fund. (20pts) Average Return Standard Deviation Beta Odyssey Growth 11.20% 21.50% 1.2 Vanguard Wellington 10.80% 19.40% 1.3 S&P500 9.40% 18.70% 1) What are the Sharpe ratios for Odyssey Growth fund and Vanguard Wellington fund? (6pts) 2) What are the M2 measures for Odyssey Growth fund and Vanguard Wellington fund? (6pts) 3) What are the Treynor ratios for Odyssey Growth fund and Vanguard Wellington fund? (6pts) 4) What are the Jensen alphas for Odyssey Growth fund and Vanguard Wellington fund? (6pts) 5) If Arkansas Tech Endowment only wants to build a portfolio that includes only one fund, which fund would you choose to add to the portfolio? Explain why. (4pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started