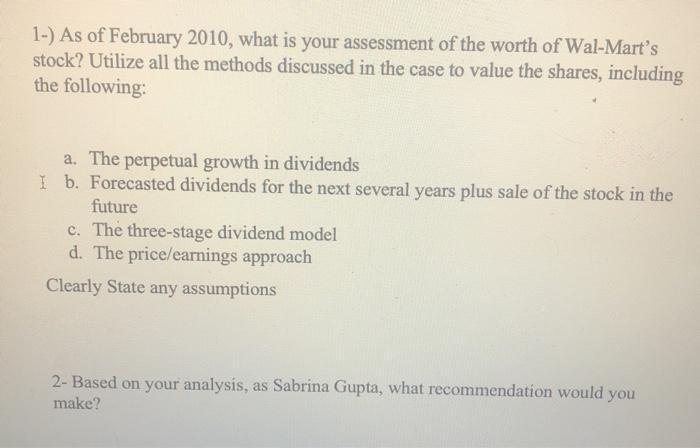

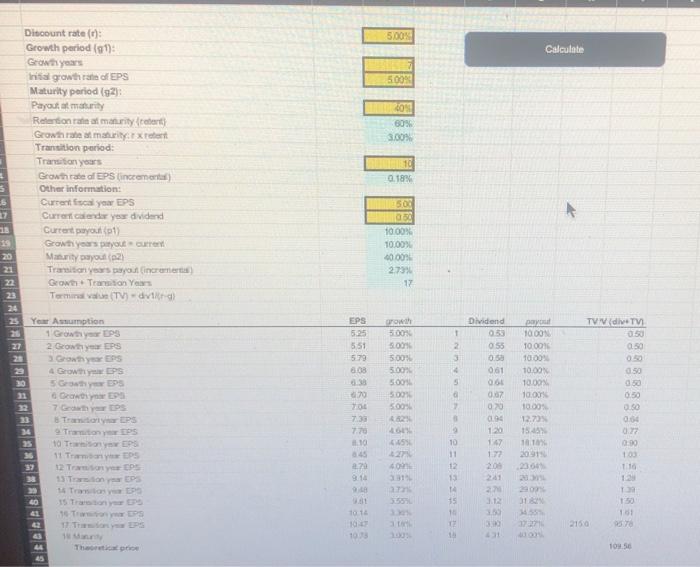

1-) As of February 2010, what is your assessment of the worth of Wal-Mart's stock? Utilize all the methods discussed in the case to value the shares, including the following: a. The perpetual growth in dividends I b. Forecasted dividends for the next several years plus sale of the stock in the future c. The three-stage dividend model d. The price/earnings approach Clearly State any assumptions 2- Based on your analysis, as Sabrina Gupta, what recommendation would you make? 5.00 Calculate 5.00% 20 80% 3.00 Discount rate(): Growth period (91): Grow years Initial growth rate of EPS Maturity period (92) Payout at maturity Retention rate at maurity cert) Growth rate at maturityrret Transition period: Transition years Growth rate of EPS (inccomental) Other information: Current your EPS Currencender your dividend Current payout 1 Geow yours payout current 2) Transition years out incremena Grow Transition Year Tormina TV) - dva 10 0.18% 5.00 15 10.00% 10.00% 6000 273 17 EPS 5.25 5.51 579 608 38 20 growth 500 5.00 5.00% 500 5001 5001 500 1 2 3 4 5 Dividend 013 055 0.50 061 06 Yer Asumption 1 Go EPS 27 2 GYERS Growth year EPS 4 Growth EPS 30 5 Goy95 Gawy 7 GDP Trai 34 10 Tony EPS 11. TEPS NAXARARARAR 93 paypalt 10.00 10.00 1000 10.00 10.00 100 1000 12.70 15 TV V(div. 3150 0.50 050 0.50 050 0130 3150 9 020 09 1:20 147 17 200 CUS 7.33 7.70 10 45 2.70 9.16 10 2011 07 0.00 100 116 13 con 12 13 20 31 150 15 10 02 10 TS 1 TUPS 1787 2150 10 44 10.50 1-) As of February 2010, what is your assessment of the worth of Wal-Mart's stock? Utilize all the methods discussed in the case to value the shares, including the following: a. The perpetual growth in dividends I b. Forecasted dividends for the next several years plus sale of the stock in the future c. The three-stage dividend model d. The price/earnings approach Clearly State any assumptions 2- Based on your analysis, as Sabrina Gupta, what recommendation would you make? 5.00 Calculate 5.00% 20 80% 3.00 Discount rate(): Growth period (91): Grow years Initial growth rate of EPS Maturity period (92) Payout at maturity Retention rate at maurity cert) Growth rate at maturityrret Transition period: Transition years Growth rate of EPS (inccomental) Other information: Current your EPS Currencender your dividend Current payout 1 Geow yours payout current 2) Transition years out incremena Grow Transition Year Tormina TV) - dva 10 0.18% 5.00 15 10.00% 10.00% 6000 273 17 EPS 5.25 5.51 579 608 38 20 growth 500 5.00 5.00% 500 5001 5001 500 1 2 3 4 5 Dividend 013 055 0.50 061 06 Yer Asumption 1 Go EPS 27 2 GYERS Growth year EPS 4 Growth EPS 30 5 Goy95 Gawy 7 GDP Trai 34 10 Tony EPS 11. TEPS NAXARARARAR 93 paypalt 10.00 10.00 1000 10.00 10.00 100 1000 12.70 15 TV V(div. 3150 0.50 050 0.50 050 0130 3150 9 020 09 1:20 147 17 200 CUS 7.33 7.70 10 45 2.70 9.16 10 2011 07 0.00 100 116 13 con 12 13 20 31 150 15 10 02 10 TS 1 TUPS 1787 2150 10 44 10.50