Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. As the amount of a increases the present value of debt net tax-shield benefits of debt increases debt net tax-shield benefits of debt

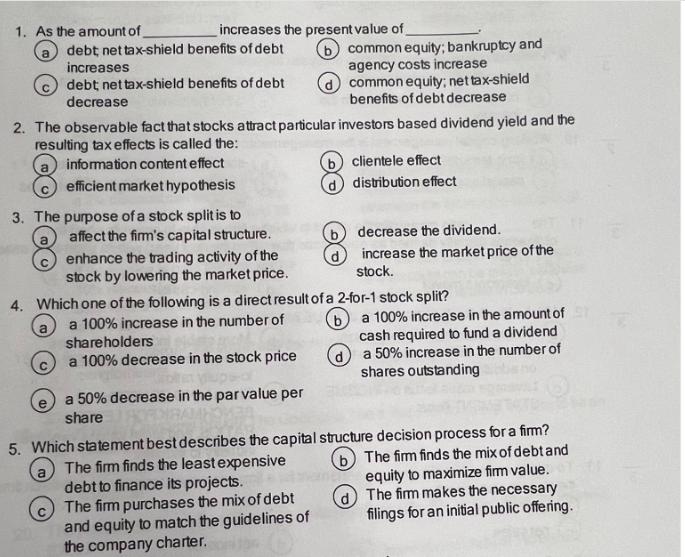

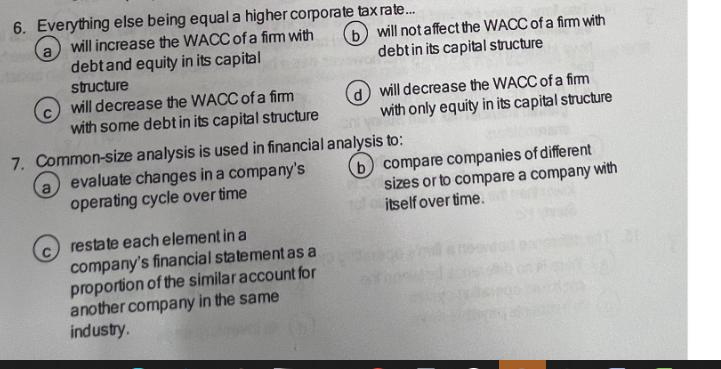

1. As the amount of a increases the present value of debt net tax-shield benefits of debt increases debt net tax-shield benefits of debt decrease 2. The observable fact that stocks attract particular investors based dividend yield and the resulting tax effects is called the: information content effect efficient market hypothesis 3. The purpose of a stock split is to a affect the firm's capital structure. enhance the trading activity of the stock by lowering the market price. b common equity; bankruptcy and agency costs increase common equity; net tax-shield benefits of debt decrease a 50% decrease in the par value per share 4. Which one of the following is a direct result of a 2-for-1 stock split? b a 100% increase in the number of shareholders a 100% decrease in the stock price clientele effect distribution effect debt to finance its projects. The firm purchases the mix of debt and equity to match the guidelines of the company charter. decrease the dividend. increase the market price of the stock. a 100% increase in the amount of ST cash required to fund a dividend d) a 50% increase in the number of shares outstanding 5. Which statement best describes the capital structure decision process for a firm? The firm finds the least expensive (b) The firm finds the mix of debt and equity to maximize firm value. The firm makes the necessary filings for an initial public offering. 6. Everything else being equal a higher corporate tax rate... will increase the WACC of a firm with debt and equity in its capital structure a will decrease the WACC of a firm with some debt in its capital structure a (b) will not affect the WACC of a firm with debt in its capital structure 7. Common-size analysis is used in financial analysis to: evaluate changes in a company's operating cycle over time restate each element in a company's financial statement as a proportion of the similar account for another company in the same industry. (d) will decrease the WACC of a firm with only equity in its capital structure b compare companies of different sizes or to compare a company with itself over time.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This is a multiplechoice questionnaire that appears to come from a finance or accounting textbook Its focused on concepts such as capital structure stock splits tax benefits of debt and weighted avera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started