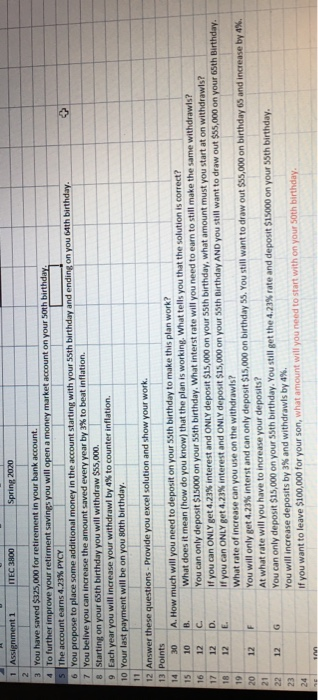

1 Assignment 1 ITEC 3800 Spring 2020 3 You have saved $325,000 for retirement in your bank account. 4 To further improve your retirment savings you will open a money market account on your 50th birthday. 5 The account earns 4.23% PYCY 6 You propose to place some additional money in the account starting with your 55th birthday and ending on you t4th birthday. 7 You belive you can increase the amount saved every year by 3% to beat inflation. 8 Starting on your 65th birthday you will withdraw $55,000. 9 Each year you will increase your withdrawl by 4% to counter inflation. 10 Your last payment will be on you goth birthday. 12 Answer these questions - Provide you excel solution and show your work 13 Points A. How much will you need to deposit on your 55th birthday to make this plan work? What does it mean (how do you know) that the plan is working. What tells you that the solution is correct? You can only deposit $15000 on your 55th birthday. What interst rate will you need to earn to still make the same withdrawls? If you can ONLY get 4.23% interest and ONLY deposit $15,000 on your 55th birthday, what amount must you start at on withdrawls? If you can ONLY get 4.23% interest and ONLY deposit $15,000 on your 55th Birthday AND you still want to draw out $55,000 on your sth Birthday What rate of increase can you use on the withdrawls? You will only get 4.23% interst and can only deposit $15,000 on birthday 55. You still want to draw out $55,000 on birthday 65 and increase by 4%. At what rate will you have to increase your deposits? You can only deposit $15,000 on your 55th birthday. You still get the 4.23% rate and deposit $15000 on your 55th birthday You will increase deposits by 3% and withdrawls by 4%. If you want to leave $100,000 for your son, what amount will you need to start with on your 50th birthday. 1 Assignment 1 ITEC 3800 Spring 2020 3 You have saved $325,000 for retirement in your bank account. 4 To further improve your retirment savings you will open a money market account on your 50th birthday. 5 The account earns 4.23% PYCY 6 You propose to place some additional money in the account starting with your 55th birthday and ending on you t4th birthday. 7 You belive you can increase the amount saved every year by 3% to beat inflation. 8 Starting on your 65th birthday you will withdraw $55,000. 9 Each year you will increase your withdrawl by 4% to counter inflation. 10 Your last payment will be on you goth birthday. 12 Answer these questions - Provide you excel solution and show your work 13 Points A. How much will you need to deposit on your 55th birthday to make this plan work? What does it mean (how do you know) that the plan is working. What tells you that the solution is correct? You can only deposit $15000 on your 55th birthday. What interst rate will you need to earn to still make the same withdrawls? If you can ONLY get 4.23% interest and ONLY deposit $15,000 on your 55th birthday, what amount must you start at on withdrawls? If you can ONLY get 4.23% interest and ONLY deposit $15,000 on your 55th Birthday AND you still want to draw out $55,000 on your sth Birthday What rate of increase can you use on the withdrawls? You will only get 4.23% interst and can only deposit $15,000 on birthday 55. You still want to draw out $55,000 on birthday 65 and increase by 4%. At what rate will you have to increase your deposits? You can only deposit $15,000 on your 55th birthday. You still get the 4.23% rate and deposit $15000 on your 55th birthday You will increase deposits by 3% and withdrawls by 4%. If you want to leave $100,000 for your son, what amount will you need to start with on your 50th birthday