Question

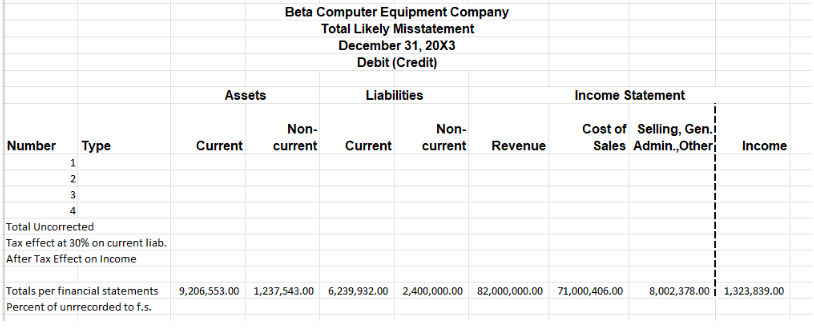

1. Assume a 30% tax rate, and the Totals per financial statements provided. Complete the following schedule as per Figure 16.4 (p. 718) in the

1. Assume a 30% tax rate, and the Totals per financial statements provided. Complete the following schedule as per Figure 16.4 (p. 718) in the text. Assume that the Totals per financial statements (second to bottom row) have appropriately been entered on this schedule from the financial statements.

2. Assume that the client does not intend to record any of the above misstatements and that 4.0 percent of income after taxes is considered a material misstatement. Provide the auditors conclusion in this situation. Only consider the income effect.

2. Assume that the client does not intend to record any of the above misstatements and that 4.0 percent of income after taxes is considered a material misstatement. Provide the auditors conclusion in this situation. Only consider the income effect.

3. Assume that the client does intends to record correcting entries for each above misstatement. Provide the auditors conclusion in this situation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started