Answered step by step

Verified Expert Solution

Question

1 Approved Answer

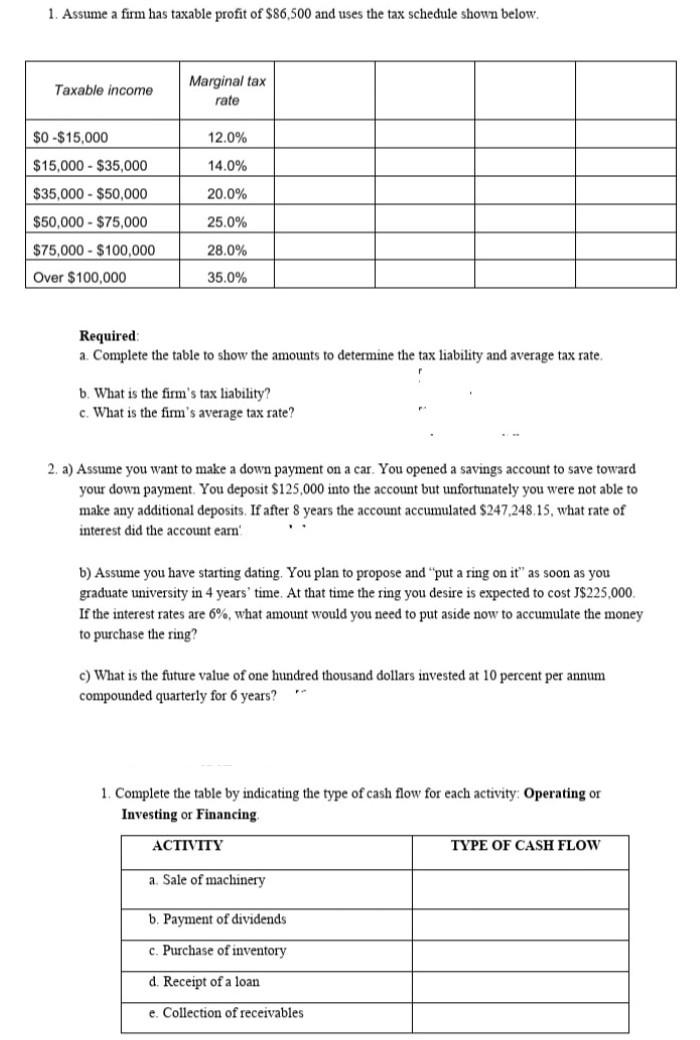

1. Assume a firm has taxable profit of $86,500 and uses the tax schedule shown below. Required: a. Complete the table to show the amounts

1. Assume a firm has taxable profit of $86,500 and uses the tax schedule shown below. Required: a. Complete the table to show the amounts to determine the tax liability and average tax rate. b. What is the firm's tax liability? c. What is the firm's average tax rate? 2. a) Assume you want to make a down payment on a car. You opened a savings account to save toward your down payment. You deposit $125,000 into the account but unfortunately you were not able to make any additional deposits. If after 8 years the account accumulated $247,248.15, what rate of interest did the account eam' b) Assume you have starting dating. You plan to propose and "put a ring on it" as soon as you graduate university in 4 years' time. At that time the ring you desire is expected to cost J\$225,000. If the interest rates are 6%, what amount would you need to put aside now to accumulate the money to purchase the ring? c) What is the future value of one hundred thousand dollars invested at 10 percent per annum compounded quarterly for 6 years? 1. Complete the table by indicating the type of cash flow for each activity: Operating or Investing or Financing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started