Answered step by step

Verified Expert Solution

Question

1 Approved Answer

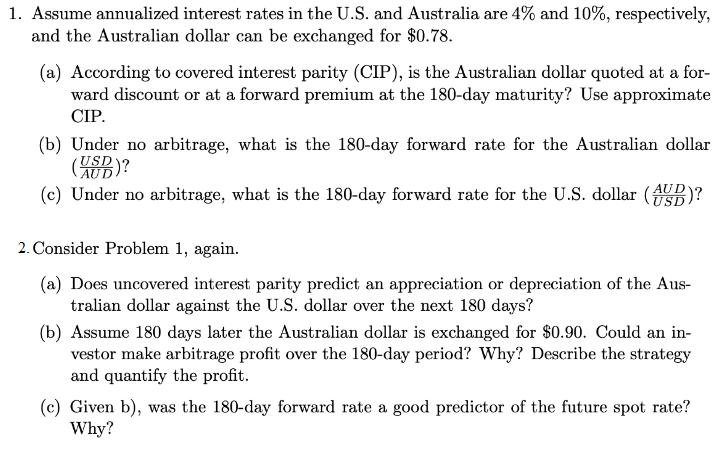

1. Assume annualized interest rates in the U.S. and Australia are 4% and 10%, respectively, and the Australian dollar can be exchanged for $0.78.

1. Assume annualized interest rates in the U.S. and Australia are 4% and 10%, respectively, and the Australian dollar can be exchanged for $0.78. (a) According to covered interest parity (CIP), is the Australian dollar quoted at a for- ward discount or at a forward premium at the 180-day maturity? Use approximate CIP. (b) Under no arbitrage, what is the 180-day forward rate for the Australian dollar EB)? (c) Under no arbitrage, what is the 180-day forward rate for the U.S. dollar (B USD AUD AUD? 2. Consider Problem 1, again. (a) Does uncovered interest parity predict an appreciation or depreciation of the Aus- tralian dollar against the U.S. dollar over the next 180 days? (b) Assume 180 days later the Australian dollar is exchanged for $0.90. Could an in- vestor make arbitrage profit over the 180-day period? Why? Describe the strategy and quantify the profit. (c) Given b), was the 180-day forward rate a good predictor of the future spot rate? Why?

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started