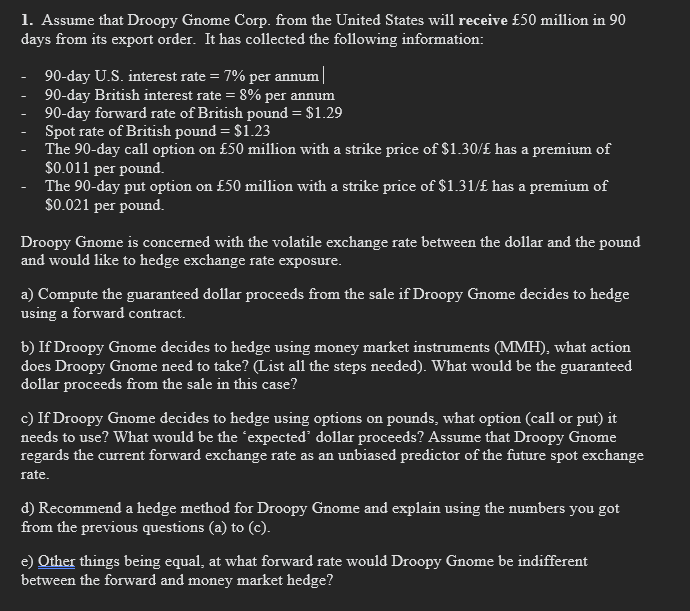

1. Assume that Droopy Gnome Corp. from the United States will receive 50 million in 90 days from its export order. It has collected the following information: 90-day U.S. interest rate = 7% per annum | 90-day British interest rate = 8% per annum 90-day forward rate of British pound = $1.29 Spot rate of British pound = $1.23 The 90-day call option on 50 million with a strike price of $1.30/ has a premium of $0.011 per pound. The 90-day put option on 50 million with a strike price of $1.31/ has a premium of $0.021 per pound. Droopy Gnome is concerned with the volatile exchange rate between the dollar and the pound and would like to hedge exchange rate exposure. a) Compute the guaranteed dollar proceeds from the sale if Droopy Gnome decides to hedge using a forward contract. b) If Droopy Gnome decides to hedge using money market instruments (MMH), what action does Droopy Gnome need to take? (List all the steps needed). What would be the guaranteed dollar proceeds from the sale in this case? c) If Droopy Gnome decides to hedge using options on pounds, what option (call or put) it needs to use? What would be the expected' dollar proceeds? Assume that Droopy Gnome regards the current forward exchange rate as an unbiased predictor of the future spot exchange rate. d) Recommend a hedge method for Droopy Gnome and explain using the numbers you got from the previous questions (a) to (c). e) Other things being equal, at what forward rate would Droopy Gnome be indifferent between the forward and money market hedge? 1. Assume that Droopy Gnome Corp. from the United States will receive 50 million in 90 days from its export order. It has collected the following information: 90-day U.S. interest rate = 7% per annum | 90-day British interest rate = 8% per annum 90-day forward rate of British pound = $1.29 Spot rate of British pound = $1.23 The 90-day call option on 50 million with a strike price of $1.30/ has a premium of $0.011 per pound. The 90-day put option on 50 million with a strike price of $1.31/ has a premium of $0.021 per pound. Droopy Gnome is concerned with the volatile exchange rate between the dollar and the pound and would like to hedge exchange rate exposure. a) Compute the guaranteed dollar proceeds from the sale if Droopy Gnome decides to hedge using a forward contract. b) If Droopy Gnome decides to hedge using money market instruments (MMH), what action does Droopy Gnome need to take? (List all the steps needed). What would be the guaranteed dollar proceeds from the sale in this case? c) If Droopy Gnome decides to hedge using options on pounds, what option (call or put) it needs to use? What would be the expected' dollar proceeds? Assume that Droopy Gnome regards the current forward exchange rate as an unbiased predictor of the future spot exchange rate. d) Recommend a hedge method for Droopy Gnome and explain using the numbers you got from the previous questions (a) to (c). e) Other things being equal, at what forward rate would Droopy Gnome be indifferent between the forward and money market hedge