Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Assume that OSG currently has accounts receivable of US $1 million from a US company which will be paid in three months. Explain

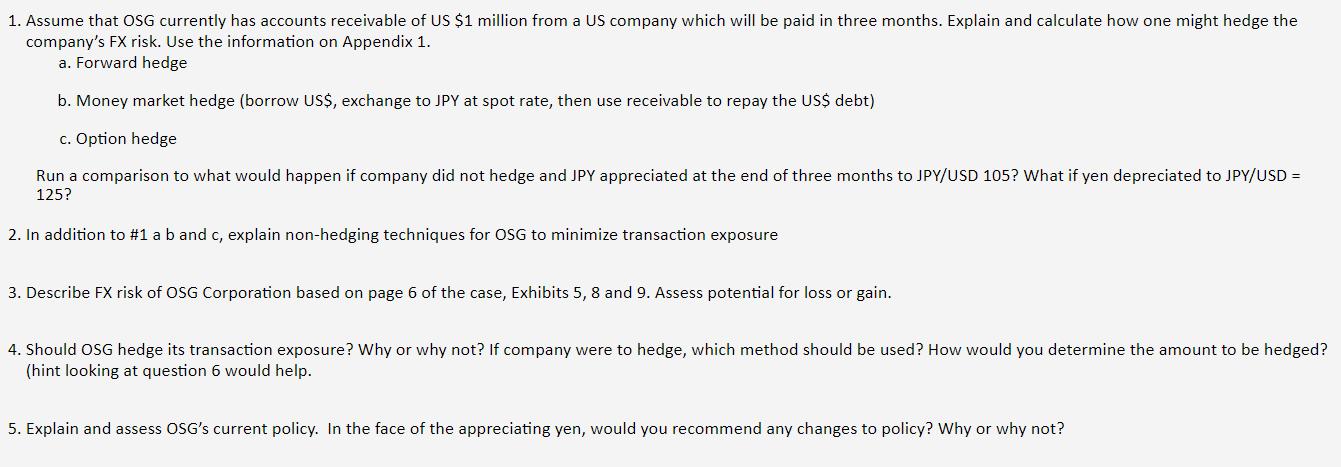

1. Assume that OSG currently has accounts receivable of US $1 million from a US company which will be paid in three months. Explain and calculate how one might hedge the company's FX risk. Use the information on Appendix 1. a. Forward hedge b. Money market hedge (borrow US$, exchange to JPY at spot rate, then use receivable to repay the US$ debt) c. Option hedge Run a comparison to what would happen if company did not hedge and JPY appreciated at the end of three months to JPY/USD 105? What if yen depreciated to JPY/USD = 125? 2. In addition to #1 a b and c, explain non-hedging techniques for OSG to minimize transaction exposure 3. Describe FX risk of OSG Corporation based on page 6 of the case, Exhibits 5, 8 and 9. Assess potential for loss or gain. 4. Should OSG hedge its transaction exposure? Why or why not? If company were to hedge, which method should be used? How would you determine the amount to be hedged? (hint looking at question 6 would help. 5. Explain and assess OSG's current policy. In the face of the appreciating yen, would you recommend any changes to policy? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Forward hedge To hedge its FX risk using a forward contract OSG can enter into an agreement with a bank to sell USD 1 million after three months at a predetermined exchange rate forward rate The for...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started