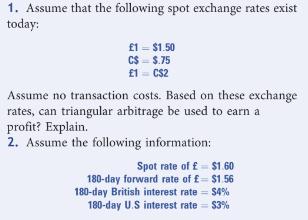

1. Assume that the following spot exchange rates exist today: 1 = $1.50 C$=$.75 1 = CS2 Assume no transaction costs. Based on these

1. Assume that the following spot exchange rates exist today: 1 = $1.50 C$=$.75 1 = CS2 Assume no transaction costs. Based on these exchange rates, can triangular arbitrage be used to earn a profit? Explain. 2. Assume the following information: Spot rate of $1.60 180-day forward rate of = $1.56 180-day British interest rate = $4% 180-day U.S interest rate = $3% Based on this information, is covered interest arbitrage by U.S. investors feasible (assuming that U.S. investors use their own funds)? Explain.

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 When exchange rate of three currencies dont match a discrepancy occurs between three currencies so ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started