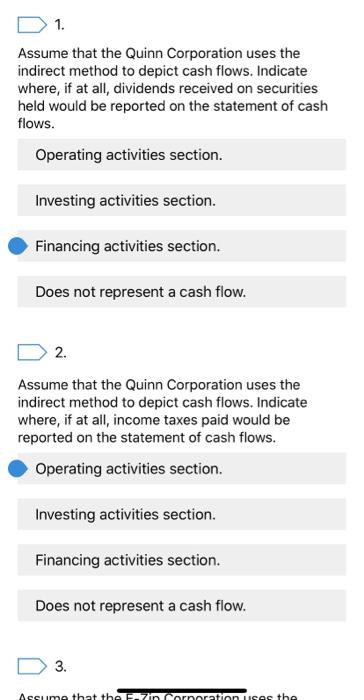

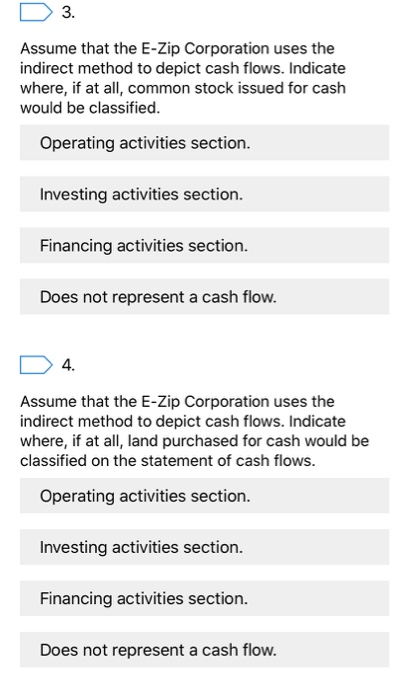

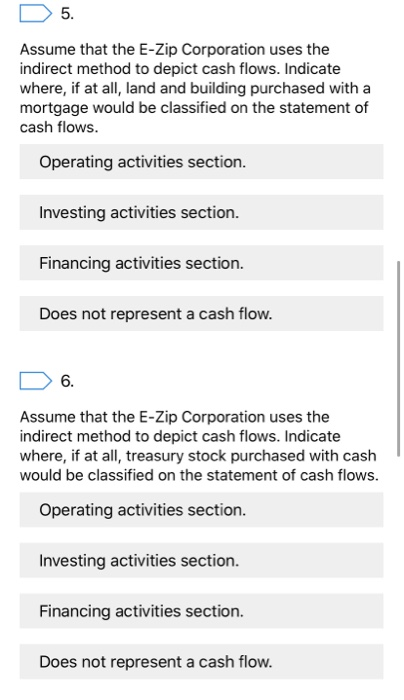

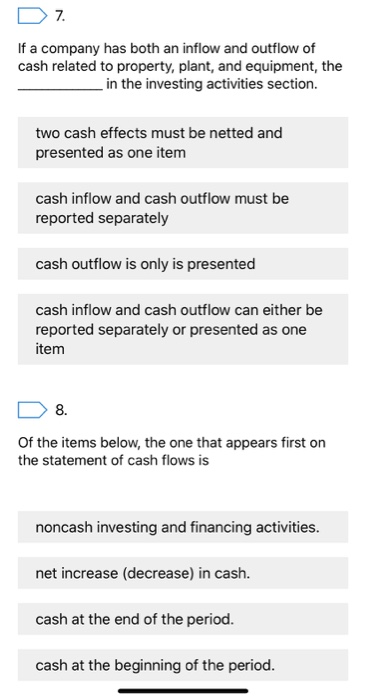

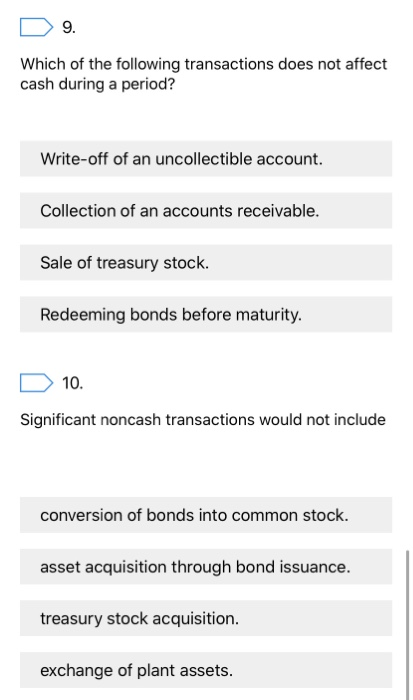

1. Assume that the Quinn Corporation uses the indirect method to depict cash flows. Indicate where, if at all, dividends received on securities held would be reported on the statement of cash flows. Operating activities section. Investing activities section. Financing activities section. Does not represent a cash flow. 2. Assume that the Quinn Corporation uses the indirect method to depict cash flows. Indicate where, if at all, income taxes paid would be reported on the statement of cash flows. Operating activities section. Investing activities section. Financing activities section. Does not represent a cash flow. 3. Assume that the Zin Corneration uses the 3. Assume that the E-Zip Corporation uses the indirect method to depict cash flows. Indicate where, if at all, common stock issued for cash would be classified. Operating activities section. Investing activities section. Financing activities section. Does not represent a cash flow. 4. Assume that the E-Zip Corporation uses the indirect method to depict cash flows. Indicate where, if at all, land purchased for cash would be classified on the statement of cash flows. Operating activities section. Investing activities section. Financing activities section. Does not represent a cash flow. 5. Assume that the E-Zip Corporation uses the indirect method to depict cash flows. Indicate where, if at all, land and building purchased with a mortgage would be classified on the statement of cash flows. Operating activities section. Investing activities section. Financing activities section. Does not represent a cash flow. 6. Assume that the E-Zip Corporation uses the indirect method to depict cash flows. Indicate where, if at all, treasury stock purchased with cash would be classified on the statement of cash flows. Operating activities section. Investing activities section. Financing activities section. Does not represent a cash flow. 7. If a company has both an inflow and outflow of cash related to property, plant, and equipment, the in the investing activities section. two cash effects must be netted and presented as one item cash inflow and cash outflow must be reported separately cash outflow is only is presented cash inflow and cash outflow can either be reported separately or presented as one item 8. of the items below, the one that appears first on the statement of cash flows is noncash investing and financing activities. net increase (decrease) in cash. cash at the end of the period. cash at the beginning of the period. 9. Which of the following transactions does not affect cash during a period? Write-off of an uncollectible account. Collection of an accounts receivable. Sale of treasury stock. Redeeming bonds before maturity. 10. Significant noncash transactions would not include conversion of bonds into common stock. asset acquisition through bond issuance. treasury stock acquisition. exchange of plant assets