Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Assume that you want to deposit an amount (BD120,000.00) into an account three years from now in order to be able to withdraw

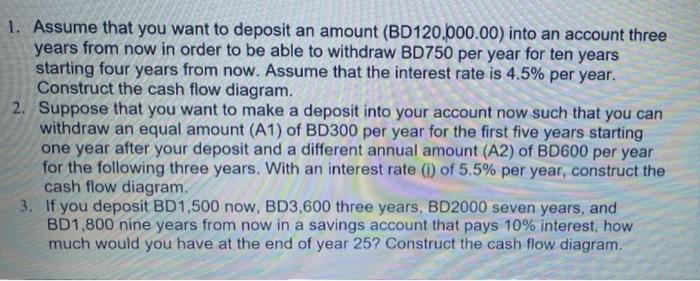

1. Assume that you want to deposit an amount (BD120,000.00) into an account three years from now in order to be able to withdraw BD750 per year for ten years starting four years from now. Assume that the interest rate is 4.5% per year. Construct the cash flow diagram. 2. Suppose that you want to make a deposit into your account now such that you can withdraw an equal amount (A1) of BD300 per year for the first five years starting one year after your deposit and a different annual amount (A2) of BD600 per year for the following three years. With an interest rate (i) of 5.5% per year, construct the cash flow diagram. 3. If you deposit BD1,500 now, BD3,600 three years, BD2000 seven years, and BD1,800 nine years from now in a savings account that pays 10% interest, how much would you have at the end of year 25? Construct the cash flow diagram.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

F 1500FP1025 3600FP1022 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started