Question

A resident foreign Corp has the following data: Gross Sales in Phil is 9M; Cost of sales- Phil is 2M; Gross sales in USA

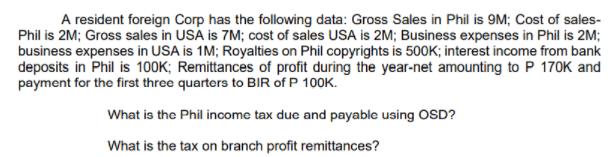

A resident foreign Corp has the following data: Gross Sales in Phil is 9M; Cost of sales- Phil is 2M; Gross sales in USA is 7M; cost of sales USA is 2M; Business expenses in Phil is 2M; business expenses in USA is 1M; Royalties on Phil copyrights is 500K; interest income from bank deposits in Phil is 100K; Remittances of profit during the year-net amounting to P 170K and payment for the first three quarters to BIR of P 100K. What is the Phil income tax due and payable using OSD? What is the tax on branch profit remittances?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A resident foreign corporation are foreign corporations that have a residential status in the Philip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Business Communication questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App