Answered step by step

Verified Expert Solution

Question

1 Approved Answer

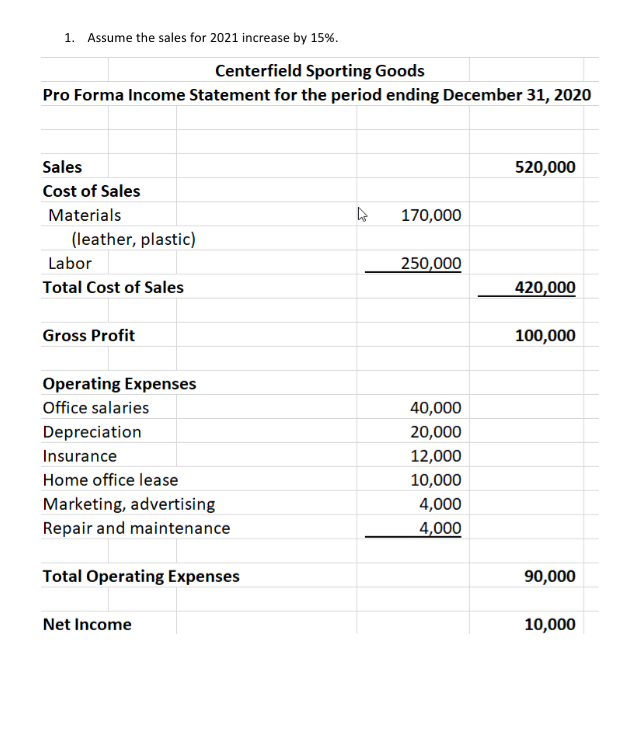

1. Assume the sales for 2021 increase by 15%. Centerfield Sporting Goods Pro Forma Income Statement for the period ending December 31, 2020 520,000 170,000

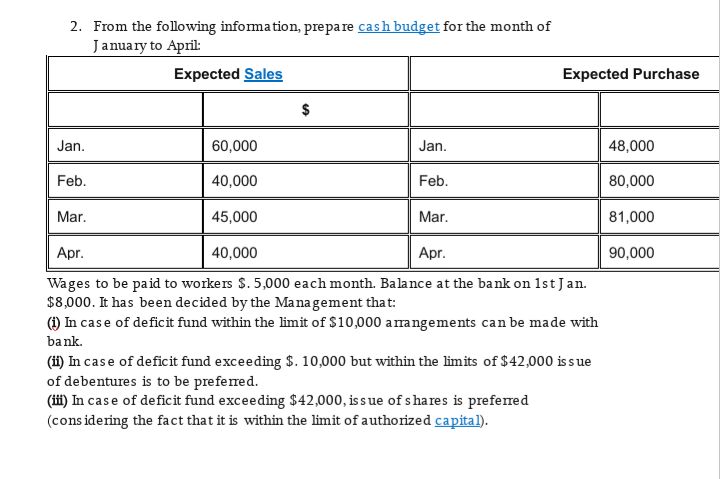

1. Assume the sales for 2021 increase by 15%. Centerfield Sporting Goods Pro Forma Income Statement for the period ending December 31, 2020 520,000 170,000 Sales Cost of Sales Materials (leather, plastic) Labor Total Cost of Sales 250,000 420,000 Gross Profit 100,000 Operating Expenses Office salaries Depreciation Insurance Home office lease Marketing, advertising Repair and maintenance 40,000 20,000 12,000 10,000 4,000 4,000 Total Operating Expenses 90,000 Net Income 10,000 2. From the following information, prepare cash budget for the month of January to April: Expected Sales Expected Purchase $ Jan. 60,000 Jan. 48,000 Feb. 40,000 Feb. 80,000 Mar. 45,000 Mar. 81,000 90,000 Apr. 40,000 Apr. Wages to be paid to workers $.5,000 each month. Balance at the bank on 1st Jan. $8,000. It has been decided by the Management that: (1) In case of deficit fund within the limit of $10,000 arrangements can be made with bank (ii) In case of deficit fund exceeding $. 10,000 but within the limits of $42,000 issue of debentures is to be preferred. (ii) In case of deficit fund exceeding $42,000, issue of shares is preferred (considering the fact that it is within the limit of authorized capital)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started