Question

1. Assume you are evaluating a project for your company. Your company is considering purchasing a new piece of equipment. The new equipment will cost

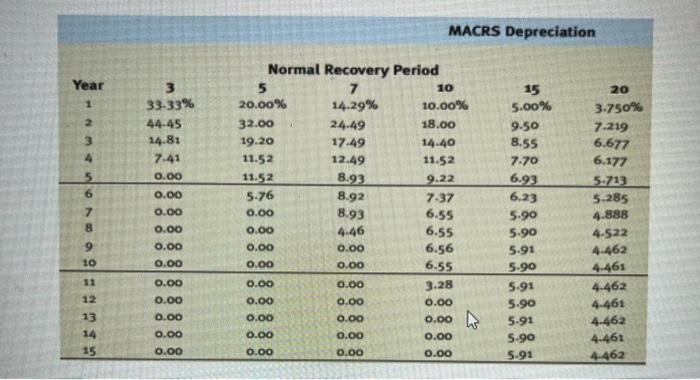

1. Assume you are evaluating a project for your company. Your company is considering purchasing a new piece of equipment. The new equipment will cost $1,200,000 to purchase, $200,000 for freight to your company, and an additional $20,000 for installation. It will be depreciated using the MACRS method of depreciation and falls under the 20-year MACRS category. At the end of its life, you estimate that your company can sell the equipment for $200,000. Assume Section 179 does not apply to this purchase. The MACRS depreciation table is listed below. You estimate that the new machine will allow you to produce and sell 800 more units each year. Each unit sells for $12,000. Variable costs are approximately 65% of total sales. You also estimate that you will need to increase inventory by $12,000, which you will do using credit. Thus, accounts payable increases by $6,000. Your company has a marginal tax rate of 21%. a. What is the free cash flow in year 0? b. What is the free cash flow in year 1? c. What is the free cash flow in year 2? d. What is the free cash flow in year 3? e. What is the free cash flow in year 4?

2. Reinhardt Co. is considering increasing production after unexpected strong demand for its new dirt bike. To evaluate the proposal, the company needs to calculate its cost of capital. You've collected the following info: The company wants to maintain its current capital structure, which is 45% equity, 25% preferred stock, and ?% debt. The firm has a marginal tax rate of 28%. The firm's preferred stock pays an annual dividend of $3.69 forever and each share is currently worth $95.61. The firm has one bond outstanding with a coupon rate of 3.5%, paid semiannually, 10 years to maturity, a face value of $1,000, and a current price of $1,053.14. Reinhardt Corp.'s beta is 0.91, the yield on Treasury bonds is 1.5%, and the expected return on the market portfolio is 10%. The current stock price is $61.44. The firm has just paid an annual dividend of $0.99, which is expected to grow by 4% per year. The firm uses a risk premium of 2.5% for the bond-yield-plus-risk-premium approach. New preferred stock and bonds would be issued by private placement, largely eliminating flotation costs. New equity would come from retained earnings, thus eliminating flotation costs. a. What is the WACC for this company? 3. Assume your company needs to replace an elevator. There are two alternatives (both of which meet all standards required to safely operate the elevator). Elevator 1 has a purchase price of $100,000, an operating cost of $10,000 per year, and a useful life of 10 years. Your company uses straight line depreciation and you estimate that the elevator will not be worth anything at the end of its useful life. Elevator 2 has a purchase price of $150,000, an operating cost of $8,000 per year, and a useful life of 14 years. Your company uses straight line depreciation and you estimate that the elevator will not be worth anything at the end of its useful life. Your company uses a discount rate of 8% and its marginal tax rate is 21%. a. What is the operating cash flow and equivalent annual cost for Elevator 1? b. What is the operating cash flow and equivalent annual cost for Elevator 2? c. Which elevator should your company purchase? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started