Question

1) Assume you invest in a machine worth $231002. The machine is classified by the IRS as an asset with a 4 year life,

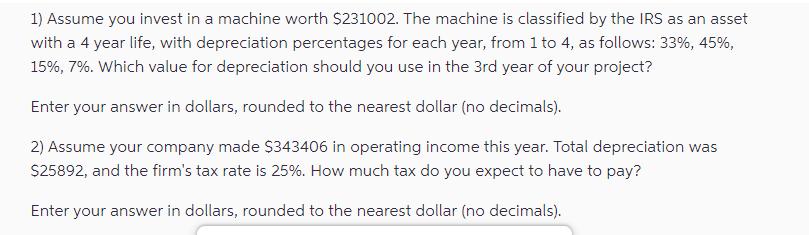

1) Assume you invest in a machine worth $231002. The machine is classified by the IRS as an asset with a 4 year life, with depreciation percentages for each year, from 1 to 4, as follows: 33%, 45%, 15%, 7%. Which value for depreciation should you use in the 3rd year of your project? Enter your answer in dollars, rounded to the nearest dollar (no decimals). 2) Assume your company made $343406 in operating income this year. Total depreciation was $25892, and the firm's tax rate is 25%. How much tax do you expect to have to pay? Enter your answer in dollars, rounded to the nearest dollar (no decimals).

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The image shows two separate financial questions related to depreciation and corporate taxation 1 Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Business Analytics

Authors: Jeffrey Camm, James Cochran, Michael Fry, Jeffrey Ohlmann, David Anderson, Dennis Sweeney, Thomas Williams

1st Edition

128518727X, 978-1337360135, 978-1285187273

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App