Question

Other information: 1. There is an arrears of preference dividend of $13,600. The constitution gives preference shareholders priority of payment of arrears of preference dividends.

Other information:

1. There is an arrears of preference dividend of $13,600. The constitution gives preference shareholders priority of payment of arrears of preference dividends. However, all shares rank equally regarding return of capital based on the number of shares held.

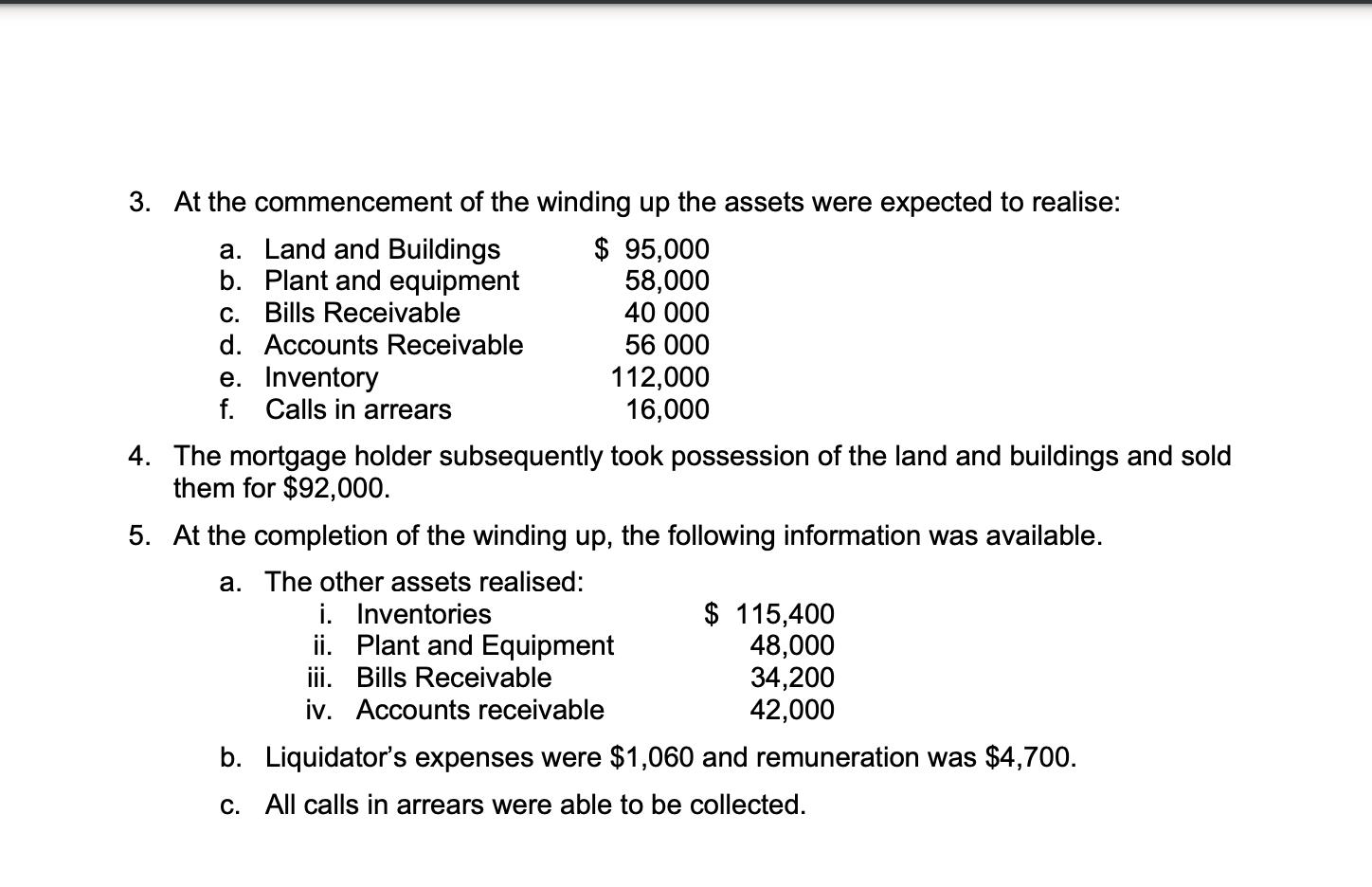

2. The liquidator discovered that:

a. $3,800 worth of Accounts Payable had not been recorded.

b. In total, the creditors were willing to give a discount of $2,500 upon settlement of the Accounts Payable.

c. Salaries and wages totalling $2,300 had not been recorded.

d. Accrued interest of $2,000 on the mortgage and $1,200 on the debentures had not been recorded.

Required

1. Prepare a summary of affairs as at 30 June 2022 for Life Ltd. (Hint: you can refer to the example of Fern Ltd on page 1249/50 of the textbook) (10 marks).

2. Prepare all the relevant journal entries in Life Ltd to wind up the company. Narrations are required. Clearly show the order of priority of payment to the creditors. (40 marks).

3. Show clearly any workings in relation to the final distribution to shareholders (i.e. prepare a shareholder’s distribution table) (10 marks).

4. Prepare a properly balanced Liquidation account, Shareholder’s distribution account and Liquidator’s cash account. Show all the relevant detail in the account entries

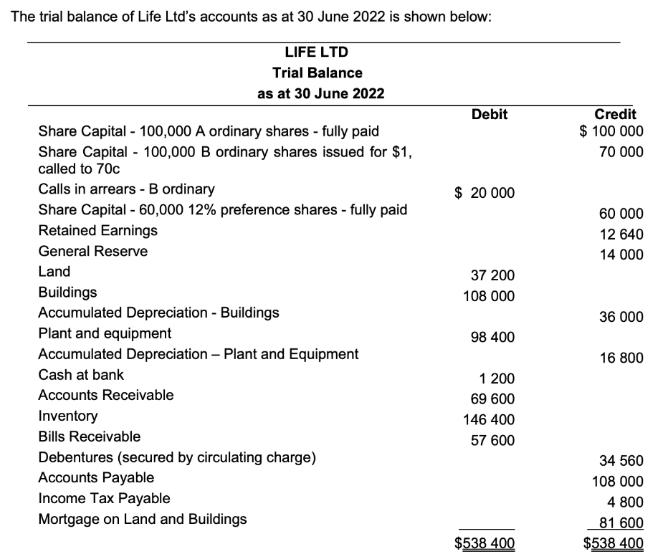

The trial balance of Life Ltd's accounts as at 30 June 2022 is shown below: LIFE LTD Trial Balance as at 30 June 2022 Share Capital - 100,000 A ordinary shares - fully paid Share Capital - 100,000 B ordinary shares issued for $1, called to 70c Calls in arrears - B ordinary Share Capital - 60,000 12% preference shares - fully paid Retained Earnings General Reserve Land Buildings Accumulated Depreciation - Buildings Plant and equipment Accumulated Depreciation - Plant and Equipment Cash at bank Accounts Receivable Inventory Bills Receivable Debentures (secured by circulating charge) Accounts Payable Income Tax Payable Mortgage on Land and Buildings Debit $ 20 000 37 200 108 000 98 400 1 200 69 600 146 400 57 600 $538 400 Credit $ 100 000 70 000 60 000 12 640 14 000 36 000 16 800 34 560 108 000 4 800 81 600 $538 400

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 LIFE LTD Summary of Affairs As at 30 June 2022 Assets Cash at Bank 46400 Accounts Receivable 42000 Inventory 16000 Bills Receivable 4200 Total Assets 108600 Liabilities Accounts Payable 4800 Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started