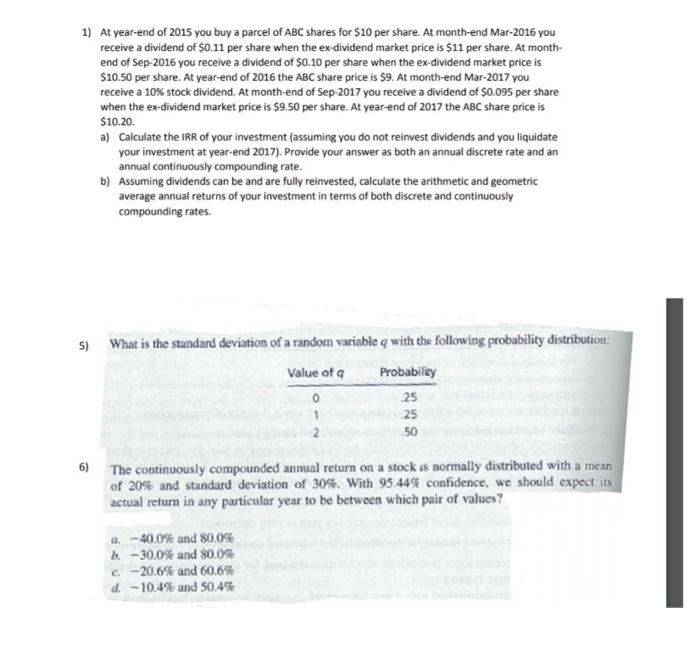

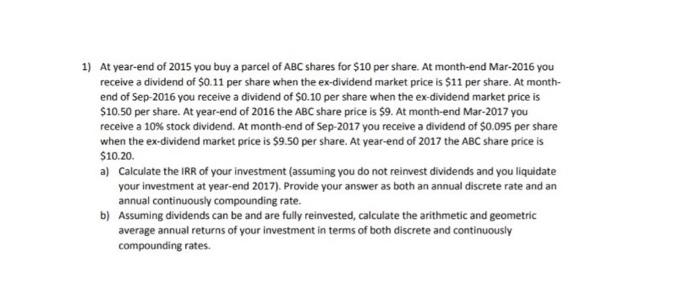

1) At year-end of 2015 you buy a parcel of ABC shares for $10 per share. At month-end Mar-2016 you receive a dividend of $0.11 per share when the ex-dividend market price is $11 per share. At month- end of Sep-2016 you receive a dividend of $0.10 per share when the ex-dividend market price is $10.50 per share. At year-end of 2016 the ABC share price is $9. At month-end Mar-2017 you receive a 10% stock dividend. At month-end of Sep-2017 you receive a dividend of $0.095 per share when the ex-dividend market price is $9.50 per share. At year-end of 2017 the ABC share price is $10.20 a) Calculate the IRR of your investment (assuming you do not reinvest dividends and you liquidate your investment at year-end 2017). Provide your answer as both an annual discrete rate and an annual continuously compounding rate. b) Assuming dividends can be and are fully reinvested, calculate the arithmetic and geometric average annual returns of your investment in terms of both discrete and continuously compounding rates 5) What is the standard deviation of a random variable q with the following probability distribution: Value of a Probability 0 25 1 25 2 50 6) The continuously compounded annual return on a stock is normally distributed with a mean of 20% and standard deviation of 30%. With 95.44% confidence, we should expect its actual return in any particular year to be between which pair of values? Q. - 40.0% and 80.0% b.-30.0% and 80.0% c -20.6% and 60.6% d.-10.4% and 50.4% 1) At year-end of 2015 you buy a parcel of ABC shares for $10 per share. At month-end Mar-2016 you receive a dividend of $0.11 per share when the ex-dividend market price is $11 per share. At month- end of Sep-2016 you receive a dividend of So.10 per share when the ex-dividend market price is $10.50 per share. At year-end of 2016 the ABC share price is $9. At month-end Mar-2017 you receive a 10% stock dividend. At month-end of Sep-2017 you receive a dividend of $0.095 per share when the ex-dividend market price is $9.50 per share. At year-end of 2017 the ABC share price is $10.20 a) Calculate the IRR of your investment (assuming you do not reinvest dividends and you liquidate your investment at year-end 2017). Provide your answer as both an annual discrete rate and an annual continuously compounding rate. b) Assuming dividends can be and are fully reinvested, calculate the arithmetic and geometric average annual returns of your investment in terms of both discrete and continuously compounding rates 1) At year-end of 2015 you buy a parcel of ABC shares for $10 per share. At month-end Mar-2016 you receive a dividend of $0.11 per share when the ex-dividend market price is $11 per share. At month- end of Sep-2016 you receive a dividend of So.10 per share when the ex-dividend market price is $10.50 per share. At year-end of 2016 the ABC share price is $9. At month-end Mar-2017 you receive a 10% stock dividend. At month-end of Sep-2017 you receive a dividend of $0.095 per share when the ex-dividend market price is $9.50 per share. At year-end of 2017 the ABC share price is $10.20 a) Calculate the IRR of your investment (assuming you do not reinvest dividends and you liquidate your investment at year-end 2017). Provide your answer as both an annual discrete rate and an annual continuously compounding rate. b) Assuming dividends can be and are fully reinvested, calculate the arithmetic and geometric average annual returns of your investment in terms of both discrete and continuously compounding rates. 1) At year-end of 2015 you buy a parcel of ABC shares for $10 per share. At month-end Mar-2016 you receive a dividend of $0.11 per share when the ex-dividend market price is $11 per share. At month- end of Sep-2016 you receive a dividend of $0.10 per share when the ex-dividend market price is $10.50 per share. At year-end of 2016 the ABC share price is $9. At month-end Mar-2017 you receive a 10% stock dividend. At month-end of Sep-2017 you receive a dividend of $0.095 per share when the ex-dividend market price is $9.50 per share. At year-end of 2017 the ABC share price is $10.20 a) Calculate the IRR of your investment (assuming you do not reinvest dividends and you liquidate your investment at year-end 2017). Provide your answer as both an annual discrete rate and an annual continuously compounding rate. b) Assuming dividends can be and are fully reinvested, calculate the arithmetic and geometric average annual returns of your investment in terms of both discrete and continuously compounding rates 5) What is the standard deviation of a random variable q with the following probability distribution: Value of a Probability 0 25 1 25 2 50 6) The continuously compounded annual return on a stock is normally distributed with a mean of 20% and standard deviation of 30%. With 95.44% confidence, we should expect its actual return in any particular year to be between which pair of values? Q. - 40.0% and 80.0% b.-30.0% and 80.0% c -20.6% and 60.6% d.-10.4% and 50.4% 1) At year-end of 2015 you buy a parcel of ABC shares for $10 per share. At month-end Mar-2016 you receive a dividend of $0.11 per share when the ex-dividend market price is $11 per share. At month- end of Sep-2016 you receive a dividend of So.10 per share when the ex-dividend market price is $10.50 per share. At year-end of 2016 the ABC share price is $9. At month-end Mar-2017 you receive a 10% stock dividend. At month-end of Sep-2017 you receive a dividend of $0.095 per share when the ex-dividend market price is $9.50 per share. At year-end of 2017 the ABC share price is $10.20 a) Calculate the IRR of your investment (assuming you do not reinvest dividends and you liquidate your investment at year-end 2017). Provide your answer as both an annual discrete rate and an annual continuously compounding rate. b) Assuming dividends can be and are fully reinvested, calculate the arithmetic and geometric average annual returns of your investment in terms of both discrete and continuously compounding rates 1) At year-end of 2015 you buy a parcel of ABC shares for $10 per share. At month-end Mar-2016 you receive a dividend of $0.11 per share when the ex-dividend market price is $11 per share. At month- end of Sep-2016 you receive a dividend of So.10 per share when the ex-dividend market price is $10.50 per share. At year-end of 2016 the ABC share price is $9. At month-end Mar-2017 you receive a 10% stock dividend. At month-end of Sep-2017 you receive a dividend of $0.095 per share when the ex-dividend market price is $9.50 per share. At year-end of 2017 the ABC share price is $10.20 a) Calculate the IRR of your investment (assuming you do not reinvest dividends and you liquidate your investment at year-end 2017). Provide your answer as both an annual discrete rate and an annual continuously compounding rate. b) Assuming dividends can be and are fully reinvested, calculate the arithmetic and geometric average annual returns of your investment in terms of both discrete and continuously compounding rates