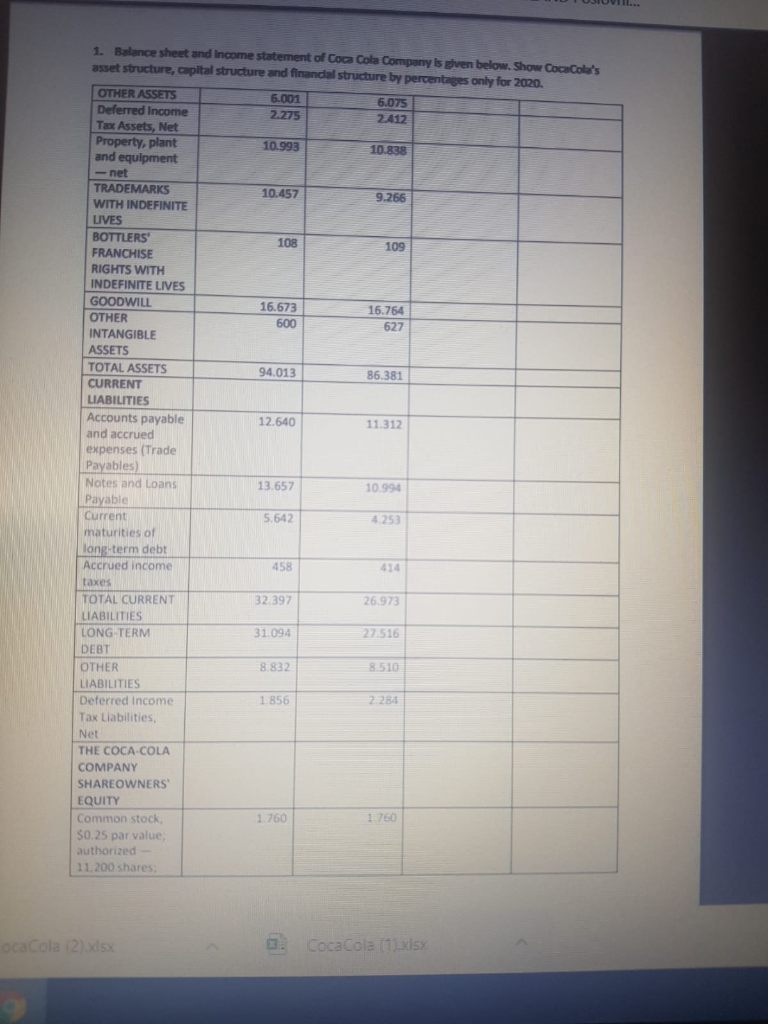

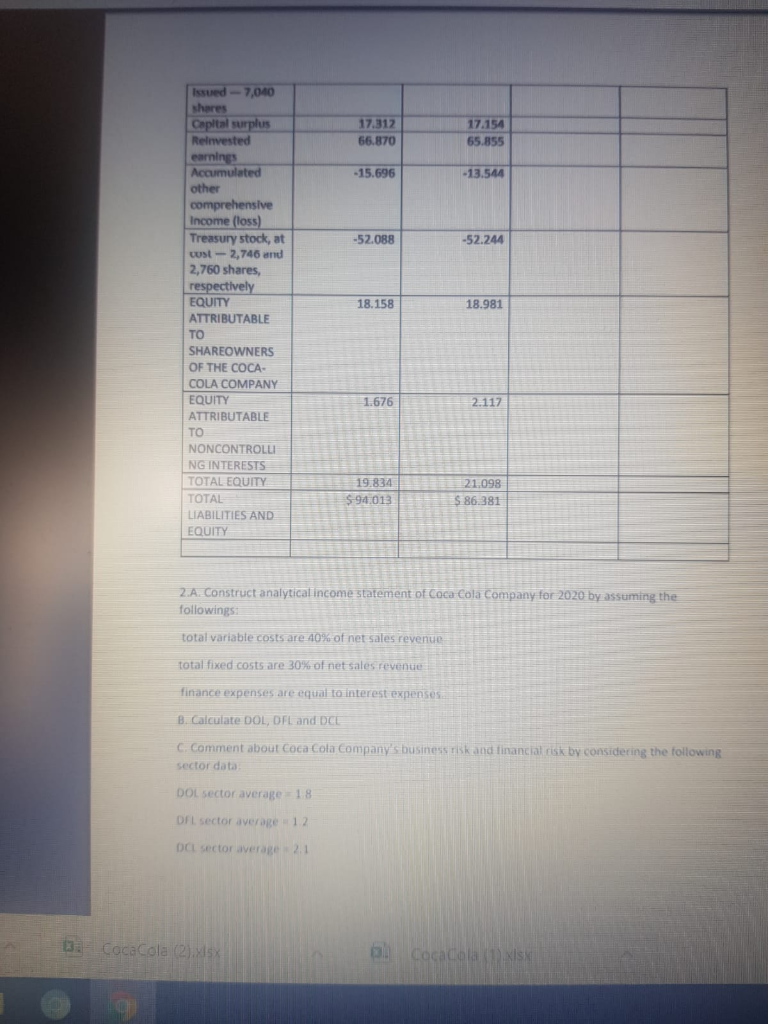

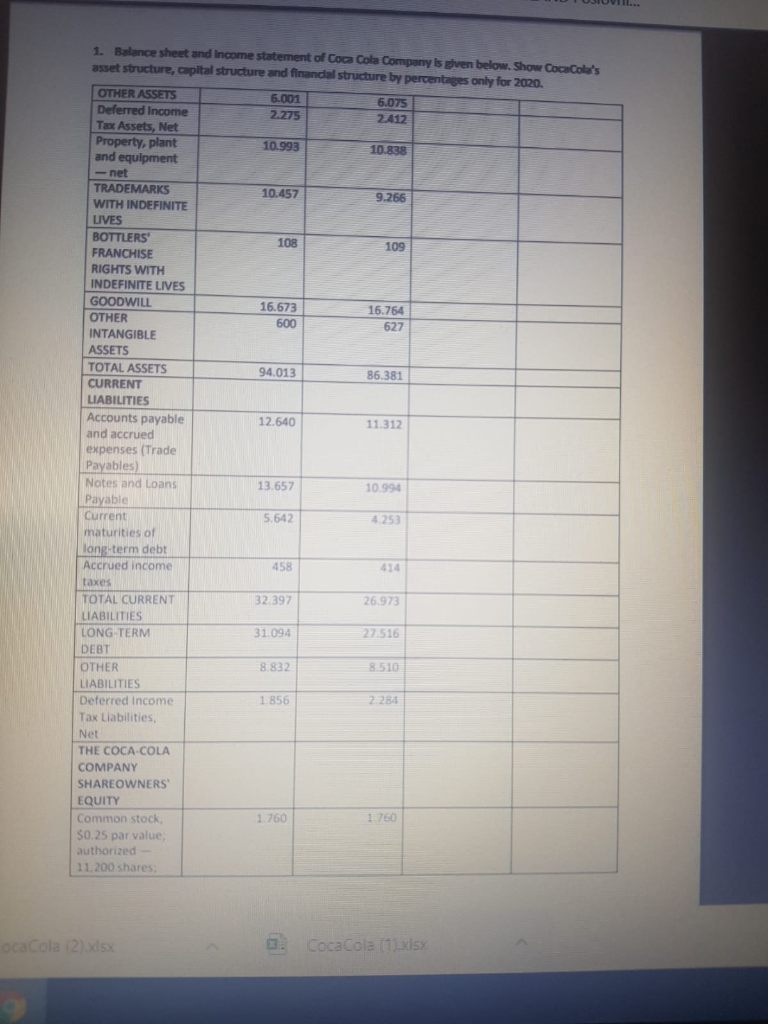

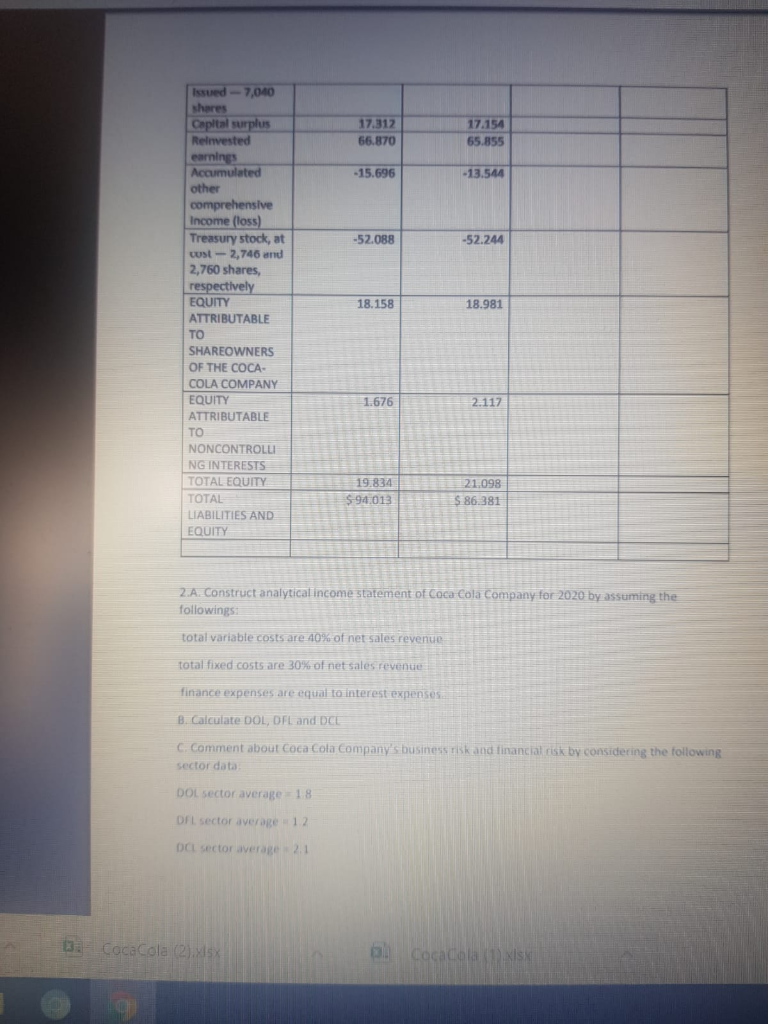

1. Balance sheet and income statement of Coca Cola Company is given below. Show CocaCola's asset structure, capital structure and finandal structure by percentages only for 2020. 6.001 2.275 6.075 2412 10.993 10.838 10.457 9.266 108 109 16.673 600 16.764 627 94.013 86.381 12.640 11.312 OTHER ASSETS Deferred Income Tax Assets, Net Property, plant and equipment - net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS CURRENT LIABILITIES Accounts payable and accrued expenses (Trade Payables) Notes and Loans Payable Current maturities of long-term debt Accrued income taxes TOTAL CURRENT LIABILITIES LONG TERM DEBT OTHER LIABILITIES Deferred income Tax Liabilities Net THE COCA-COLA COMPANY SHAREOWNERS EQUITY Common stock, $0.25 par value authorized 11.200 shares 13.657 10 994 5.642 4253 458 32.397 26.973 31.094 27516 8.832 8.510 1.856 2284 1.760 1.760 oca Cola (2).xlsx Coca Cola (1).xlsx Issued 7,040 shares Capital surplus Relnvested 17,312 66.870 17.154 65.855 carning - 15.696 - 13.544 -52.088 -52.244 18.158 18.981 Accumulated other comprehensive Income (loss) Treasury stock, at wust - 2,746 and 2,760 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA- COLA COMPANY EQUITY ATTRIBUTABLE TO TO NONCONTROLL NG INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 1.676 2.117 19.834 $94.013 21.098 $ 86.381 2.A. Construct analytical income statement of Coca Cola Company for 2020 by assuming the followings total variable costs are 40% of net sales revenue total fixed costs are 30% of net sales revenue finance expenses are equal to interest expenses B Calculate DOL OFL and DCE C. Comment about Coca Cola Company's business risk and financial risk by considering the following sector data DOL sector average 18 DFL sector average 12 DCL Sector average 2.1 Da Coca Cola (2) Coca Cola 1. Balance sheet and income statement of Coca Cola Company is given below. Show CocaCola's asset structure, capital structure and finandal structure by percentages only for 2020. 6.001 2.275 6.075 2412 10.993 10.838 10.457 9.266 108 109 16.673 600 16.764 627 94.013 86.381 12.640 11.312 OTHER ASSETS Deferred Income Tax Assets, Net Property, plant and equipment - net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS CURRENT LIABILITIES Accounts payable and accrued expenses (Trade Payables) Notes and Loans Payable Current maturities of long-term debt Accrued income taxes TOTAL CURRENT LIABILITIES LONG TERM DEBT OTHER LIABILITIES Deferred income Tax Liabilities Net THE COCA-COLA COMPANY SHAREOWNERS EQUITY Common stock, $0.25 par value authorized 11.200 shares 13.657 10 994 5.642 4253 458 32.397 26.973 31.094 27516 8.832 8.510 1.856 2284 1.760 1.760 oca Cola (2).xlsx Coca Cola (1).xlsx Issued 7,040 shares Capital surplus Relnvested 17,312 66.870 17.154 65.855 carning - 15.696 - 13.544 -52.088 -52.244 18.158 18.981 Accumulated other comprehensive Income (loss) Treasury stock, at wust - 2,746 and 2,760 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA- COLA COMPANY EQUITY ATTRIBUTABLE TO TO NONCONTROLL NG INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 1.676 2.117 19.834 $94.013 21.098 $ 86.381 2.A. Construct analytical income statement of Coca Cola Company for 2020 by assuming the followings total variable costs are 40% of net sales revenue total fixed costs are 30% of net sales revenue finance expenses are equal to interest expenses B Calculate DOL OFL and DCE C. Comment about Coca Cola Company's business risk and financial risk by considering the following sector data DOL sector average 18 DFL sector average 12 DCL Sector average 2.1 Da Coca Cola (2) Coca Cola