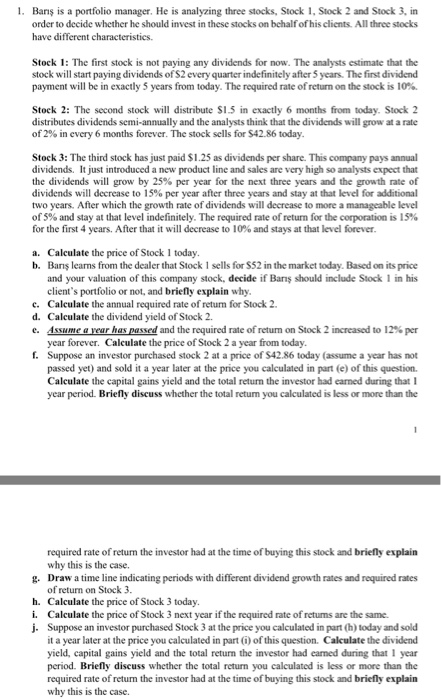

1. Bani is a portfolio manager. He is analyzing three stocks, Stock 1, Stock 2 and Stock 3, in order to decide whether he should invest in these stocks on bchalf of his clients. All three stocks have different characteristics. Stock 1: The first stock is not paying any dividends for now. The analysts estimate that the stock will start paying dividends of S2 every quarter indefinitely after 5 years. The first dividend payment will be in exactly 5 years from today. The required rate of return on the stock is 10%. Stock 2: The second stock will distribute S1.5 in exactly 6 months from today. Stock 2 distributes dividends semi-annually and the analysts think that the dividends will grow at a rate of 2% in every 6 months forever. The stock sells for S42.86 today Stock 3: The third stock has just paid $1.25 as dividends per share. This company pays annual dividends. It just introduced a new product line and sales are very high so analysts expect that the dividends will grow by 25% per year for the next three years and the growth rate of dividends will decrease to 15% per year after three years and stay at that level for additional two years. After which the growth rate of dividends will decrease to more a manageable level of 5% and stay at that level indefinitely. The required rate of return for the corporation is 15% for the first 4 years. After that it will decrease to 10% and stays at that level forever a. Calculate the price of Stock 1 today b. Bani learns from the dealer that Stock 1 sells for $52 in the market today. Based on its price and your valuation of this company stock, decide if Bans should include Siock 1 in his client's portfolio or not, and briely explain why. c. Calculate the annual required rate of returm for Stock2 d. Calculate the dividend yield of Stock 2 e. Assume a rear has passed and the required rate of retum on Stock 2 increased to 12% per year forever. Calculate the price of Stock 2 a year from today Suppose an investor purchased stock 2 at a price of $42.86 today (assume a year has not passed yet) and sold it a year later at the price you calculated in part (e) of this question Calculate the capital gains yield and the total return the investor had earned during thatI year period. Briefly discuss whether the total return you calculated is less or more than the f. required rate of return the investor had at the time of buying this stock and briefly explairn why this is the case. Draw a time line indicating periods with different dividend growth rates and required rates of return on Stock 3 g. h. Calculate the price of Stock 3 today. i. Calculate the price of Stock 3 next year if the required rate of retums are the same. j. Suppose an investor purchased Stock 3 at the price you calculated in part (h) today and sold it a year later at the price you calculated in part () of this question. Calculate the dividend yield, capital gains yield and the total return the investor had earmed during that 1 year period. Briefly discuss whether the total return you calculated is less or more than the required rate of return the investor had at the time of buying this stock and briefly explain why this is the case