Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Bank reconciliations tend to have the following format (as seen on WP 20-5 in your case materials): Balance Per Bank: $XXX Plus: Deposits

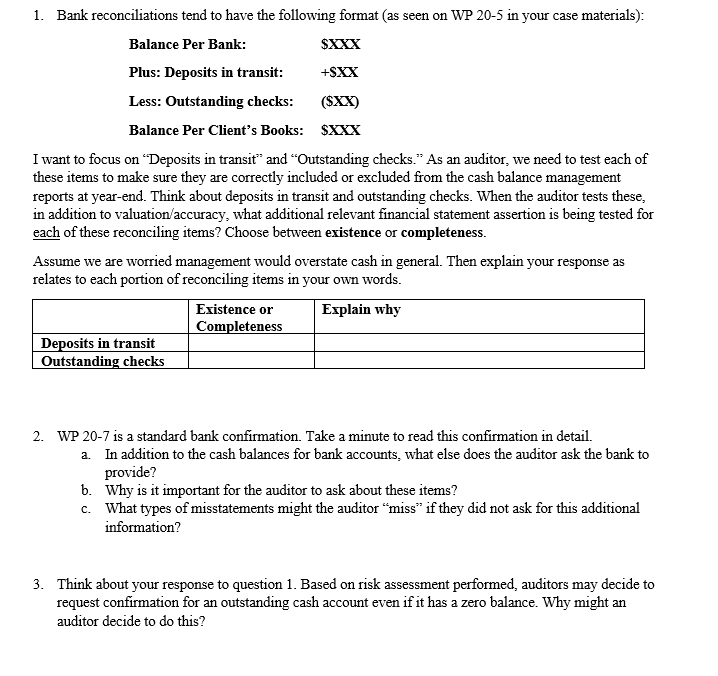

1. Bank reconciliations tend to have the following format (as seen on WP 20-5 in your case materials): Balance Per Bank: $XXX Plus: Deposits in transit: +SXX Less: Outstanding checks: ($XX) Balance Per Client's Books: $XXX I want to focus on "Deposits in transit" and "Outstanding checks." As an auditor, we need to test each of these items to make sure they are correctly included or excluded from the cash balance management reports at year-end. Think about deposits in transit and outstanding checks. When the auditor tests these, in addition to valuation/accuracy, what additional relevant financial statement assertion is being tested for each of these reconciling items? Choose between existence or completeness. Assume we are worried management would overstate cash in general. Then explain your response as relates to each portion of reconciling items in your own words. Existence or Completeness Explain why Deposits in transit Outstanding checks 2. WP 20-7 is a standard bank confirmation. Take a minute to read this confirmation in detail. a. In addition to the cash balances for bank accounts, what else does the auditor ask the bank to provide? b. Why is it important for the auditor to ask about these items? c. What types of misstatements might the auditor "miss" if they did not ask for this additional information? 3. Think about your response to question 1. Based on risk assessment performed, auditors may decide to request confirmation for an outstanding cash account even if it has a zero balance. Why might an auditor decide to do this?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Deposits in Transit and Outstanding Checks Audit Assertions When testing deposits in transit and outstanding checks for bank reconciliations the auditor is primarily concerned with the completeness ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e83ae43e12_880587.pdf

180 KBs PDF File

661e83ae43e12_880587.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started