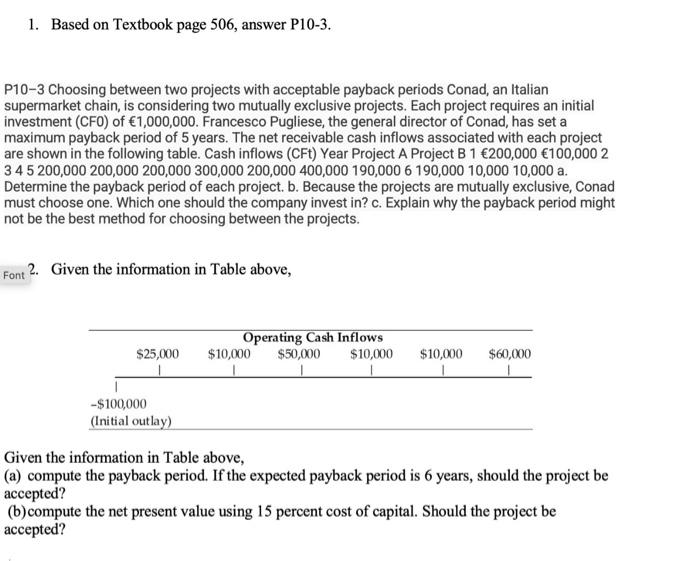

1. Based on Textbook page 506, answer P10-3. P10-3 Choosing between two projects with acceptable payback periods Conad, an Italian supermarket chain, is considering two mutually exclusive projects. Each project requires an initial investment (CFO) of 1,000,000. Francesco Pugliese, the general director of Conad, has set a maximum payback period of 5 years. The net receivable cash inflows associated with each project are shown in the following table. Cash inflows (CFt) Year Project A Project B 1 200,000 100,000 2 3 4 5 200,000 200,000 200,000 300,000 200,000 400,000 190,000 6 190,000 10,000 10,000 a. Determine the payback period of each project. b. Because the projects are mutually exclusive, Conad must choose one. Which one should the company invest in? c. Explain why the payback period might not be the best method for choosing between the projects. Font 2. Given the information in Table above, Operating Cash Inflows $10,000 $50,000 $10,000 $25,000 $10,000 $60,000 -$100,000 (Initial outlay) Given the information in Table above, (a) compute the payback period. If the expected payback period is 6 years, should the project be accepted? (b)compute the net present value using 15 percent cost of capital. Should the project be accepted? 1. Based on Textbook page 506, answer P10-3. P10-3 Choosing between two projects with acceptable payback periods Conad, an Italian supermarket chain, is considering two mutually exclusive projects. Each project requires an initial investment (CFO) of 1,000,000. Francesco Pugliese, the general director of Conad, has set a maximum payback period of 5 years. The net receivable cash inflows associated with each project are shown in the following table. Cash inflows (CFt) Year Project A Project B 1 200,000 100,000 2 3 4 5 200,000 200,000 200,000 300,000 200,000 400,000 190,000 6 190,000 10,000 10,000 a. Determine the payback period of each project. b. Because the projects are mutually exclusive, Conad must choose one. Which one should the company invest in? c. Explain why the payback period might not be the best method for choosing between the projects. Font 2. Given the information in Table above, Operating Cash Inflows $10,000 $50,000 $10,000 $25,000 $10,000 $60,000 -$100,000 (Initial outlay) Given the information in Table above, (a) compute the payback period. If the expected payback period is 6 years, should the project be accepted? (b)compute the net present value using 15 percent cost of capital. Should the project be accepted