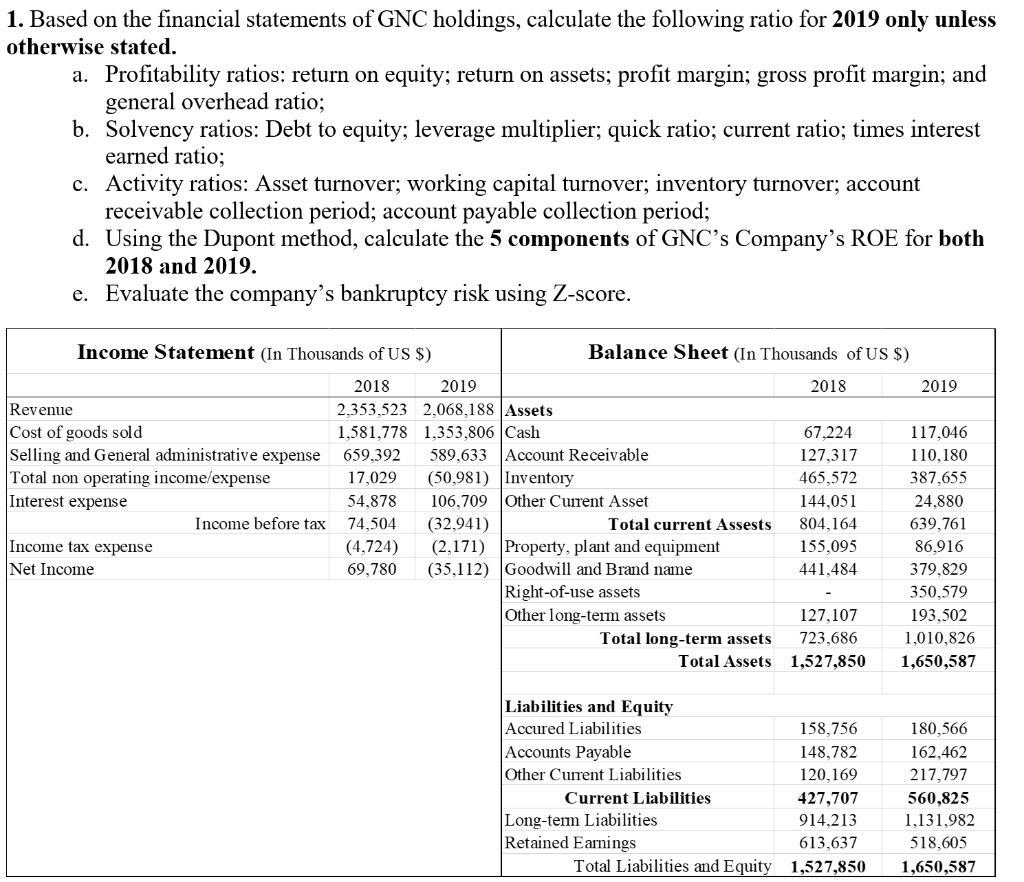

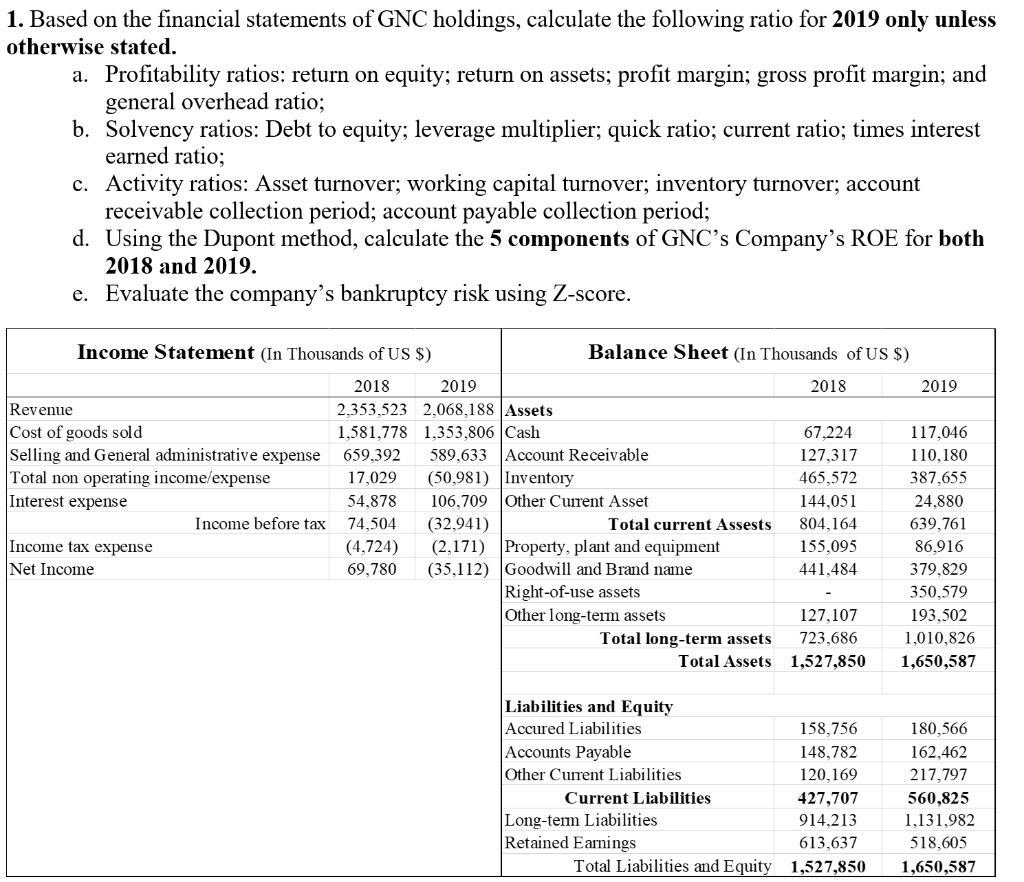

1. Based on the financial statements of GNC holdings, calculate the following ratio for 2019 only unless otherwise stated. a. Profitability ratios: return on equity; return on assets; profit margin; gross profit margin; and general overhead ratio; b. Solvency ratios: Debt to equity; leverage multiplier; quick ratio; current ratio; times interest earned ratio; c. Activity ratios: Asset turnover; working capital turnover; inventory turnover; account receivable collection period; account payable collection period; d. Using the Dupont method, calculate the 5 components of GNC's Company's ROE for both 2018 and 2019. e. Evaluate the company's bankruptcy risk using Z-score. Income Statement (In Thousands of US $) Balance Sheet (In Thousands of US $) 2018 2019 2018 2019 Revenue 2,353,523 2,068,188 Assets Cost of goods sold 1,581,778 1,353,806 Cash 67,224 117,046 Selling and General administrative expense 659,392 589,633 Account Receivable 127,317 110,180 Total non operating income/expense 17,029 (50,981) Inventory 465,572 387,655 Interest expense 54,878 106,709 Other Current Asset 144,051 24,880 Income before tax 74,504 (32,941) Total current Assests 804,164 639,761 Income tax expense (4,724) (2,171) Property, plant and equipment 155,095 86.916 Net Income 69,780 (35,112) Goodwill and Brand name 441,484 379,829 Right-of-use assets 350,579 Other long-term assets 127,107 193,502 Total long-term assets 723,686 1,010,826 Total Assets 1,527,850 1,650,587 Liabilities and Equity Accured Liabilities 158,756 Accounts Payable 148,782 Other Current Liabilities 120,169 Current Liabilities 427,707 Long-term Liabilities 914,213 Retained Earnings 613,637 Total Liabilities and Equity 1,527,850 180,566 162,462 217,797 560,825 1,131,982 518,605 1,650,587 1. Based on the financial statements of GNC holdings, calculate the following ratio for 2019 only unless otherwise stated. a. Profitability ratios: return on equity; return on assets; profit margin; gross profit margin; and general overhead ratio; b. Solvency ratios: Debt to equity; leverage multiplier; quick ratio; current ratio; times interest earned ratio; c. Activity ratios: Asset turnover; working capital turnover; inventory turnover; account receivable collection period; account payable collection period; d. Using the Dupont method, calculate the 5 components of GNC's Company's ROE for both 2018 and 2019. e. Evaluate the company's bankruptcy risk using Z-score. Income Statement (In Thousands of US $) Balance Sheet (In Thousands of US $) 2018 2019 2018 2019 Revenue 2,353,523 2,068,188 Assets Cost of goods sold 1,581,778 1,353,806 Cash 67,224 117,046 Selling and General administrative expense 659,392 589,633 Account Receivable 127,317 110,180 Total non operating income/expense 17,029 (50,981) Inventory 465,572 387,655 Interest expense 54,878 106,709 Other Current Asset 144,051 24,880 Income before tax 74,504 (32,941) Total current Assests 804,164 639,761 Income tax expense (4,724) (2,171) Property, plant and equipment 155,095 86.916 Net Income 69,780 (35,112) Goodwill and Brand name 441,484 379,829 Right-of-use assets 350,579 Other long-term assets 127,107 193,502 Total long-term assets 723,686 1,010,826 Total Assets 1,527,850 1,650,587 Liabilities and Equity Accured Liabilities 158,756 Accounts Payable 148,782 Other Current Liabilities 120,169 Current Liabilities 427,707 Long-term Liabilities 914,213 Retained Earnings 613,637 Total Liabilities and Equity 1,527,850 180,566 162,462 217,797 560,825 1,131,982 518,605 1,650,587