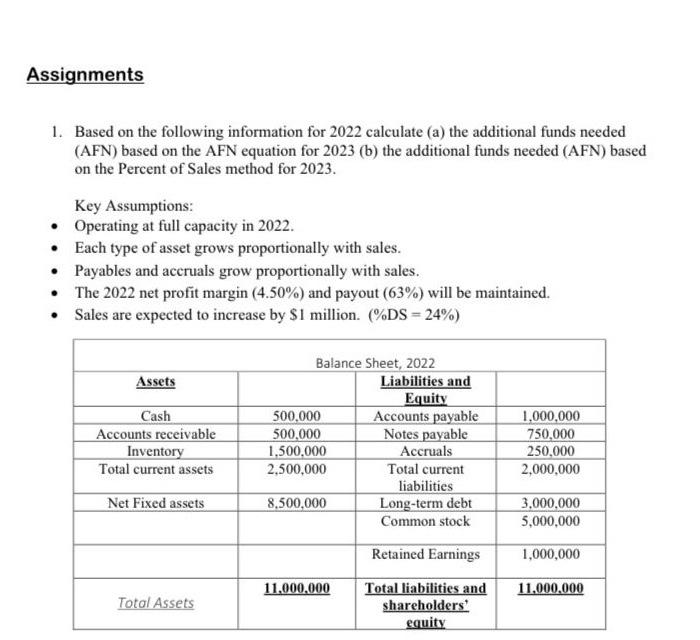

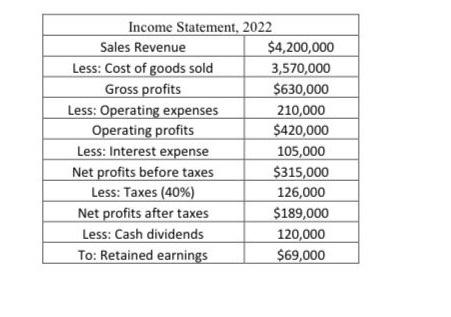

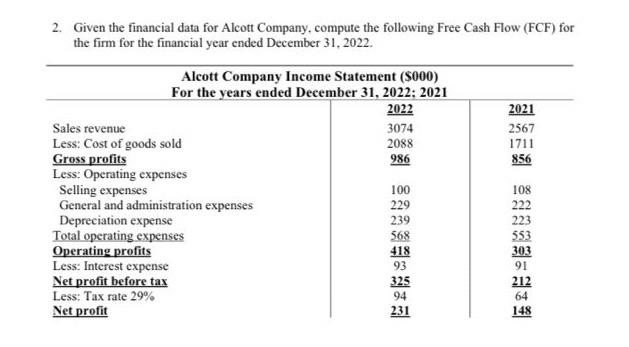

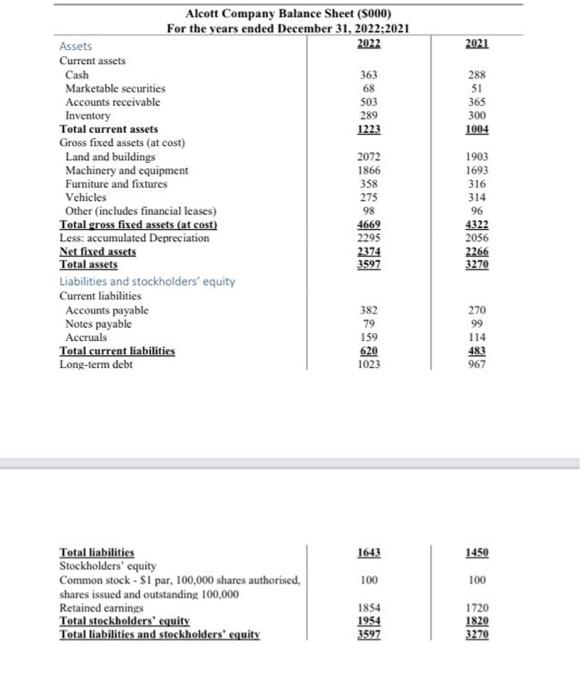

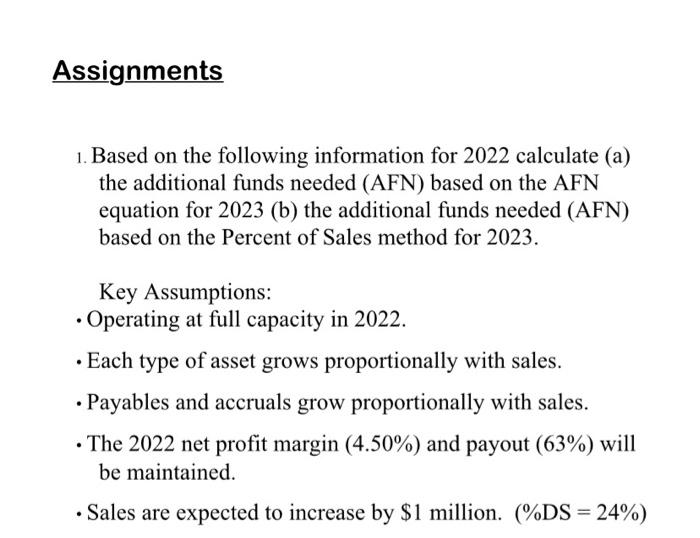

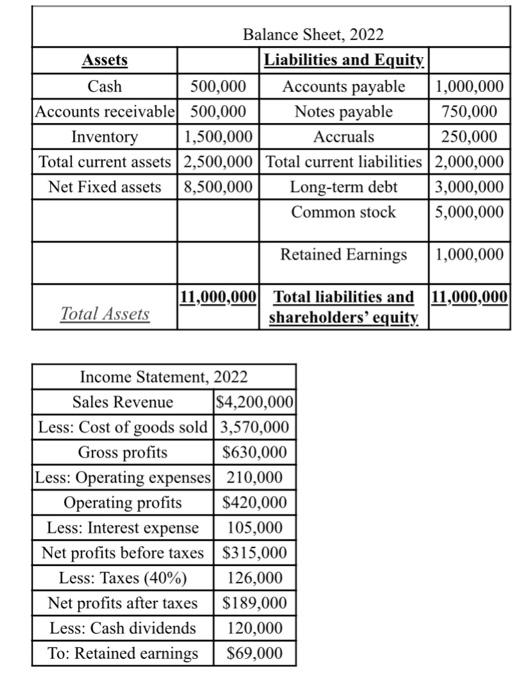

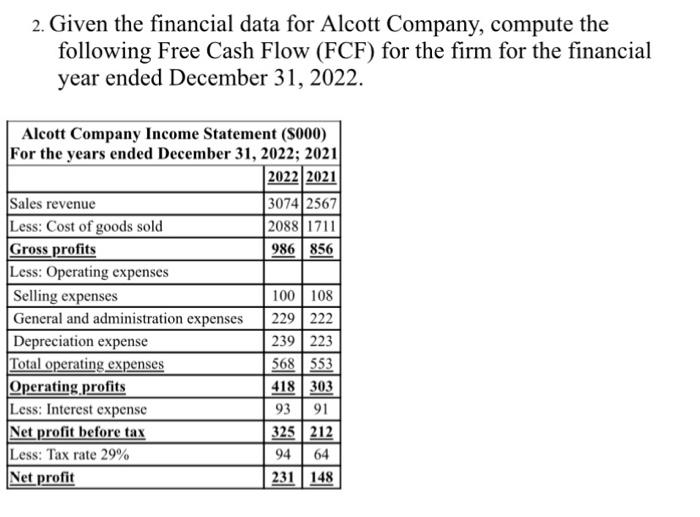

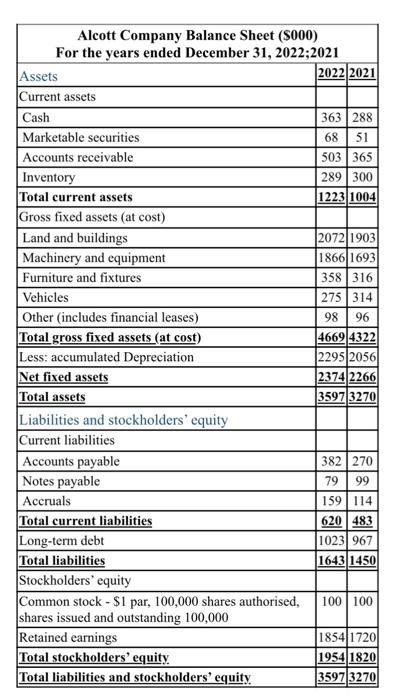

1. Based on the following information for 2022 calculate (a) the additional funds needed (AFN) based on the AFN equation for 2023 (b) the additional funds needed (AFN) based on the Percent of Sales method for 2023. Key Assumptions: - Operating at full capacity in 2022. - Each type of asset grows proportionally with sales. - Payables and accruals grow proportionally with sales. - The 2022 net profit margin (4.50%) and payout (63%) will be maintained. - Sales are expected to increase by $1 million. (%DS=24%) \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Income Statement, 2022} \\ \hline Sales Revenue & $4,200,000 \\ \hline Less: Cost of goods sold & 3,570,000 \\ \hline Gross profits & $630,000 \\ \hline Less: Operating expenses & 210,000 \\ \hline Operating profits & $420,000 \\ \hline Less: Interest expense & 105,000 \\ \hline Net profits before taxes & $315,000 \\ \hline Less: Taxes (40\%) & 126,000 \\ \hline Net profits after taxes & $189,000 \\ \hline Less: Cash dividends & 120,000 \\ \hline To: Retained earnings & $69,000 \\ \hline \end{tabular} 2. Given the financial data for Alcott Company, compute the following Free Cash Flow (FCF) for the firm for the financial year ended December 31,2022 . Alcott Company Balance Sheet (\$000) For the vears ended December 31, 2022 2021 \begin{tabular}{l|c|c} Total liabilities & 1643 & 1450 \\ Stockholders' equity & 100 & 100 \\ Common stock - SI par, 100,000 shares authorised. & & 1720 \\ shares issued and outstanding 100,000 & 1854 & 1820 \\ Retained earnings & 1954 & 3597 \\ Total stockholders' equity & Total liabilities and stockholders' equity & \end{tabular} 1. Based on the following information for 2022 calculate (a) the additional funds needed (AFN) based on the AFN equation for 2023 (b) the additional funds needed (AFN) based on the Percent of Sales method for 2023. Key Assumptions: - Operating at full capacity in 2022. - Each type of asset grows proportionally with sales. - Payables and accruals grow proportionally with sales. - The 2022 net profit margin (4.50\%) and payout (63\%) will be maintained. - Sales are expected to increase by $1 million. (%DS=24%) \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Income Statement, 2022} \\ \hline Sales Revenue & $4,200,000 \\ \hline Less: Cost of goods sold & 3,570,000 \\ \hline Gross profits & $630,000 \\ \hline Less: Operating expenses & 210,000 \\ \hline Operating profits & $420,000 \\ \hline Less: Interest expense & 105,000 \\ \hline Net profits before taxes & $315,000 \\ \hline Less: Taxes (40\%) & 126,000 \\ \hline Net profits after taxes & $189,000 \\ \hline Less: Cash dividends & 120,000 \\ \hline To: Retained earnings & $69,000 \\ \hline \end{tabular} 2. Given the financial data for Alcott Company, compute the following Free Cash Flow (FCF) for the firm for the financial year ended December 31, 2022. \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ Alcott Company Balance Sheet (\$000) } \\ For the years ended December 31, 2022;2021 \\ \hline Assets & 2022 & 2021 \\ \hline Current assets & & \\ \hline Cash & 363 & 288 \\ \hline Marketable securities & 68 & 51 \\ \hline Accounts receivable & 503 & 365 \\ \hline Inventory & 289 & 300 \\ \hline Total current assets & 1223 & 1004 \\ \hline Gross fixed assets (at cost) & & \\ \hline Land and buildings & 2072 & 1903 \\ \hline Machinery and equipment & 1866 & 1693 \\ \hline Furniture and fixtures & 358 & 316 \\ \hline Vehicles & 275 & 314 \\ \hline Other (includes financial leases) & 98 & 96 \\ \hline Total gross fixed assets (at cost) & 4669 & 4322 \\ \hline Less: accumulated Depreciation & 2295 & 2056 \\ \hline Net fixed assets & 2374 & 2266 \\ \hline Total assets & 3597 & 3270 \\ \hline \hline Liabilities and stockholders' equity & & \\ \hline Current liabilities & & \\ \hline Accounts payable & 382 & 270 \\ \hline Notes payable & 79 & 99 \\ \hline Accruals & 159 & 114 \\ \hline Total current liabilities & 620 & 483 \\ \hline Long-term debt & 1023 & 967 \\ \hline Total liabilities & 1643 & 1450 \\ \hline Stockholders' equity & & \\ \hline Common stock - \$1 par, 100,000 shares authorised, & 100 & 100 \\ shares issued and outstanding 100,000 & & \\ \hline Retained earnings & 1854 & 1720 \\ \hline Total stockholders' equity & 1954 & 1820 \\ \hline Total liabilities and stockholders' equity & 3597 & 3270 \\ \hline \hline \end{tabular} 1. Based on the following information for 2022 calculate (a) the additional funds needed (AFN) based on the AFN equation for 2023 (b) the additional funds needed (AFN) based on the Percent of Sales method for 2023. Key Assumptions: - Operating at full capacity in 2022. - Each type of asset grows proportionally with sales. - Payables and accruals grow proportionally with sales. - The 2022 net profit margin (4.50%) and payout (63%) will be maintained. - Sales are expected to increase by $1 million. (%DS=24%) \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Income Statement, 2022} \\ \hline Sales Revenue & $4,200,000 \\ \hline Less: Cost of goods sold & 3,570,000 \\ \hline Gross profits & $630,000 \\ \hline Less: Operating expenses & 210,000 \\ \hline Operating profits & $420,000 \\ \hline Less: Interest expense & 105,000 \\ \hline Net profits before taxes & $315,000 \\ \hline Less: Taxes (40\%) & 126,000 \\ \hline Net profits after taxes & $189,000 \\ \hline Less: Cash dividends & 120,000 \\ \hline To: Retained earnings & $69,000 \\ \hline \end{tabular} 2. Given the financial data for Alcott Company, compute the following Free Cash Flow (FCF) for the firm for the financial year ended December 31,2022 . Alcott Company Balance Sheet (\$000) For the vears ended December 31, 2022 2021 \begin{tabular}{l|c|c} Total liabilities & 1643 & 1450 \\ Stockholders' equity & 100 & 100 \\ Common stock - SI par, 100,000 shares authorised. & & 1720 \\ shares issued and outstanding 100,000 & 1854 & 1820 \\ Retained earnings & 1954 & 3597 \\ Total stockholders' equity & Total liabilities and stockholders' equity & \end{tabular} 1. Based on the following information for 2022 calculate (a) the additional funds needed (AFN) based on the AFN equation for 2023 (b) the additional funds needed (AFN) based on the Percent of Sales method for 2023. Key Assumptions: - Operating at full capacity in 2022. - Each type of asset grows proportionally with sales. - Payables and accruals grow proportionally with sales. - The 2022 net profit margin (4.50\%) and payout (63\%) will be maintained. - Sales are expected to increase by $1 million. (%DS=24%) \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Income Statement, 2022} \\ \hline Sales Revenue & $4,200,000 \\ \hline Less: Cost of goods sold & 3,570,000 \\ \hline Gross profits & $630,000 \\ \hline Less: Operating expenses & 210,000 \\ \hline Operating profits & $420,000 \\ \hline Less: Interest expense & 105,000 \\ \hline Net profits before taxes & $315,000 \\ \hline Less: Taxes (40\%) & 126,000 \\ \hline Net profits after taxes & $189,000 \\ \hline Less: Cash dividends & 120,000 \\ \hline To: Retained earnings & $69,000 \\ \hline \end{tabular} 2. Given the financial data for Alcott Company, compute the following Free Cash Flow (FCF) for the firm for the financial year ended December 31, 2022. \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ Alcott Company Balance Sheet (\$000) } \\ For the years ended December 31, 2022;2021 \\ \hline Assets & 2022 & 2021 \\ \hline Current assets & & \\ \hline Cash & 363 & 288 \\ \hline Marketable securities & 68 & 51 \\ \hline Accounts receivable & 503 & 365 \\ \hline Inventory & 289 & 300 \\ \hline Total current assets & 1223 & 1004 \\ \hline Gross fixed assets (at cost) & & \\ \hline Land and buildings & 2072 & 1903 \\ \hline Machinery and equipment & 1866 & 1693 \\ \hline Furniture and fixtures & 358 & 316 \\ \hline Vehicles & 275 & 314 \\ \hline Other (includes financial leases) & 98 & 96 \\ \hline Total gross fixed assets (at cost) & 4669 & 4322 \\ \hline Less: accumulated Depreciation & 2295 & 2056 \\ \hline Net fixed assets & 2374 & 2266 \\ \hline Total assets & 3597 & 3270 \\ \hline \hline Liabilities and stockholders' equity & & \\ \hline Current liabilities & & \\ \hline Accounts payable & 382 & 270 \\ \hline Notes payable & 79 & 99 \\ \hline Accruals & 159 & 114 \\ \hline Total current liabilities & 620 & 483 \\ \hline Long-term debt & 1023 & 967 \\ \hline Total liabilities & 1643 & 1450 \\ \hline Stockholders' equity & & \\ \hline Common stock - \$1 par, 100,000 shares authorised, & 100 & 100 \\ shares issued and outstanding 100,000 & & \\ \hline Retained earnings & 1854 & 1720 \\ \hline Total stockholders' equity & 1954 & 1820 \\ \hline Total liabilities and stockholders' equity & 3597 & 3270 \\ \hline \hline \end{tabular}