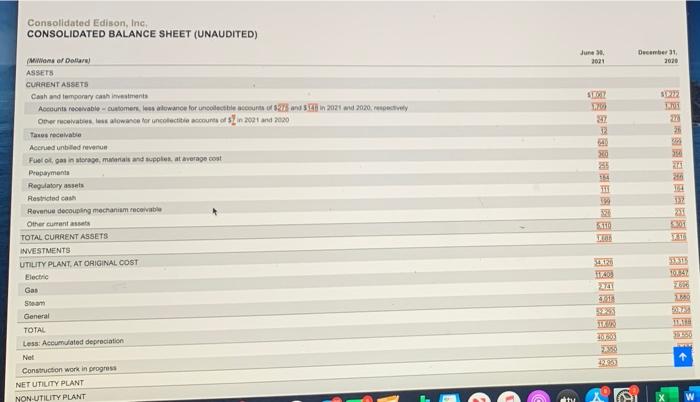

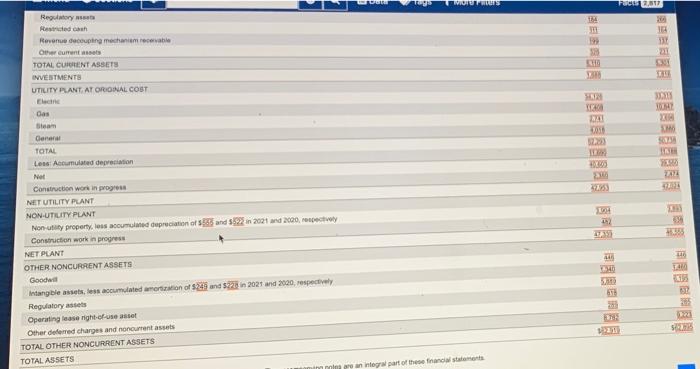

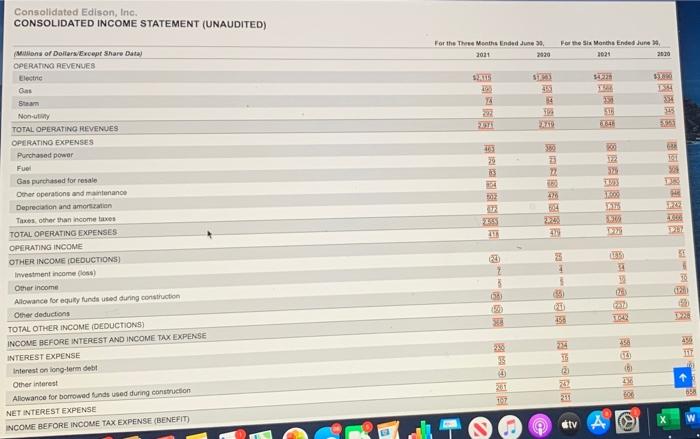

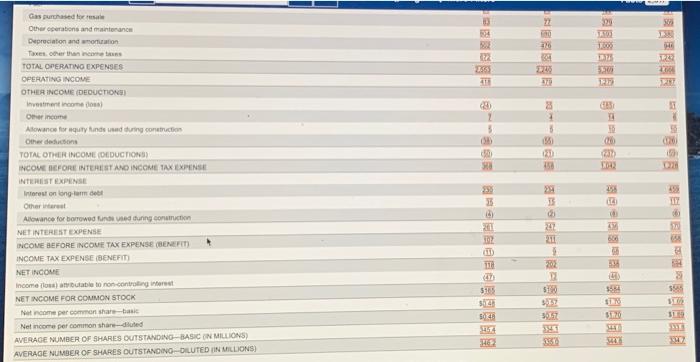

1. Based on the information in the company's most recent annual report, answer the following questions: a. What amount of accounts receivable did the company report at the end of the most recent year? b. What is the balance in the company's Allowance for Uncollectible Accounts at the end of the most recent year? a. What percentage of total current assets is accounts receivable at the end of each of the two years presented? Has this percentage increased decreased, or remained the same during this period? 2. Using the information presented in the company's annual report, compute the company's accounts receivable turnover for the current and previous years. Based on this information, has the company's management of accounts receivable improved? Briefly explain your answer. (PROVIDE A SCREEN SHOT OF BALANCE SHEET AND INCOME STATEMENT) Consolidated Edison, Inc, CONSOLIDATED BALANCE SHEET (UNAUDITED) June 2021 December 31 2020 S2 21 28 Millions of Dollar ASSETS CURRENT ASSETS Cash and temporary cash investments Accounts receivable customers, les clowance for uncolectie cu 373 2021 2020 De ce salowance for uncolectii cont of in 2021 and 2020 Tasos receivable Accred unbited revenue Fuel in mulas and suppler at average cost Prepayment Regulatory assets Restricted can Revenue decoupling mechanism Other current TOTAL CURRENT ASSETS INVESTMENTS UTILITY PLANT, AT ORIGINAL COST Electric Gas Steam General TOTAL Less: Accumulated depreciation Net Construction work in progress NET UTILITY PLANT NON-UTILITY PLANT SENESTE ES EL , 5601 1 -3511 ER! 338 229 WORDS 10 19 Regulatory Restricted can Revenue decouping mechanism recevable Other current TOTAL CURRENT ASSETS INVESTMENTS UTILITY PLANT. AT ORIONAL COST 11 YAM TO WY 2011 52 TE 2 225 112 Oas Steam CHI TOTAL Les Accumulated depreciation Nel Construction work in progress NET UTILITY PLANT NON UTILITY PLANT Nontaty property, less accumulated depreciation of and in 2021 and 2000, petty Construction work in progress NET PLANT OTHER NONCURRENT ASSETS Good Intangible assets, less accumulated amortization of 25 and in 2021 and 2000, respectively Regulatory stets Operating lease right-usesse Other deferred charges and noncurrent assets TOTAL OTHER NONCURRENT ASSETS TOTAL ASSETS are an integral part of the financial statements 14 TU 2 Consolidated Edison, Inc. CONSOLIDATED INCOME STATEMENT (UNAUDITED) For the Three Months Ende June 3 2011 2020 For the Six Months Ended June 2021 2030 SALE 34 32 331 110 8641 201 25 TO F2 3 28 3205 Millions of Dollars. Except Share Data) OPERATING REVENUES Electric Gas Star Non- TOTAL OPERATING REVENUES OPERATINO EXPENSES Purchased power Fuel Gas purchased for resale Other operations and maintenance Deprecation and amorsation The other than income taxes TOTAL OPERATING EXPENSES OPERATING INCOME OTHER INCOME DEDUCTIONS) Investment income) Other income Allowance for equity funds used during construction Other deductions TOTAL OTHER INCOME (DEDUCTIONS INCOME BEFORE INTEREST AND INCOME TAX EXPENSE INTEREST EXPENSE Interest on long-term debit Other interest Allowance for borrowed funds used during construction NET INTEREST EXPENSE INCOME BEFORE INCOME TAX EXPENSE (BENEFIT) - 15 ( Z 3 08 s g 12 2 15 4 1 28 6 etv A 329 HE 72% 222 30 22 2 3 3 10 0 Gas purchased for sale Other operations and maintenance Depreciation and on Taxes Other than TOTAL OPERATING EXPENSES OPERATING INCOME OTHER INCOME (DEDUCTION Investment income on Other income Allowance forutyunds and during construction Other do TOTAL OTHER INCOME DEDUCTIONS INCOME BEFORE INTEREST AND INCOME TAX EXPENSE INTEREST EXPENSE Interest on long-lo! Other Allowance for borrowed under tuning construction NETINTEREST EXPENSE INCOME BEFORE INCOME TAX EXPENSE BENEFIT) INCOME TAX EXPENSE BENEFIT NET INCOME Income Los) table to non-cong Wort NET INCOME FOR COMMON STOCK Natome per common shares Net income per common shared AVERAGE NUMBER OF SHARES OUTSTANDING-BASIC ON MILLIONS) AVERAGE NUMBER OF SHARES OUTSTANDING OILUTED IN MILLIONS) ESS ziwwww5 9 3 ILI 21 242 211 11 22 510 SALZ 3017 352 S18 H62 1. Based on the information in the company's most recent annual report, answer the following questions: a. What amount of accounts receivable did the company report at the end of the most recent year? b. What is the balance in the company's Allowance for Uncollectible Accounts at the end of the most recent year? a. What percentage of total current assets is accounts receivable at the end of each of the two years presented? Has this percentage increased decreased, or remained the same during this period? 2. Using the information presented in the company's annual report, compute the company's accounts receivable turnover for the current and previous years. Based on this information, has the company's management of accounts receivable improved? Briefly explain your answer. (PROVIDE A SCREEN SHOT OF BALANCE SHEET AND INCOME STATEMENT) Consolidated Edison, Inc, CONSOLIDATED BALANCE SHEET (UNAUDITED) June 2021 December 31 2020 S2 21 28 Millions of Dollar ASSETS CURRENT ASSETS Cash and temporary cash investments Accounts receivable customers, les clowance for uncolectie cu 373 2021 2020 De ce salowance for uncolectii cont of in 2021 and 2020 Tasos receivable Accred unbited revenue Fuel in mulas and suppler at average cost Prepayment Regulatory assets Restricted can Revenue decoupling mechanism Other current TOTAL CURRENT ASSETS INVESTMENTS UTILITY PLANT, AT ORIGINAL COST Electric Gas Steam General TOTAL Less: Accumulated depreciation Net Construction work in progress NET UTILITY PLANT NON-UTILITY PLANT SENESTE ES EL , 5601 1 -3511 ER! 338 229 WORDS 10 19 Regulatory Restricted can Revenue decouping mechanism recevable Other current TOTAL CURRENT ASSETS INVESTMENTS UTILITY PLANT. AT ORIONAL COST 11 YAM TO WY 2011 52 TE 2 225 112 Oas Steam CHI TOTAL Les Accumulated depreciation Nel Construction work in progress NET UTILITY PLANT NON UTILITY PLANT Nontaty property, less accumulated depreciation of and in 2021 and 2000, petty Construction work in progress NET PLANT OTHER NONCURRENT ASSETS Good Intangible assets, less accumulated amortization of 25 and in 2021 and 2000, respectively Regulatory stets Operating lease right-usesse Other deferred charges and noncurrent assets TOTAL OTHER NONCURRENT ASSETS TOTAL ASSETS are an integral part of the financial statements 14 TU 2 Consolidated Edison, Inc. CONSOLIDATED INCOME STATEMENT (UNAUDITED) For the Three Months Ende June 3 2011 2020 For the Six Months Ended June 2021 2030 SALE 34 32 331 110 8641 201 25 TO F2 3 28 3205 Millions of Dollars. Except Share Data) OPERATING REVENUES Electric Gas Star Non- TOTAL OPERATING REVENUES OPERATINO EXPENSES Purchased power Fuel Gas purchased for resale Other operations and maintenance Deprecation and amorsation The other than income taxes TOTAL OPERATING EXPENSES OPERATING INCOME OTHER INCOME DEDUCTIONS) Investment income) Other income Allowance for equity funds used during construction Other deductions TOTAL OTHER INCOME (DEDUCTIONS INCOME BEFORE INTEREST AND INCOME TAX EXPENSE INTEREST EXPENSE Interest on long-term debit Other interest Allowance for borrowed funds used during construction NET INTEREST EXPENSE INCOME BEFORE INCOME TAX EXPENSE (BENEFIT) - 15 ( Z 3 08 s g 12 2 15 4 1 28 6 etv A 329 HE 72% 222 30 22 2 3 3 10 0 Gas purchased for sale Other operations and maintenance Depreciation and on Taxes Other than TOTAL OPERATING EXPENSES OPERATING INCOME OTHER INCOME (DEDUCTION Investment income on Other income Allowance forutyunds and during construction Other do TOTAL OTHER INCOME DEDUCTIONS INCOME BEFORE INTEREST AND INCOME TAX EXPENSE INTEREST EXPENSE Interest on long-lo! Other Allowance for borrowed under tuning construction NETINTEREST EXPENSE INCOME BEFORE INCOME TAX EXPENSE BENEFIT) INCOME TAX EXPENSE BENEFIT NET INCOME Income Los) table to non-cong Wort NET INCOME FOR COMMON STOCK Natome per common shares Net income per common shared AVERAGE NUMBER OF SHARES OUTSTANDING-BASIC ON MILLIONS) AVERAGE NUMBER OF SHARES OUTSTANDING OILUTED IN MILLIONS) ESS ziwwww5 9 3 ILI 21 242 211 11 22 510 SALZ 3017 352 S18 H62