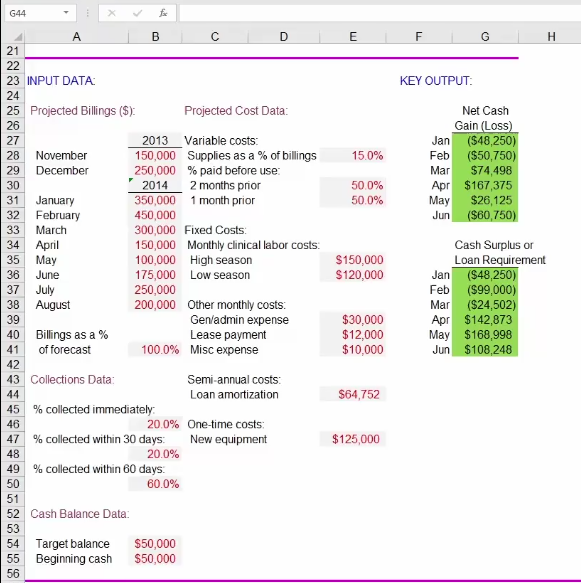

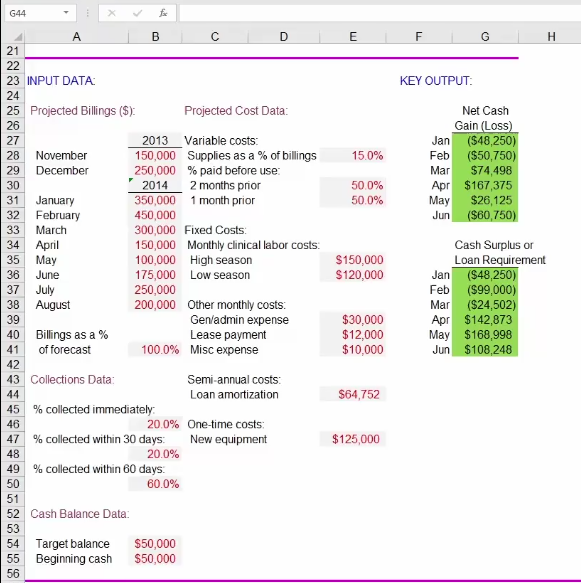

1. Based on the monthly cash budget, what is the maximum loan requirement for January? Based on the daily cash budget, what is the maximum loan requirement for January? Why are the numbers different? 2. The monthly cash budget assumes that all cash flows occur on the same day each month. Suppose the clinic's outflows tend to cluster at the beginning of the month, while collections tend to be heaviest towards the end of each month. How would this affect the usefulness of the monthly budget? 3. The monthly cash budget does not provide for interest paid on loans or interest earned on cash surpluses. a) Modify the monthly portion of the model to include these cash flows for February to June. Assume that interest earned (paid) occurs in the month following the end- of-month cash surplus (loan requirement.) b) What is the new maximum loan requirement and in what month? Do these cash flows have a significant impact on estimated loan requirements?.

G44 & E F . KEY OUTPUT: 15.0% Net Cash Gain (Loss) Jan (548,250) Feb ($50,750) Mar $74,498 Apr $167,375 May $26,125 Jun ($60,750) 50.0% 50.0% $150,000 $120,000 July B D 21 22 23 INPUT DATA: 24 25 Projected Billings ($) Projected Cost Data: 26 27 2013_Variable costs: 28 November 150,000 Supplies as a % of billings 29 December 250,000% paid before use 30 2014 2 months prior 31 January 350,000 1 month prior 32 February 450,000 33 March 300,000 Fixed Costs 34 April 150,000 Monthly clinical labor costs. 35 May 100,000 High season 36 June 175,000 Low season 37 250,000 38 August 200,000 Other monthly costs: 39 Gen/admin expense 40 Billings as a % Lease payment 41 of forecast 100.0% Misc expense 42 43 Collections Data: Semi-annual costs: 44 Loan amortization 45 % collected immediately 46 20.0% One-time costs: 47 % collected within 30 days: New equipment 48 20.0% 49 % collected within 60 days: 50 60.0% 51 52 Cash Balance Data: 53 54 Target balance $50,000 55 Beginning cash $50,000 56 Cash Surplus or Loan Requirement Jan (S48,250) Feb ($99,000) Mar ($24,502) Apr $142,873 May $168,998 Jun $108,248 $30,000 $12,000 $10,000 $64,752 $125,000 G44 & E F . KEY OUTPUT: 15.0% Net Cash Gain (Loss) Jan (548,250) Feb ($50,750) Mar $74,498 Apr $167,375 May $26,125 Jun ($60,750) 50.0% 50.0% $150,000 $120,000 July B D 21 22 23 INPUT DATA: 24 25 Projected Billings ($) Projected Cost Data: 26 27 2013_Variable costs: 28 November 150,000 Supplies as a % of billings 29 December 250,000% paid before use 30 2014 2 months prior 31 January 350,000 1 month prior 32 February 450,000 33 March 300,000 Fixed Costs 34 April 150,000 Monthly clinical labor costs. 35 May 100,000 High season 36 June 175,000 Low season 37 250,000 38 August 200,000 Other monthly costs: 39 Gen/admin expense 40 Billings as a % Lease payment 41 of forecast 100.0% Misc expense 42 43 Collections Data: Semi-annual costs: 44 Loan amortization 45 % collected immediately 46 20.0% One-time costs: 47 % collected within 30 days: New equipment 48 20.0% 49 % collected within 60 days: 50 60.0% 51 52 Cash Balance Data: 53 54 Target balance $50,000 55 Beginning cash $50,000 56 Cash Surplus or Loan Requirement Jan (S48,250) Feb ($99,000) Mar ($24,502) Apr $142,873 May $168,998 Jun $108,248 $30,000 $12,000 $10,000 $64,752 $125,000