Answered step by step

Verified Expert Solution

Question

1 Approved Answer

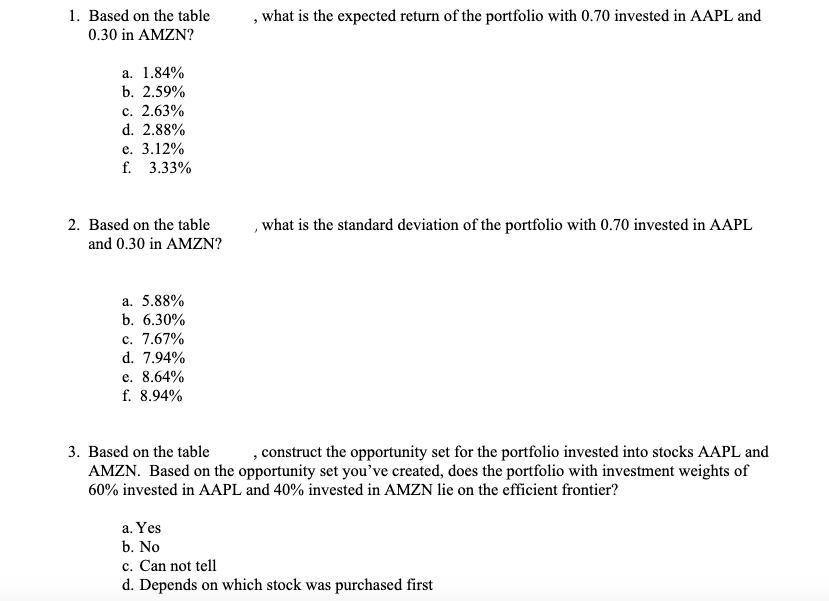

1. Based on the table 0.30 in AMZN? a. 1.84% b. 2.59% c. 2.63% d. 2.88% e. 3.12% f. 3.33% 2. Based on the

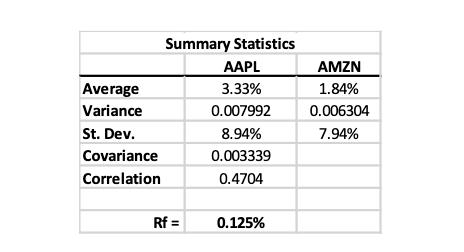

1. Based on the table 0.30 in AMZN? a. 1.84% b. 2.59% c. 2.63% d. 2.88% e. 3.12% f. 3.33% 2. Based on the table and 0.30 in AMZN? a. 5.88% b. 6.30% c. 7.67% d. 7.94% e. 8.64% f. 8.94% , what is the expected return of the portfolio with 0.70 invested in AAPL and a. Yes b. No ) what is the standard deviation of the portfolio with 0.70 invested in AAPL 3. Based on the table , construct the opportunity set for the portfolio invested into stocks AAPL and AMZN. Based on the opportunity set you've created, does the portfolio with investment weights of 60% invested in AAPL and 40 % invested in AMZN lie on the efficient frontier? c. Can not tell d. Depends on which stock was purchased first Average Variance St. Dev. Covariance Correlation Summary Statistics AAPL 3.33% 0.007992 Rf= 8.94% 0.003339 0.4704 0.125% AMZN 1.84% 0.006304 7.94%

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To answer these questions we will use the information from the provided summary statistic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started