Answered step by step

Verified Expert Solution

Question

1 Approved Answer

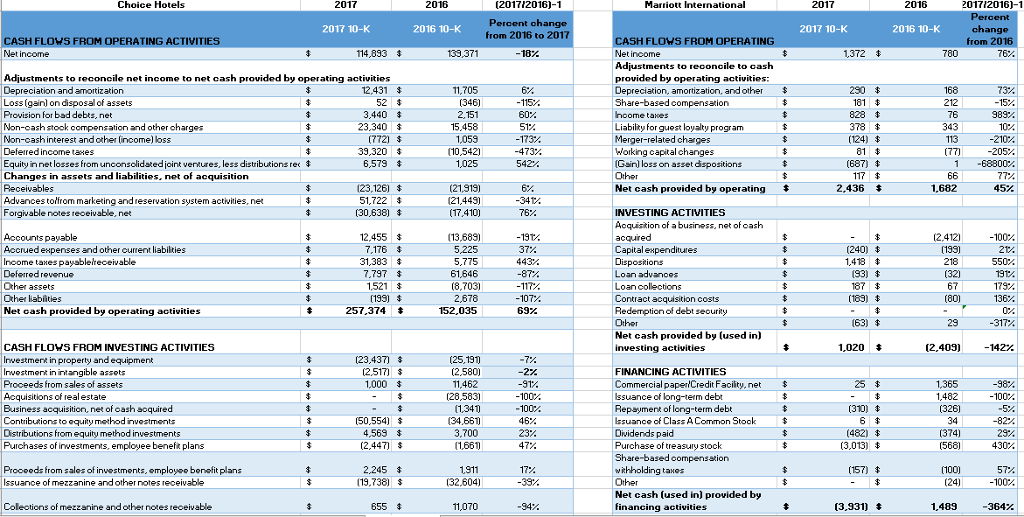

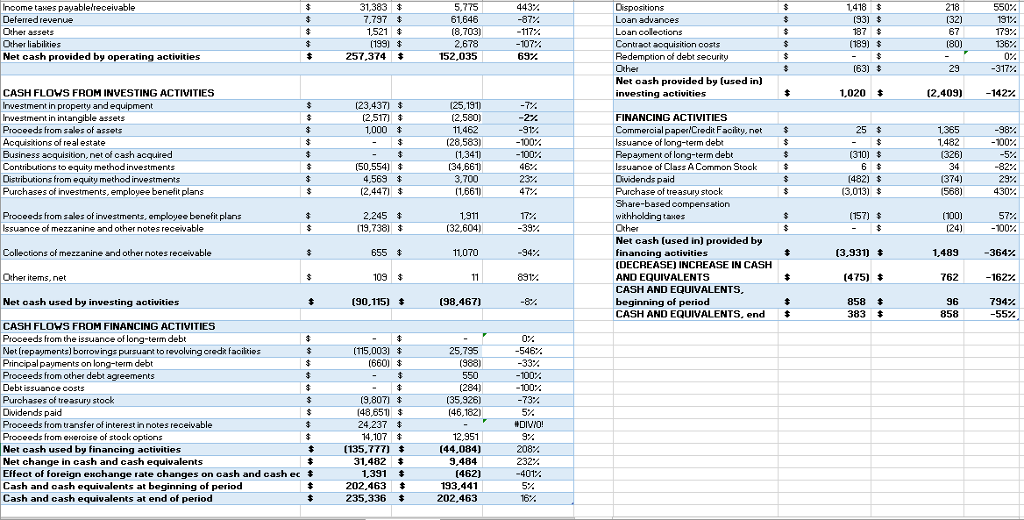

1. Based on your horizontal analysis of Choice Hotels' and Marriott International's operating, investing, and financing activities, which company is most attractive for an acquisition

1. Based on your horizontal analysis of Choice Hotels' and Marriott International's operating, investing, and financing activities, which company is most attractive for an acquisition by the equity firm and why?

2. What advice would you give to the client, Choice Hotels, to improve their investing and financing activities?

Choice Hotels 2017 2016 (201712016)-1 Marriott International 2017 2016 201712016)-1 2016 10-K t change from 2016 to 2017 2017 10-K 2017 10-K 2016 10-K change CASH FLOWS FROM OPERATING ACTIVITI FLOWS FROM OPERATING 114,893 $ 133,371 1372 Adjustments to reconcile to oash provided by operating activities: Depreciation, amortization, andother Share-based compensation Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization Loss (gainl ondisposal of assets Provision for bad debts, net Non-cash stook compensation and other charges Non-cashinterest and other lincome) loss Deferredincome taxes 12,431$ (346) 2,151 212 76 3,440 23,340$ 60% iabily for guest loyalty program Merger-related charges Working capital changes Gainl loss on asset dispositions 378 1,059 10,542) 113 39,320 $ -473% 205% Equity innet losses from unconsolidated joint ventures, less distributions re Changes in assets and liabilities, net of acquisition 6,579 (687) $ 2.436$ (23,126)$ 51,722$ Net cash provided by operating Advances tolfrom marketing andreservation system actvities, net Forgivable notes teceivable, ne (21,443 (17.410) (30,638) INVESTING ACTIVITIES Acquistion of a business, net of cash Accounts payable Accrued expenses and other current liabilkies Income taxes payablereceable Doferred rovenue Other assets Capital expenditures 31,383 7,797$ 1521 $ 218 550 61,646 (8,703) 83) $ Contract acquisition costs Redemption of debt seourity (183) Net cash provided by operating activities 257.374 152,035 69% 29 -317% Net cash provided by (used in) investing activities 1,020 CASH FLOYS FROM INVESTING ACTIVITIES Inwestmert in property and equipment Inwestment inintangiblo assots Proceeds from sales of assets Acquisitions of realestate Business acquisition, net of cash aoquired Contibutions to equity method investments Distributions from equity method investments Purchases of irwestments, employee benefa plans (23,437) (25,1910 7% 2% 2517)$ FINANCING ACTIVITIES Commercial paper'Credit Faciity, net Issuance of long-term Repayment of long-term debt suance of ClassACommon Stook $ Dividends paid 1.365-98%! (50,554) 34 (482) (3,013) (374) 1,660 e of treasuy stock Procoods from salos of investments, omployee bonofit plans Issuance of mezzanine andother notes receivable 1.911 (32,604) Share-based compensation wihholding tanes 2,245$ (157) $ 57% Net cash (used in) provided by financing activities Colections of mezzanine and other notes teceivable 11,070 (3,931) 1.489 5,775 s 1418 (93) 218 Income taes pauableeceivable Deferredrevenue Other assets Other liabilities Net cash provided by operating activities 7,797 1521 $ 61,646 Loan advances 117% (189) $ Contraot acquisition costs Redemption of debt 257.374$ 152,035 0% 29 Net oash od by (used in) investing activities CASH FLOWS FROM INVESTING ACTIVITIES Irwesiment in property and equipment Invesment in intangible assets Proooods from salos of assets Acquisitions of real estate Business acquisition, net of cash acquired Contributions to equity method investments Distributions from equity methodinwestments 1,020 (2,409) -142% (23,437)$ (2,517) 4 (25,191) (2,580) (28,583) (34,661) 2% FINANCING ACTIVITIES CommercialpaperlCredit Facity, not Issuance of long-term debt Repayment of long-term debt lssuanoe of Class A Common Stock Dividends paicd Purchase of treasury stock Share-based compensation (50,554) 34 (482) $ 3,013) 4,569 $ Purchases of inwestments, employee benefit plans Proooods from sales of inwestments, employee bonefit plans Issuance of mezzanine and other notes receivable 2,245 $ 19,738$ 157) s (100) (24) (32,604) -100% Net cash (used in) provided by financing activities [DECREASE) INCREASE IN CASH AND EQUIVALENTS CASH AND EQUIVALENTS beginning of period CASH AND EQUIVALENTS, end Collections of mezzanine and other notes receivable -94% [3,931]1t 1,489 364% Other items, net 831% (475) 762-162%| Net oash used by investing aotivities [90.115) * t(98.467) 858 383$ 794% 858 CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from the issuance of long-term debt Not [ropayments) borrowings pursuant to revolving credt faciitios Pincipal payments on lo Proceeds from other debt agreements Debtissuance costs Purchases of treasury stock (15,003) $ 25,795 (284) (35,926) (46,182) 100% (9.807) $ (48,651$ Proceeds from transfer of interest innotes receivable Prooceds from o oroise of stook Net cash used by financing activities Net change in cash and cash equivalents Effect of foreign exchange rate changes on cash and cash ec t Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 24,237 4,107 (135,777) * 31,482$ 1,391 202.463* 235.336$ NDIVIO 9% 12,951 (44,084) 9,484 (462) 193.441 202.463Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started