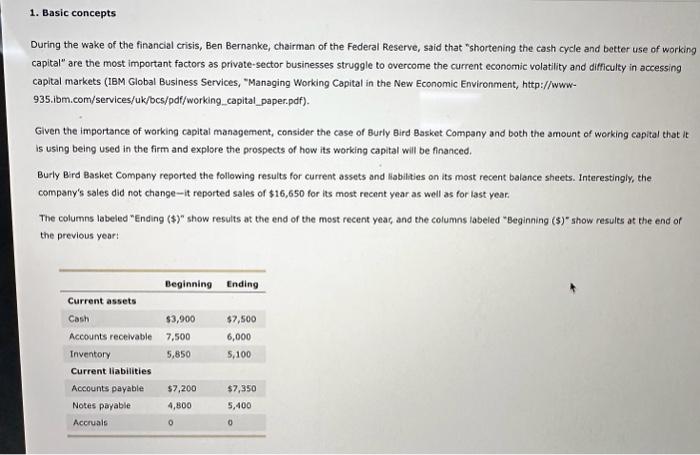

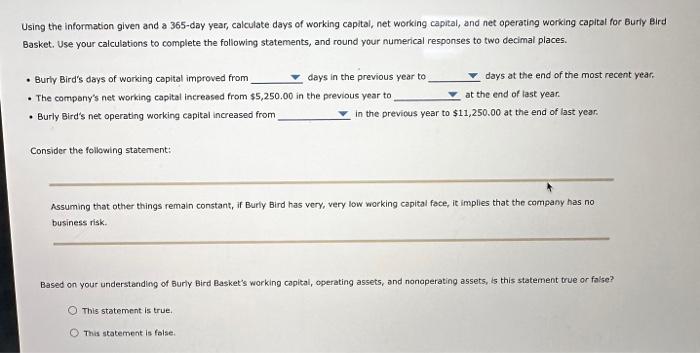

1. Basic concepts During the wake of the financial crisis, Ben Bernanke, chairman of the Federal Reserve, said that "shortening the cash cycle and better use of working capital" are the most important factors as private-sector businesses struggle to overcome the current economic volatility and difficulty in accessing capital markets (IBM Global Business Services, "Managing Working Capital in the New Economic Environment, http://www935.ibm.com/services/uk/bcs/pdf/working_capital_paper.pdf). Given the importance of working capital management, consider the case of Burly Bird Basket Company and both the amount of working capital that it is using being used in the firm and explore the prospects of how its working capital will be financed. Burly Bird Basket Company reported the following results for current assets and liabilities on its most recent baiance sheets. Interestingly, the company's sales did not change-it reported sales of $16,650 for its most recent year as well as for iast year. The columns labeled "Ending ($) show results at the end of the most recent yeac, and the columns labeled "Beginning (\$)" show results at the end of the previous year: Jsing the intormation given and a 365-day year, calculate days of working capital, net working capital, and net operating working capital for Burly Gasket. Use your calculations to complete the following statements, and round your numerical responses to two decimal places. - Burly Bird's days of working capital improved from days in the previous year to days at the end of the most recent ye: - The compony's net working capital increased from $5,250.00 in the previous year to at the end of last year. - Burly Bird's net operating working eapital increased from in the previous year to $11,250.00 at the end of last year. Consider the following statement: Assuming that other things remain constant, if Burly Bird has very, very low working capital face, it implles that the company has no business risk. Based on your understanding of Burly Bird Basket's working copital, operating assets, and nonaperating assets, is this statement true or false? This statement is true. This statement is false