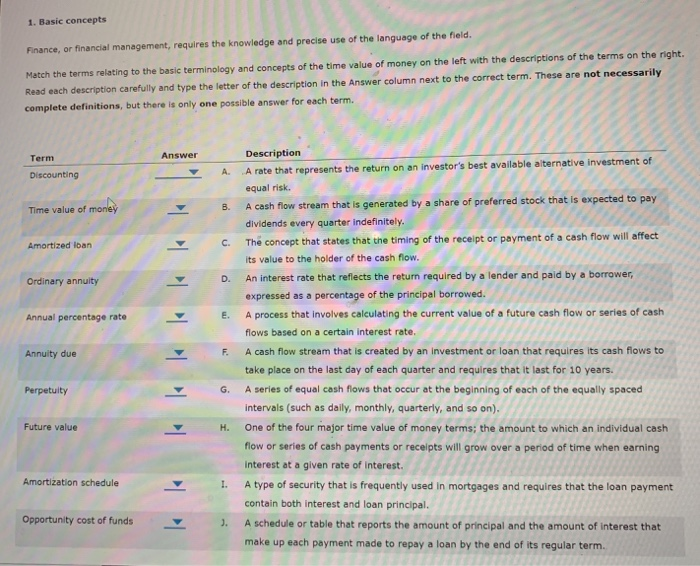

1. Basic concepts Finance, or financial management, requires the knowledge and precise use of the language of the field. Match the terms relating to the basic terminology and concepts of the time value of money on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. These are not necessarily complete definitions, but there is only one possible answer for each term. Answer Term Discounting . Time value of money B. Amortized loan C. Ordinary annuity D. Annual percentage rate E. Annuity due F. Description A rate that represents the return on an investor's best available alternative investment of equal risk. A cash flow stream that is generated by a share of preferred stock that is expected to pay dividends every quarter indefinitely. The concept that states that the timing of the receipt or payment of a cash flow will affect its value to the holder of the cash flow. An interest rate that reflects the return required by a lender and paid by a borrower, expressed as a percentage of the principal borrowed. A process that involves calculating the current value of a future cash flow or series of cash flows based on a certain interest rate. A cash flow stream that is created by an investment or loan that requires its cash flows to take place on the last day of each quarter and requires that it last for 10 years. A series of equal cash flows that occur at the beginning of each of the equally spaced intervals (such as daily, monthly, quarterly, and so on). One of the four major time value of money terms; the amount to which an individual cash flow or series of cash payments or receipts will grow over a period of time when earning interest at a given rate of interest. A type of security that is frequently used in mortgages and requires that the loan payment contain both interest and loan principal. A schedule or table that reports the amount of principal and the amount of interest that make up each payment made to repay a loan by the end of its regular term. Perpetuity G Future value H. Amortization schedule I. Opportunity cost of funds 3