Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Basic Products Inc. (Basic) produces small home handyman tools, including an electric drill. The sales budget for the first quarter of the fiscal

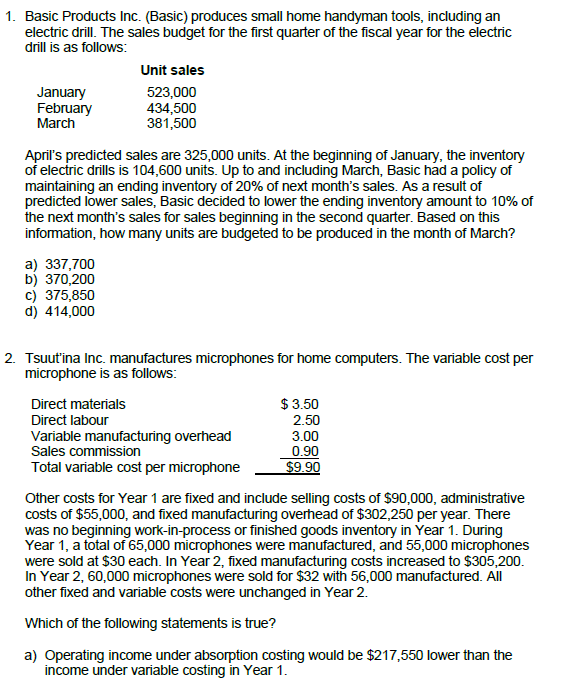

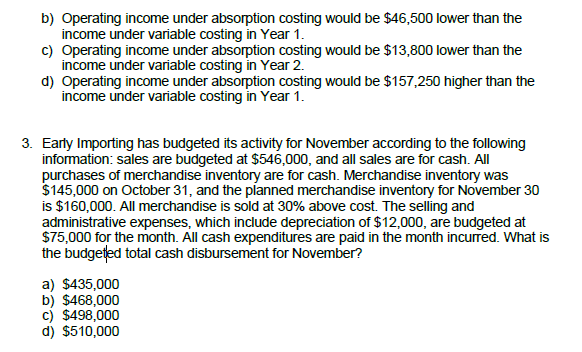

1. Basic Products Inc. (Basic) produces small home handyman tools, including an electric drill. The sales budget for the first quarter of the fiscal year for the electric drill is as follows: January February March April's predicted sales are 325,000 units. At the beginning of January, the inventory of electric drills is 104,600 units. Up to and including March, Basic had a policy of maintaining an ending inventory of 20% of next month's sales. As a result of predicted lower sales, Basic decided to lower the ending inventory amount to 10% of the next month's sales for sales beginning in the second quarter. Based on this information, how many units are budgeted to be produced in the month of March? a) 337,700 b) 370,200 c) 375,850 d) 414,000 Unit sales 523,000 434,500 381,500 2. Tsuutina Inc. manufactures microphones for home computers. The variable cost per microphone is as follows: Direct materials Direct labour Variable manufacturing overhead Sales commission Total variable cost per microphone $ 3.50 2.50 3.00 0.90 $9.90 Other costs for Year 1 are fixed and include selling costs of $90,000, administrative costs of $55,000, and fixed manufacturing overhead of $302,250 per year. There was no beginning work-in-process or finished goods inventory in Year 1. During Year 1, a total of 65,000 microphones were manufactured, and 55,000 microphones were sold at $30 each. In Year 2, fixed manufacturing costs increased to $305,200. In Year 2, 60,000 microphones were sold for $32 with 56,000 manufactured. All other fixed and variable costs were unchanged in Year 2. Which of the following statements is true? a) Operating income under absorption costing would be $217,550 lower than the income under variable costing in Year 1. b) Operating income under absorption costing would be $46,500 lower than the income under variable costing in Year 1. c) Operating income under absorption costing would be $13,800 lower than the income under variable costing in Year 2. d) Operating income under absorption costing would be $157,250 higher than the income under variable costing in Year 1. 3. Early Importing has budgeted its activity for November according to the following information: sales are budgeted at $546,000, and all sales are for cash. All purchases of merchandise inventory are for cash. Merchandise inventory was $145,000 on October 31, and the planned merchandise inventory for November 30 is $160,000. All merchandise is sold at 30% above cost. The selling and administrative expenses, which include depreciation of $12,000, are budgeted at $75,000 for the month. All cash expenditures are paid in the month incurred. What is the budgetled total cash disbursement for November? a) $435,000 b) $468,000 c) $498,000 d) $510,000

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started