Answered step by step

Verified Expert Solution

Question

1 Approved Answer

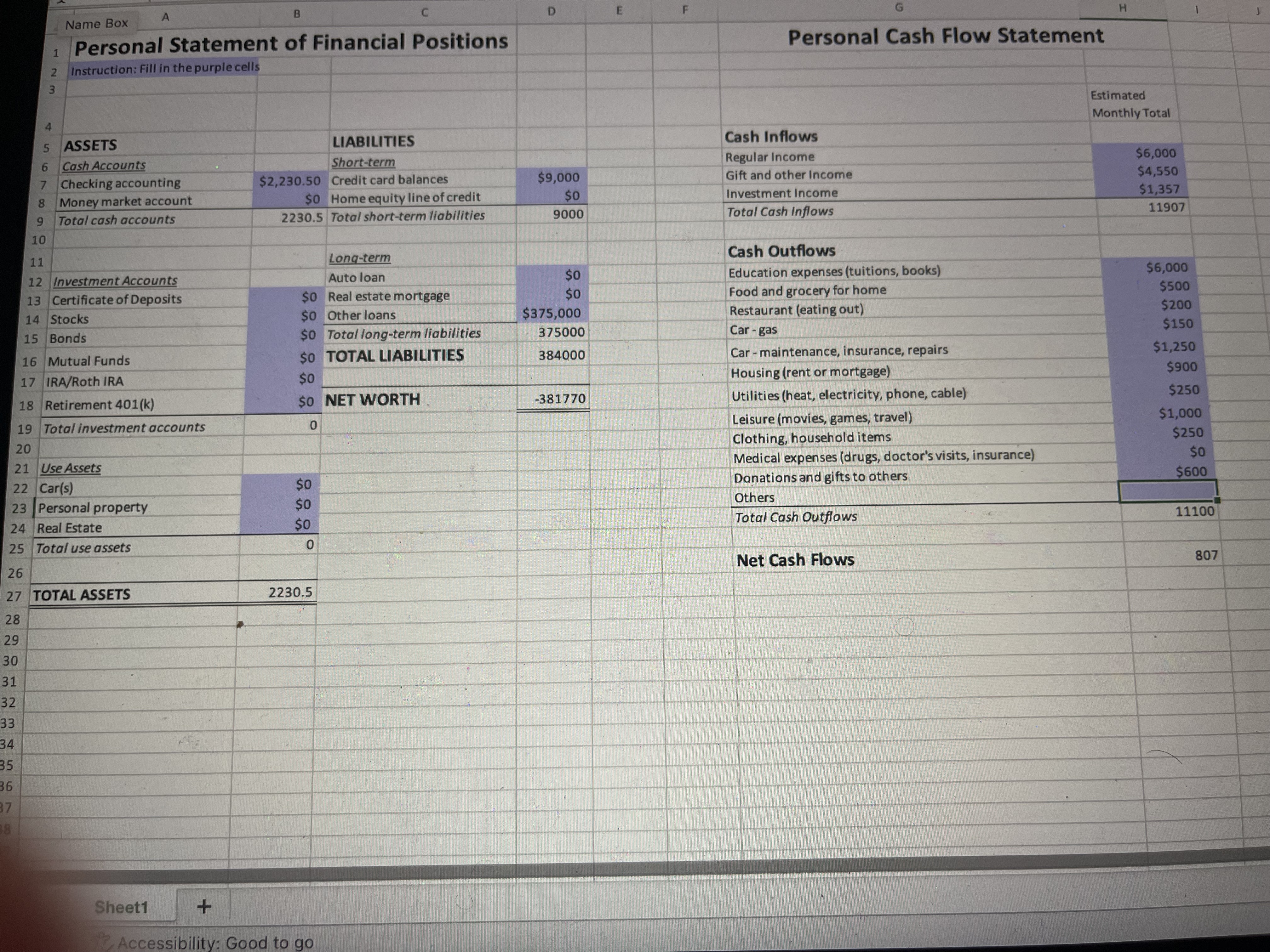

1. Before starting the next part of this assignment, first review your personal cash flow statement that you completed earlier this semester. How much can

1. Before starting the next part of this assignment, first review your personal cash flow statement that you completed earlier this semester. How much can you afford to pay each month for personal loans?

2. Go to the page "How to get a personal loan" on the website:www.bankrate.com Links to an external site..

- What are some good reasons for taking out a personal loan?

- What are some bad reasons?

- What are the current personal loan rates for different credit rating? How may the difference in rates affect your monthly payments?

4 38 1 2 Instruction: Fill in the purple cells 3 5 ASSETS 6 Cash Accounts 7 Checking accounting 8 Money market account 9 Total cash accounts 10 A Name Box Personal Statement of Financial Positions 11 12 Investment Accounts 13 Certificate of Deposits 14 Stocks 15 Bonds 16 Mutual Funds 17 IRA/Roth IRA 18 Retirement 401(k) 19 Total investment accounts 20 21 Use Assets 22 Car(s) 23 Personal property 24 Real Estate 25 Total use assets 26 27 TOTAL ASSETS 28 29 30 31 32 33 34 35 36 37 Sheet1 B + LIABILITIES Short-term Credit card balances $0 Home equity line of credit 2230.5 Total short-term liabilities $2,230.50 Long-term Auto loan $0 Real estate mortgage $0 Other loans $0 Total long-term liabilities $0 TOTAL LIABILITIES $0 $0 NET WORTH 0 $0 $0 $0 C 0 2230.5 Accessibility: Good to go D $9,000 $0 9000 $0 $0 $375,000 375000 384000 -381770 E F Personal Cash Flow Statement Cash Inflows Regular Income Gift and other Income Investment Income Total Cash Inflows G Cash Outflows Education expenses (tuitions, books) Food and grocery for home Restaurant (eating out) Car-gas Car-maintenance, insurance, repairs Housing (rent or mortgage) Utilities (heat, electricity, phone, cable) Leisure (movies, games, travel) Clothing, household items Medical expenses (drugs, doctor's visits, insurance) Donations and gifts to others Others Total Cash Outflows Net Cash Flows H Estimated Monthly Total $6,000 $4,550 $1,357 11907 $6,000 $500 $200 $150 $1,250 $900 $250 $1,000 $250 $0 $600 11100 807

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 I can afford to pay 500 per month for personal loans 2 Some good re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started