Answered step by step

Verified Expert Solution

Question

1 Approved Answer

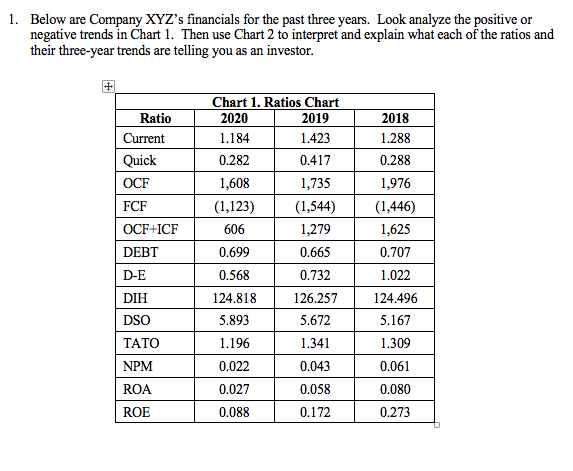

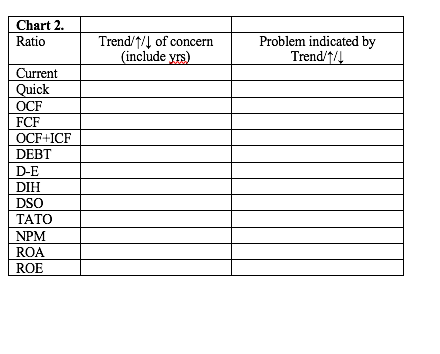

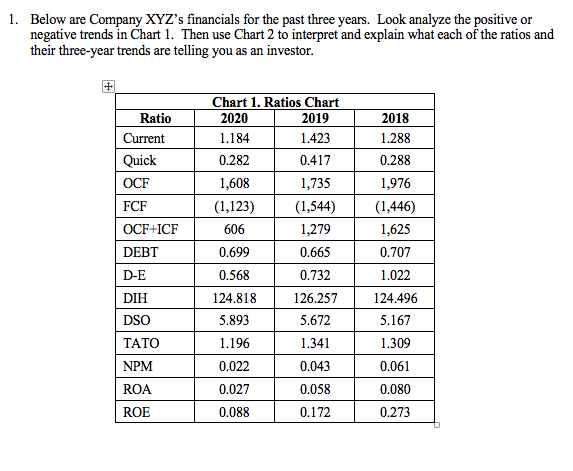

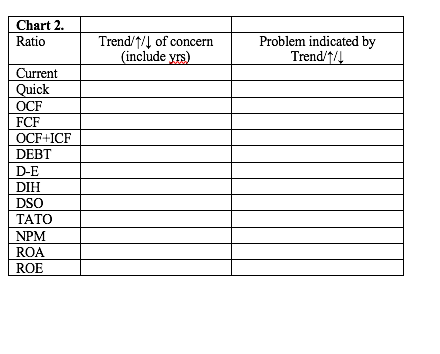

1. Below are Company XYZ's financials for the past three years. Look analyze the positive or negative trends in Chart 1. Then use Chart

-

\

\

1. Below are Company XYZ's financials for the past three years. Look analyze the positive or negative trends in Chart 1. Then use Chart 2 to interpret and explain what each of the ratios and their three-year trends are telling you as an investor. + Ratio Current Quick OCF FCF OCF+ICF DEBT D-E DIH DSO TATO NPM ROA ROE Chart 1. Ratios Chart 2020 2019 1.184 1.423 0.282 0.417 1,608 1,735 (1,123) (1,544) 606 1,279 0.699 0.665 0.568 0.732 124.818 126.257 5.893 5.672 1.196 1.341 0.022 0.043 0.027 0.058 0.088 0.172 2018 1.288 0.288 1,976 (1,446) 1,625 0.707 1.022 124.496 5.167 1.309 0.061 0.080 0.273 Chart 2. Ratio Trend/1/1 of concern (include yrs) Problem indicated by Trend/144 Current Quick OCF FCF OCF+ICF DEBT D-E DIH DSO TATO NPM ROA ROE 1. Below are Company XYZ's financials for the past three years. Look analyze the positive or negative trends in Chart 1. Then use Chart 2 to interpret and explain what each of the ratios and their three-year trends are telling you as an investor. + Ratio Current Quick OCF FCF OCF+ICF DEBT D-E DIH DSO TATO NPM ROA ROE Chart 1. Ratios Chart 2020 2019 1.184 1.423 0.282 0.417 1,608 1,735 (1,123) (1,544) 606 1,279 0.699 0.665 0.568 0.732 124.818 126.257 5.893 5.672 1.196 1.341 0.022 0.043 0.027 0.058 0.088 0.172 2018 1.288 0.288 1,976 (1,446) 1,625 0.707 1.022 124.496 5.167 1.309 0.061 0.080 0.273 Chart 2. Ratio Trend/1/1 of concern (include yrs) Problem indicated by Trend/144 Current Quick OCF FCF OCF+ICF DEBT D-E DIH DSO TATO NPM ROA ROE

\

\Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started