Question

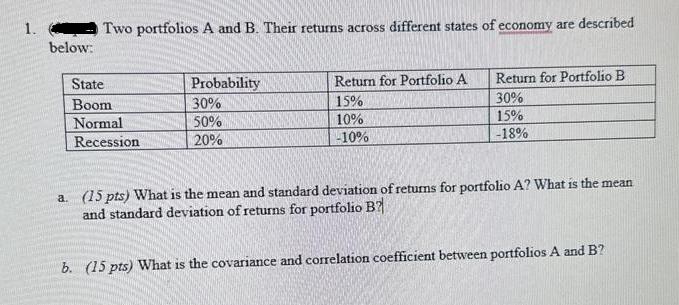

1. below: Two portfolios A and B. Their returns across different states of economy are described State Boom Normal Recession Probability 30% 50% 20%

1. below: Two portfolios A and B. Their returns across different states of economy are described State Boom Normal Recession Probability 30% 50% 20% Return for Portfolio A 15% 10% -10% Return for Portfolio B 30% 15% -18% a. (15 pts) What is the mean and standard deviation of returns for portfolio A? What is the mean and standard deviation of returns for portfolio B? b. (15 pts) What is the covariance and correlation coefficient between portfolios A and B?

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham

Concise 9th Edition

1305635937, 1305635930, 978-1305635937

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App