Answered step by step

Verified Expert Solution

Question

1 Approved Answer

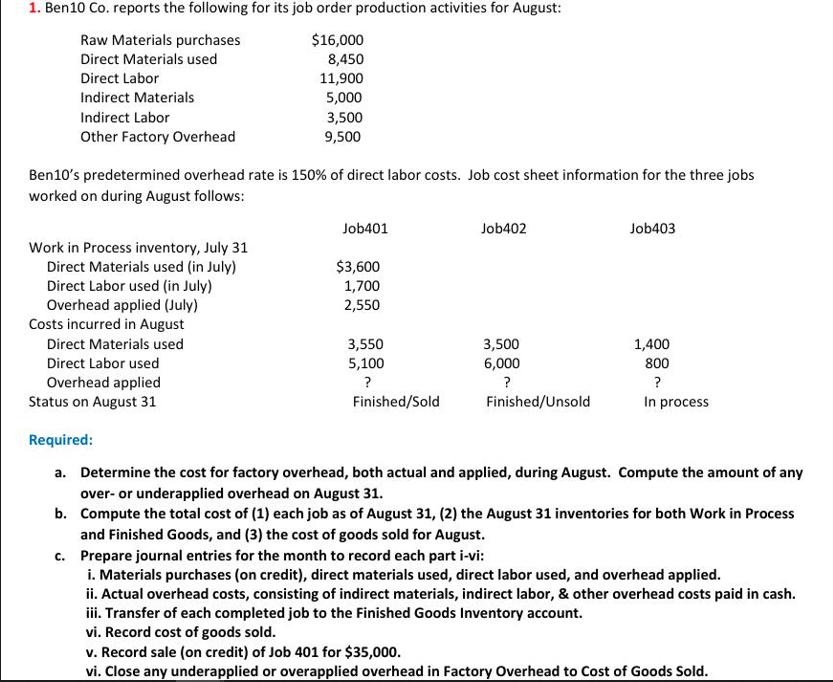

1. Ben10 Co. reports the following for its job order production activities for August: Raw Materials purchases $16,000 8,450 Direct Materials used Direct Labor

1. Ben10 Co. reports the following for its job order production activities for August: Raw Materials purchases $16,000 8,450 Direct Materials used Direct Labor 11,900 Indirect Materials 5,000 Indirect Labor Other Factory Overhead Ben10's predetermined overhead rate is 150% of direct labor costs. Job cost sheet information for the three jobs worked on during August follows: Work in Process inventory, July 31 Direct Materials used (in July) Direct Labor used (in July) Overhead applied (July) Costs incurred in August Direct Materials used Direct Labor used 3,500 9,500 Overhead applied Status on August 31 Job401 $3,600 1,700 2,550 3,550 5,100 ? Finished/Sold Job402 3,500 6,000 ? Finished/Unsold Job403 1,400 800 ? In process Required: a. Determine the cost for factory overhead, both actual and applied, during August. Compute the amount of any over- or underapplied overhead on August 31. b. Compute the total cost of (1) each job as of August 31, (2) the August 31 inventories for both Work in Process and Finished Goods, and (3) the cost of goods sold for August. c. Prepare journal entries for the month to record each part i-vi: i. Materials purchases (on credit), direct materials used, direct labor used, and overhead applied. ii. Actual overhead costs, consisting of indirect materials, indirect labor, & other overhead costs paid in cash. iii. Transfer of each completed job to the Finished Goods Inventory account. vi. Record cost of goods sold. v. Record sale (on credit) of Job 401 for $35,000. vi. Close any underapplied or overapplied overhead in Factory Overhead to Cost of Goods Sold.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

It appears that you have provided an accounting problem related to job order costing and youre asking for help with solving various parts of the question Lets tackle each part step by step a To determ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started