Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Benefits may be deferred up to age 70 with increase of 0.6% per month that you defer your payment, but cannot be collected sooner

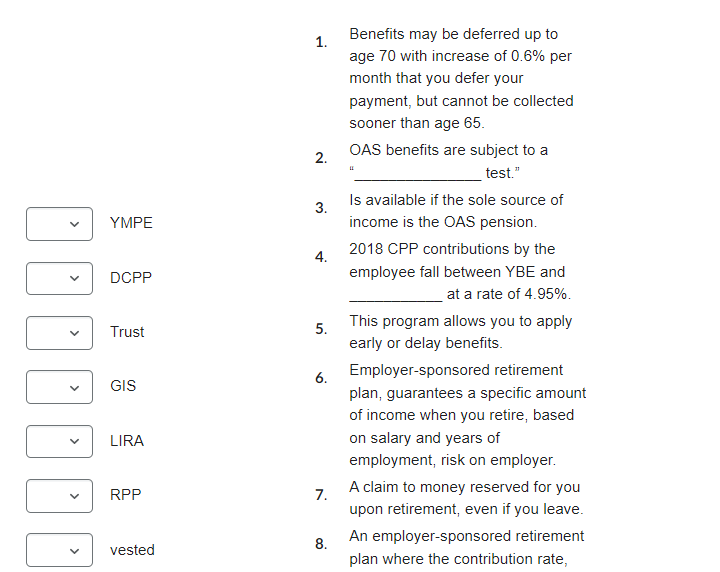

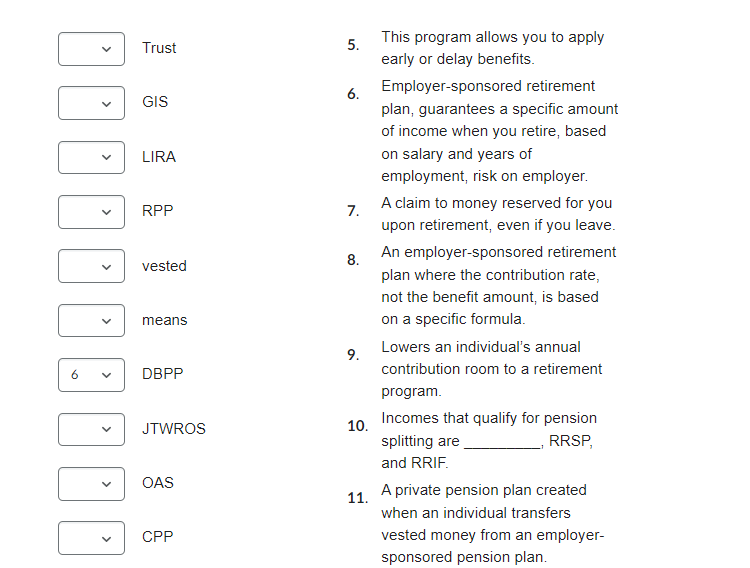

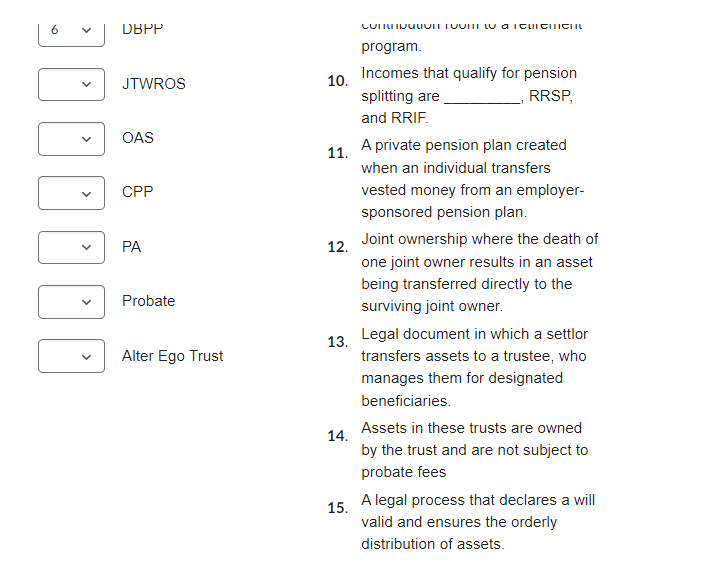

1. Benefits may be deferred up to age 70 with increase of 0.6% per month that you defer your payment, but cannot be collected sooner than age 65. 2. OAS benefits are subject to a test." YMPE DCPP Trust GIS LIRA RPP vested 3. Is available if the sole source of income is the OAS pension. 4. 2018 CPP contributions by the employee fall between YBE and at a rate of 4.95%. 5. This program allows you to apply early or delay benefits. 6. Employer-sponsored retirement plan, guarantees a specific amount of income when you retire, based on salary and years of employment, risk on employer. 7. A claim to money reserved for you upon retirement, even if you leave. 8. An employer-sponsored retirement plan where the contribution rate, Trust GIS LIRA RPP vested means DBPP JTWROS OAS 5. This program allows you to apply early or delay benefits. 6. Employer-sponsored retirement plan, guarantees a specific amount of income when you retire, based on salary and years of employment, risk on employer. 7. A claim to money reserved for you upon retirement, even if you leave. 8. An employer-sponsored retirement plan where the contribution rate, not the benefit amount, is based on a specific formula. 9. Lowers an individual's annual contribution room to a retirement program. 10. Incomes that qualify for pension splitting are RRSP, and RRIF. 11. A private pension plan created when an individual transfers vested money from an employer-sponsored pension plan. 6 JTWROS OAS CPP PA Probate Alter Ego Trust program. 10. Incomes that qualify for pension splitting are RRSP, and RRIF. 11. A private pension plan created when an individual transfers vested money from an employer-sponsored pension plan. 12. Joint ownership where the death of one joint owner results in an asset being transferred directly to the surviving joint owner. 13. Legal document in which a settlor transfers assets to a trustee, who manages them for designated beneficiaries. 14. Assets in these trusts are owned by the trust and are not subject to probate fees 15. A legal process that declares a will valid and ensures the orderly distribution of assets

1. Benefits may be deferred up to age 70 with increase of 0.6% per month that you defer your payment, but cannot be collected sooner than age 65. 2. OAS benefits are subject to a test." YMPE DCPP Trust GIS LIRA RPP vested 3. Is available if the sole source of income is the OAS pension. 4. 2018 CPP contributions by the employee fall between YBE and at a rate of 4.95%. 5. This program allows you to apply early or delay benefits. 6. Employer-sponsored retirement plan, guarantees a specific amount of income when you retire, based on salary and years of employment, risk on employer. 7. A claim to money reserved for you upon retirement, even if you leave. 8. An employer-sponsored retirement plan where the contribution rate, Trust GIS LIRA RPP vested means DBPP JTWROS OAS 5. This program allows you to apply early or delay benefits. 6. Employer-sponsored retirement plan, guarantees a specific amount of income when you retire, based on salary and years of employment, risk on employer. 7. A claim to money reserved for you upon retirement, even if you leave. 8. An employer-sponsored retirement plan where the contribution rate, not the benefit amount, is based on a specific formula. 9. Lowers an individual's annual contribution room to a retirement program. 10. Incomes that qualify for pension splitting are RRSP, and RRIF. 11. A private pension plan created when an individual transfers vested money from an employer-sponsored pension plan. 6 JTWROS OAS CPP PA Probate Alter Ego Trust program. 10. Incomes that qualify for pension splitting are RRSP, and RRIF. 11. A private pension plan created when an individual transfers vested money from an employer-sponsored pension plan. 12. Joint ownership where the death of one joint owner results in an asset being transferred directly to the surviving joint owner. 13. Legal document in which a settlor transfers assets to a trustee, who manages them for designated beneficiaries. 14. Assets in these trusts are owned by the trust and are not subject to probate fees 15. A legal process that declares a will valid and ensures the orderly distribution of assets Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started