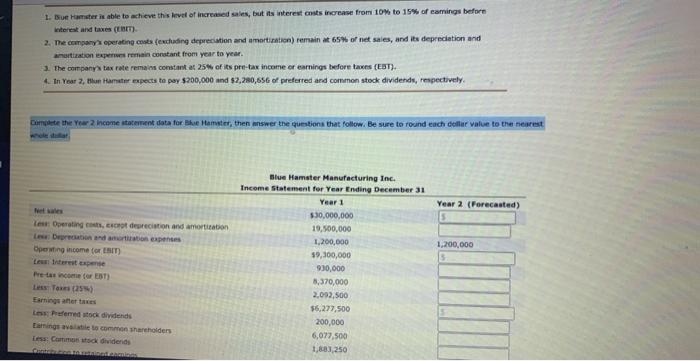

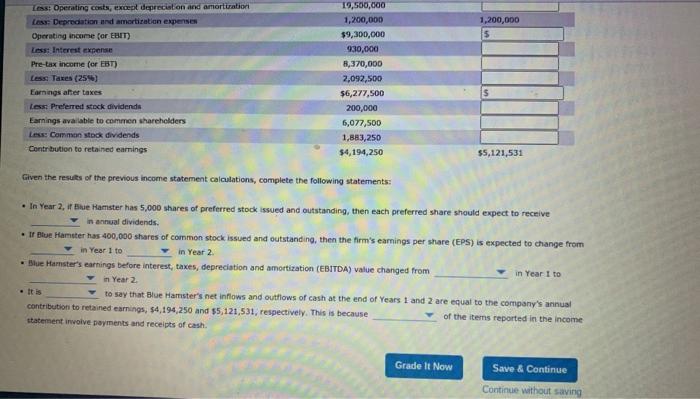

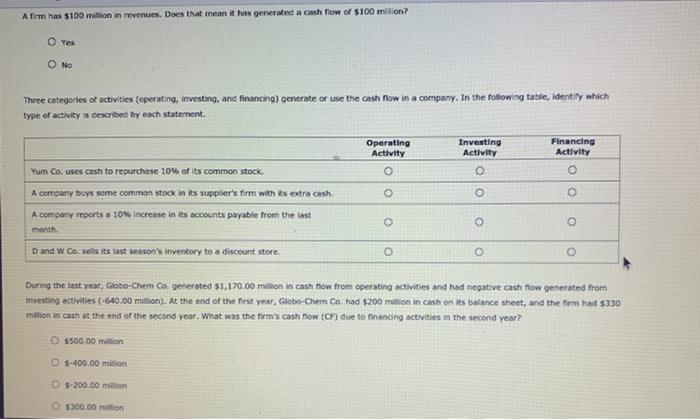

1. Bester able to achieve this level of increased sales, but its interesents increase from 10% to 15% of namings before interest and taxes (1) 2. The company operating costs (excluding depreciation and amortization) remain at 65% of net sales, and its depreciation and amortization premain content from year to year. 3. The company tax rate remains constant at 25of its pre-tax income or earnings before taxes (ET). In Year 2, thun Hamuter expects to pay $200,000 and $2,280,656 of preferred and common stock dividends, respectively Domnulete the Year 2 income statement data for the Hamster, then answer the questions that follow. Be sure to round each other value to the nearest Year 2 (Forecasted) Les Operating decision and amortization Deprecation and antion expenses Operating income (EST) Lettres en Pre-acom (ET) 1,200,000 3 Blue Hamster Manufacturing Inc. Income Statement for Year Ending December 31 Year 1 $30,000,000 19,500,000 1.200,000 59,300,000 930,000 8,370,000 2,092,500 56,277,500 200,000 6,077,500 1,883,250 Earning after tanes Los Preferred stock dividends Earnings are common shareholders Less Comments dividends 1,200,000 5 Tess: Operating costs, except depreciation and amortiration Lass: Deprecation and amortization expenses Operating income for EBIT) Less: Interest Expense Pre-tax income (or EBST) Less Taxes (259) Earnings after taxes Loss Preferred stock dividende Earnings available to common shareholders Less Common stock dividends Contribution to retained earnings 19,500,000 1,200,000 $9,300,000 930,000 1,370,000 2,092,500 $6,277,500 200,000 6,077,500 1,883,250 $4,194,250 $ $5,121,531 Given the results of the previous income statement calculations, complete the following statements: In Year 2, i Hue Hamster has 5,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive in annual dividends. If Blue Hamster has 400,000 shares of common stock issued and outstanding, then the firm's earnings per share (EPS) is expected to change from in Year 1 to in Year 2 Blue Harnster's earnings before interest, taxes, depreciation and amortization (EBITDA) value changed from in Year I to in Year 2 to say that Blue Hamster's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company's annual contribution to retained earnings, $4,194,250 and 55,121,531, respectively. This is because of the items reported in the income statement involve payments and receipts of cash Grade It Now Save & Continue Continue without saving A firm has $100 million in revenues. Does that mean it has generated a cash flow of $100 million? Yes O NO Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identity which type of activity described by each statement Operating Activity Investing Activity o Financing Activity 0 O Yum Co. uses cash to repurchase 10% of its common stock A company bays some common stock in its supplier's firm with is extra cash. A company reports a 10% increase in its accounts payable from the fast month D and w ca. seis its last season's inventory to a discount store During the last year, Globo-Chem Co generated $1,170.00 million in cash How from operating activities and had negative cash flow generated from Investing activities (640.00 million). At the end of the first year, Globe-Chem Co. had $200 million in cash on its balance sheet, and the firm had $330 million in cash at the end of the second year. What was the firm's cash now (C) due to financing activities in the second year? O $500.00 Million 5-400.00 milion $ 200.00 min $300.00 Million