Answered step by step

Verified Expert Solution

Question

1 Approved Answer

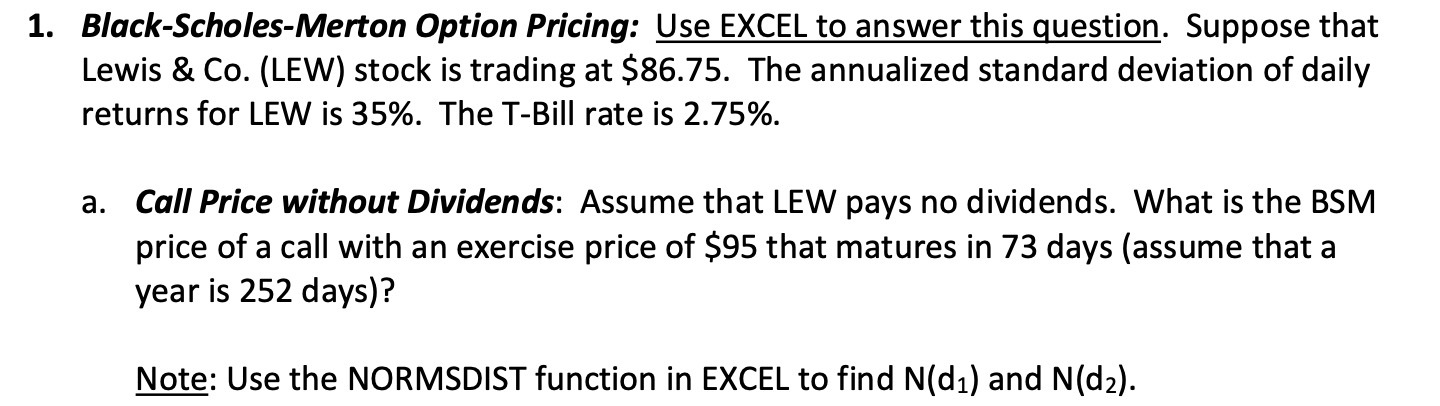

1. Black-Scholes-Merton Option Pricing: Use EXCEL to answer this question. Suppose that Lewis & Co. (LEW) stock is trading at $86.75. The annualized standard

1. Black-Scholes-Merton Option Pricing: Use EXCEL to answer this question. Suppose that Lewis & Co. (LEW) stock is trading at $86.75. The annualized standard deviation of daily returns for LEW is 35%. The T-Bill rate is 2.75%. a. Call Price without Dividends: Assume that LEW pays no dividends. What is the BSM price of a call with an exercise price of $95 that matures in 73 days (assume that a year is 252 days)? Note: Use the NORMSDIST function in EXCEL to find N(d1) and N(d2).

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the BlackScholesMerton BSM price of a call option without dividends we can use the foll...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started