Answered step by step

Verified Expert Solution

Question

1 Approved Answer

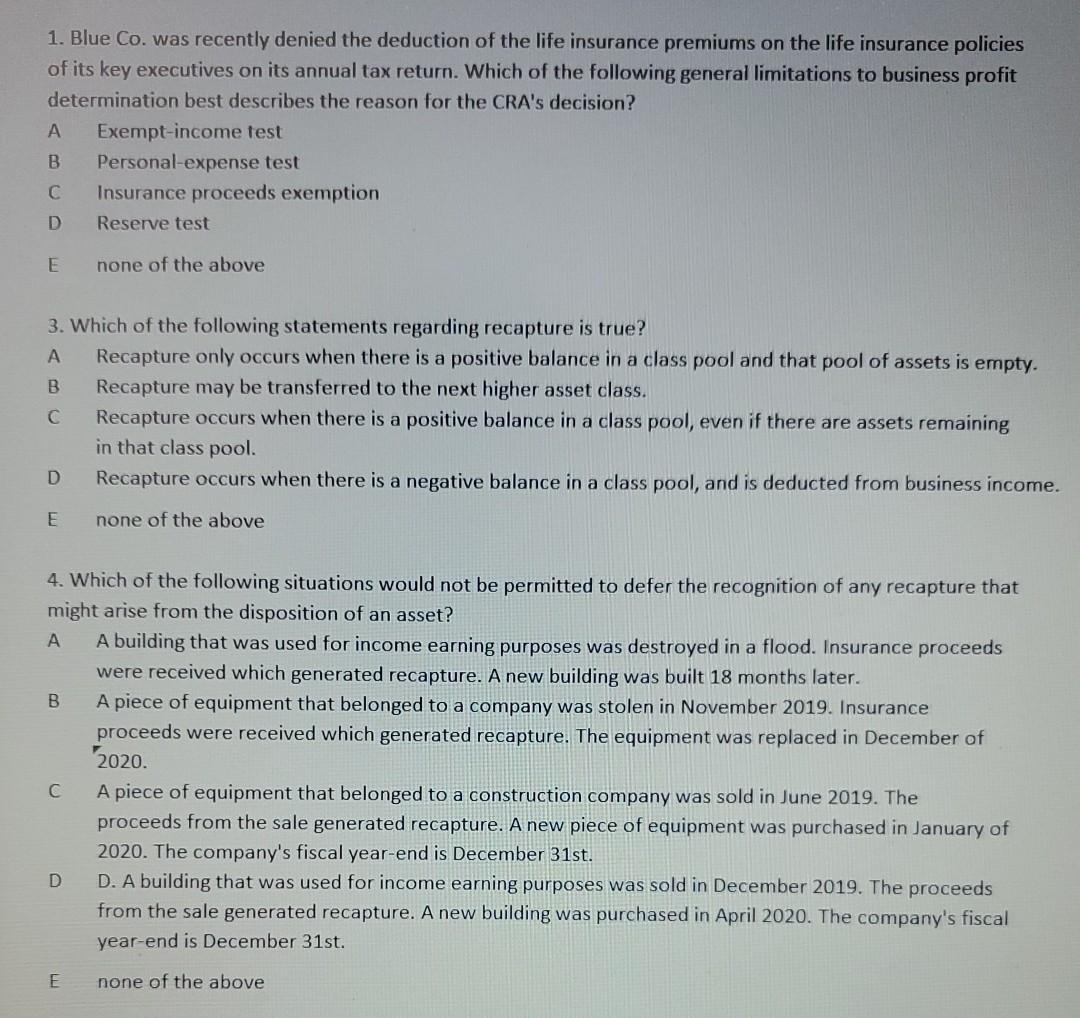

1. Blue Co. was recently denied the deduction of the life insurance premiums on the life insurance policies of its key executives on its annual

1. Blue Co. was recently denied the deduction of the life insurance premiums on the life insurance policies of its key executives on its annual tax return. Which of the following general limitations to business profit determination best describes the reason for the CRA's decision? Exempt-income test B Personal-expense test Insurance proceeds exemption D Reserve test E none of the above 3. Which of the following statements regarding recapture is true? A Recapture only occurs when there is a positive balance in a class pool and that pool of assets is empty. B Recapture may be transferred to the next higher asset class. C Recapture occurs when there is a positive balance in a class pool, even if there are assets remaining in that class pool. D Recapture occurs when there is a negative balance in a class pool, and is deducted from business income. E none of the above 4. Which of the following situations would not be permitted to defer the recognition of any recapture that might arise from the disposition of an asset? A A building that was used for income earning purposes was destroyed in a flood. Insurance proceeds were received which generated recapture. A new building was built 18 months later. B A piece of equipment that belonged to a company was stolen in November 2019. Insurance proceeds were received which generated recapture. The equipment was replaced in December of 2020. A piece of equipment that belonged to a construction company was sold in June 2019. The proceeds from the sale generated recapture. A new piece of equipment was purchased in January of 2020. The company's fiscal year-end is December 31st. D D. A building that was used for income earning purposes was sold in December 2019. The proceeds from the sale generated recapture. A new building was purchased in April 2020. The company's fiscal year-end is December 31st. E none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started