Question

1. Brian purchased a new bedroom set for his wife's birthday present. The cost of the bedroom set was $1,999 with no payments for six

1. Brian purchased a new bedroom set for his wife's birthday present. The cost of the bedroom set was $1,999 with no payments for six months. However, at the end of six months Brian owes the price of the bedroom set, plus 12% annual interest, compounded monthly. How much interest will Brian pay on his wife's birthday present?

2. Tim put $35,000 in a five-year CD paying 5.75% annual interest, compounded quarterly. What is the total amount Tim will receive when he withdraws his money after five years?

3. Andrew wants to pay off his car. He has a two-year loan at 9% annual interest that is compounded monthly. Andrew must pay $18,700 at the end of the two-year period. How much did Andrew originally borrow?

Please solve each of the following problems showing precision to five decimal places:

1. What is the nominal rate of an investment that returns 9%?

2. What is the periodic rate for a 10% loan compounded monthly?

3. What is the effective rate for each monthly payment of an auto loan when the loan is issued at 13% compounded weekly? (Assume 4.333 weeks per month.)

4. You have decided to start saving for retirement and are making quarterly payments into an account that earns 4.25% with monthly compounding. What effective interest rate is your money earning per quarter?

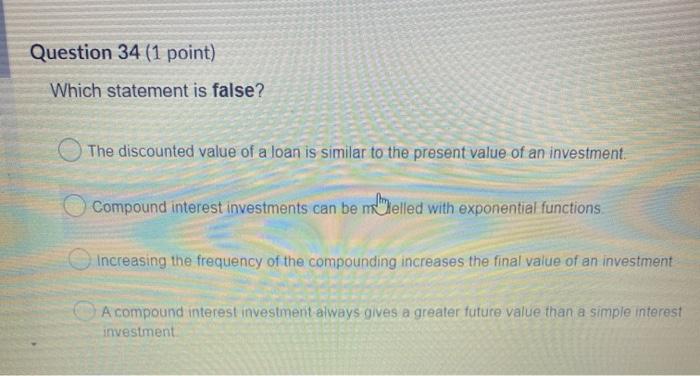

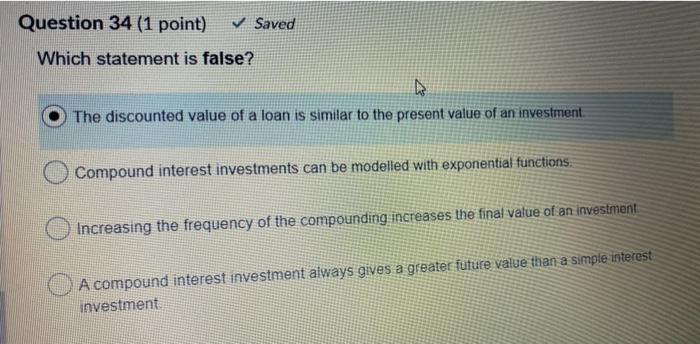

Question 34 (1 point) Which statement is false? The discounted value of a loan is similar to the present value of an investment. Compound interest investments can be melled with exponential functions Increasing the frequency of the compounding increases the final value of an investment A compound interest investment always gives a greater future value than a simple interest investment

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the total amount Brian will pay on his wifes birthday present including interest we first find the amount of interest accumulated over the six months The formula for compound interest i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started