Question

1. Briefly describe how to calculate net present value (NPV) and incremental rate of return (IRR). What is the formula used for each? 2. Describe

1. Briefly describe how to calculate net present value (NPV) and incremental rate of return (IRR). What is the formula used for each?

2. Describe how NPV is used in investment decisions (what it means when NPV is positive, zero, negative). Describe how IRR is used in investment decisions. Compare the pros and cons of using NPV versus IRR.

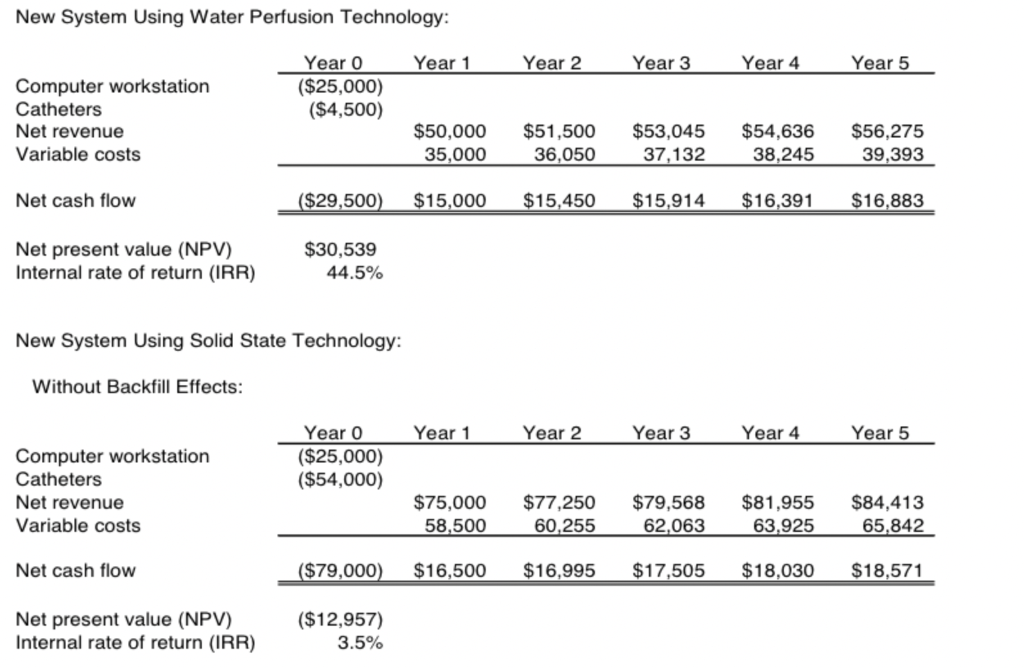

3. From looking at the tables below, What are the NPVs and IRRs of the two alternative technologies Based on the information in the case, what factor drives the financial superiority of the more profitable technology?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started